WSJ highlights the rebellion of ants… “The overall impact of the stock market is limited”

–

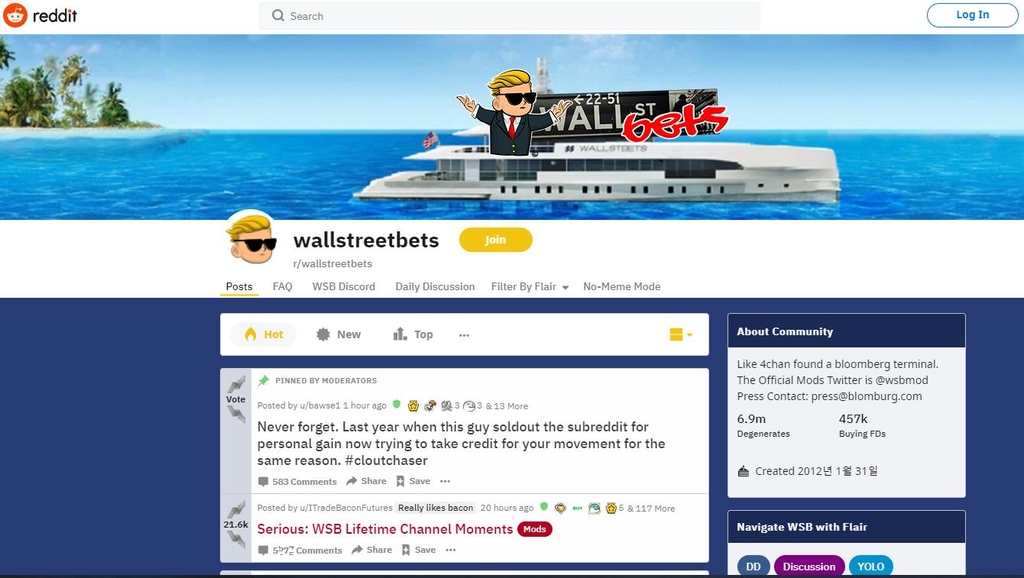

[홈페이지 캡처]

–

(New York = Yonhap News) Correspondent Kang Gun-taek = US major media are also eager to analyze the US’game stop incident’, which is called the revolt of ants (individual investors).

In the confrontation between David and Goliath, the case in which an individual investor defeated Wall Street’s hedge fund has even been evaluated as a revolution that will be a milestone in the history of the stock market.

The Wall Street Journal (WSJ) published a special article titled’The Real Forces Leading the Game Stop Revolution’ on the 30th (local time). It was analyzed as the peak of’market democratization’.

Vogel, who founded the Vanguard Group in 1975, was the first to create an index mutual fund for individual investors, not institutional, and helped ants make low-cost investments by lowering fees.

Seeds sown by Vogel sprout and grow, and today’s’free commission’ securities apps like Robin Hood appeared, allowing individual investors to easily invest in stocks anytime, anywhere without burdening the cost. Compared to decades ago, stock fund fees reached up to 8% and individual investors’ stock transaction fees reached up to 5%.

The final stage of the investment revolution, symbolized by GameStop, is the online community Reddit’s discussion room’Wall Streetbets’, the newspaper reported.

This is because millions of individual investors encouraging each other online, collecting pennies and overpowering the huge capital betting on short selling.

This revolutionary event was like a’couch potato’ watching a game of the NBA’s Los Angeles Lakers (a person lying on the sofa and watching TV while eating potato chips) emptied the beer and jumped into the court and blocked LeBron James’ shot. The WSJ likened it to a dunk shot over Anthony Davis.

In fact, the newspaper points out that amateur investors have advantages over professional institutional investors.

–

[AP/뉴욕증권거래소=연합뉴스]

–

It is the ants’ weapon that they can make long-term investments ignoring short-term losses. Professional traders can be fired if their performance is bad, and they can be asked to return their investments from customers when things get tough.

Now, individual investors can take advantage of these advantages and communicate in real time, mainly online, and unite with each other to raise the price of stocks short-sold by hedge funds. In the case of institutional investors, such public offering is prohibited by law.

The newspaper reported that this atmosphere is reminiscent of the years 1999-2000 and 1901, respectively, when the stock market bubble formed.

However, some analysts say that this revolution, which took place in some stocks such as GameStop, has not a significant impact on the market as a whole.

Stocks, which have recently been subject to intensive purchase by individual investors, accounted for 0.13% of the Standard & Poor’s (S&P) 500 index as of December 31, last year, and 4-5% of the index consisting mainly of small stocks.

This proportion rose to 0.17% and 8.6-11%, respectively, as of January 27, when the ant rebellion was in full swing. Although it has risen considerably, it is difficult to say that it gave a big impact to the entire stock market.

In addition, as stock prices such as GameStop have recently skyrocketed, individual investors suffering from debt burdens are also considering the timing of selling, WSJ reported in a separate article.

Den Kobox, 25, an IT (information technology) expert in Detroit, sold GameStop shares the day before and raised nearly $2,500 in cash. It was to pay off a credit card debt amounting to $7,000.

One Reddit user wrote that “I never thought I would pay it off so quickly,” saying that he paid off $23,000 in student loans by buying and selling GameStop stock.

In addition, it is reported that many investors are considering selling stocks to repay loans, pay for school expenses, finance for marriage, and arrange a home.