Bitcoin (BTC) is definitely starting a new week with a bearish move, which, however, fails to shake investors’ confidence in the bull run. During the mixed weekend, BTC / USD closed above $ 47,000 to lose all its previous profits a few hours later and attack the support of 45,000 USD.

Salvador “buys decline”

Amid the turmoil in traditional markets led by the Evergrande saga in China it may not be profitable trades this week. For the popular trader Pentoshi, now is the time to take an inventory and wait for the situation to be resolved.

Im def spot long. I’m bullish. Said it the last week. I think this week will be noisy. Lacking a lot of info. I think we could go as low as 41k but IMO we are going to 56-58 and thus just chilling in spot

— ????????????Pent◎shi Wont DM You (@Pentosh1) September 20, 2021

The $ 44,000 price represents the wall of support you are making now Bitcoin apparently about to retest. A deeper dive could bring in $ 41,000 or $ 38,000, with the latter being a key level of Fibonacci retracement.

Overall, however, the mood remains firmly in favor of a return to market growth kryptoměn to the 4th quarter. Among those “buying the decline” is the government of El Salvador, which confirmed on Monday that it bought another 150 BTC for a total of 700 BTC held.

Bitcoin sticks “as an absolute champion”

There is a challenging environment outside, and when it comes down to it, Bitcoin is doing much better than expected, analysts say.

Whether it’s stocks or stocks gold, the picture is definitely less pink this week. For example, the S&P 500 index is well on its way to closing below its 50-day moving average for the first time since June. Gold is heading for its lows of April, while against the Nasdaq 100 index, as veteran Peter Brandt notes, the precious metal is almost at its lows of 20 years ago.

The price of Gold is approaching the cheapest levels ever set in 2000 compared to the NASDAQ 100 Index$NDX $QQQ $ NQ_F #GOLD $GC_F $GLD pic.twitter.com/C19m6fT46G

— Peter Brandt (@PeterLBrandt) September 18, 2021

The strength of the US dollar is clearly visible, taking the currency index US dollar (DXY) is approaching 94, which is a classic headwind for Bitcoin. Therefore, if this condition begins to change, an impulse for much stronger BTC performance is clearly in place.

Bitcoin is preparing the first 5th increase in difficulty in a row

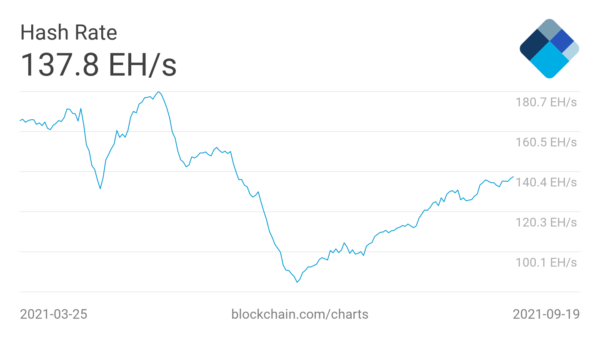

The basics of bitcoin have never looked better, it may be a cliché, but this week the numbers speak for themselves. Difficulty even the hashrate stubbornly rejects the declining trend, suggesting that the miners’ basic beliefs remain steadfastly bullish.

Mining difficulty, which has been mitigating the impact of China’s mining routine in May for several months, is now set to rise for the fifth time in a row on Tuesday.

This is a rare event – the last time this difficulty has risen five times in a row since the end of 2019, before the mood in the cross-market in March swept in March 2020. Not even the subsequent bull market and the run to historical highs of 64,500 USD he could not repeat this success.

For those who believe that price action must follow network fundamentals, the outlook seems more bullish than ever. Estimates continue to show 140 EH / s for the network, which corresponds to only 17% below historical highs.

Bitcoin is still upstairs

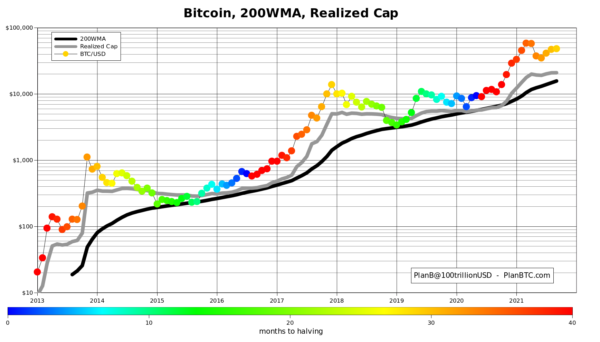

The realized capitalization of bitcoin is now higher than the historical maximum spot price from 2017, which is 21,000 USD. Its 200-week moving average (WMA), which is commonly considered the definitive price bottom and level, which BTC / USD has never violated, is now at $ 15,600.

The relationship between realized capitalization and 200WMA is a useful measure of market growth potential. Previous peaks of the price cycle, especially at the end of 2013 and in the year 2017, were accompanied by a large difference between the two metrics. This time, however, the opposite is true – and the chances of Bitcoin being a solid “buy” are higher.

Not really, realised cap was much higher relative to 200WMA at previous peaks:

Top 2013: 320/49 = 6.5

Top 2017: 5k/1.4k = 3.6

today: 21k/16k = 1.3 (so IMO we’re fine, top has yet to come)— PlanB (@100trillionUSD) September 19, 2021

Estimates speak of a six-digit BTC price by the end of the year. The springboard should be Q4, with October providing a solid foundation with a minimum monthly closing of $ 63,000. The September “worst case scenario”, meanwhile, is $ 43,000 monthly deadline.

The best bear market in history

This is a classic setting that has historically ruled out a significant period of bullish price action, Bitcoin is relatively close to historical highs, but no one is interested in it. Although BTC / USD is trading at close to $ 50,000, this month is a topic that fewer and fewer people are on the language.

However, as he suggests analyst William Clemente, such conditions are ideal for the BTC prize to bring a surprising shock.

Bitcoin broke out of a bull flag last night, set a higher high, funding at 0.01%, and my feed is dead silent.

Excellent.

— Will Clemente (@WClementeIII) September 18, 2021

Investor sentiment is currently also in an ideal mood, with the Crypto Fear & Greed Index in “neutral” territory, while Bitcoin revolves around the last resistance before $ 50,000.

DON’T FORGET TO ADD ALSO ON OUR DISCORD SERVER.

–