2-The resistance of the old market

Despite the health and economic impacts, the year 2020, marked by the pandemic, will have spared the activity of old real estate and the first quarter of 2021 confirms this. On the balance sheet side, according to the latest statistics from notaries and professionals in the sector (networks and federations), the market is holding up. Transaction activity continues at a high pace, in such an atypical context with the various periods of confinement and the uncertainties linked to the crisis.

Sales volumes of old housing (source notaries from France)

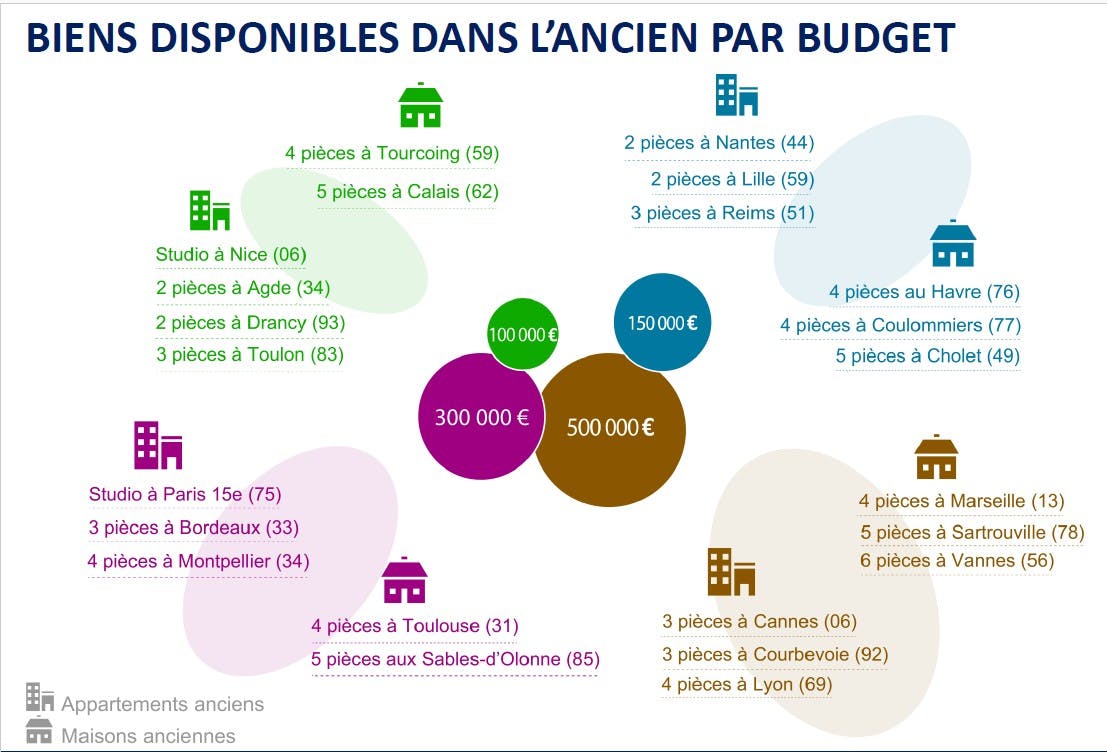

Examples of prices of goods in the old (source notaries of France)

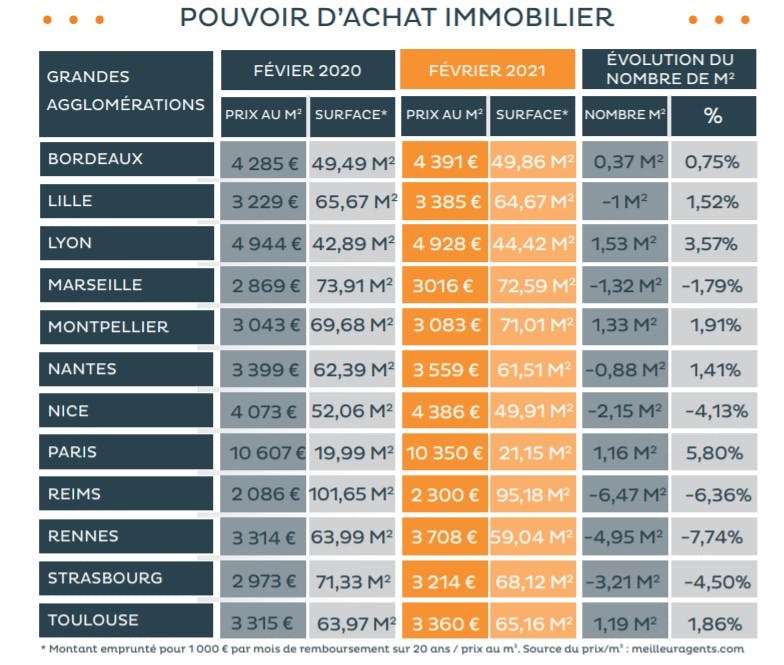

Examples, projection of real estate purchasing power (source Cafpi)

3-The new criteria of spaces and greenery

The confinement experience had the effect of accelerating trends. Desires for space, nature, quality of life, even if they remain in the domain of dreams, have been at the heart of real estate research. The desire for larger accommodation, even if it means moving away from a metropolis with new criteria (outdoor spaces, garden, terrace, etc.) was acclaimed. But it is not easy to change jobs, where people live together, whether as a couple, with children … which still hinders mobility. The decision-making process is long. However, the search for a better quality of life, accelerated by the possibilities of teleworking, is a fundamental movement that can take several years.

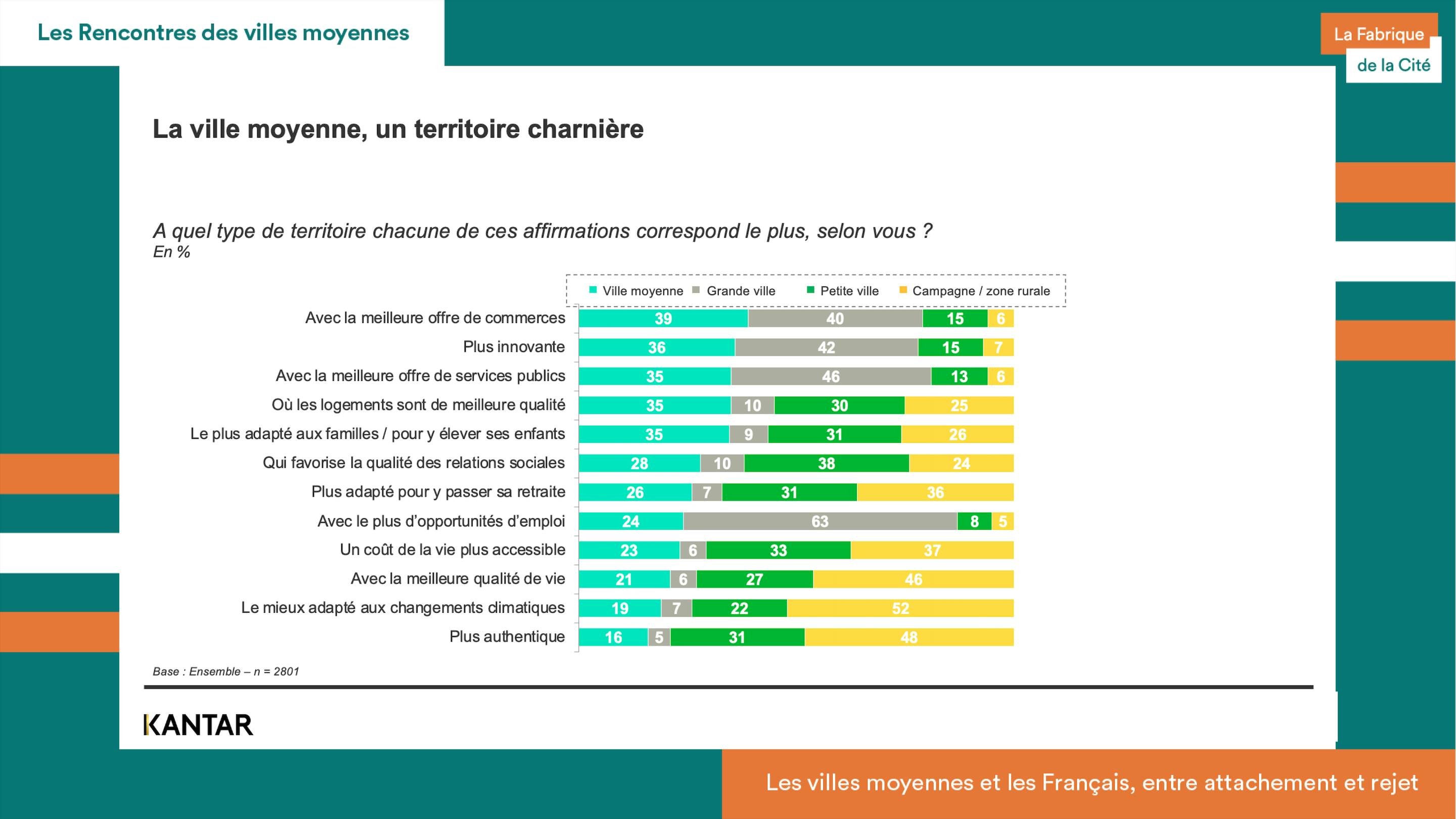

4-The appeal of medium-sized cities

Real estate purchasing power, quality of life, teleworking, transport time … medium-sized towns can benefit from territorial rebalancing. Among the many surveys that point in this direction, study of The Factory of the City, emphasizes that the French consider the medium-sized city as a pivotal city. Perceived as more dynamic than 10 years ago. Far from the image of the city on the decline, where one is bored. What draws in the average city? tranquility, proximity to nature, the cost of living, more spacious accommodation … Below, excerpt with the president of the Fabrique de la Cité, Cécile Maisonneuve.

5-The new conditions for granting loans

In order to allow a greater number of people to access property despite the crisis and to support the market, the recommendations addressed to banks by Bercy have been relaxed. In December 2020, the authorities of the High Council for Financial Stability (HCSF) have loose, the most restrictive measures. Officially, there is greater flexibility for access to credit, especially for the poorest households (the maximum duration of loans can reach 27 years instead of 25 years ; the share of monthly loan payments is increased to 35 % of household income instead of 33 %). The fact remains that employment is still and even more so in the current economic context, a non-negligible criterion.

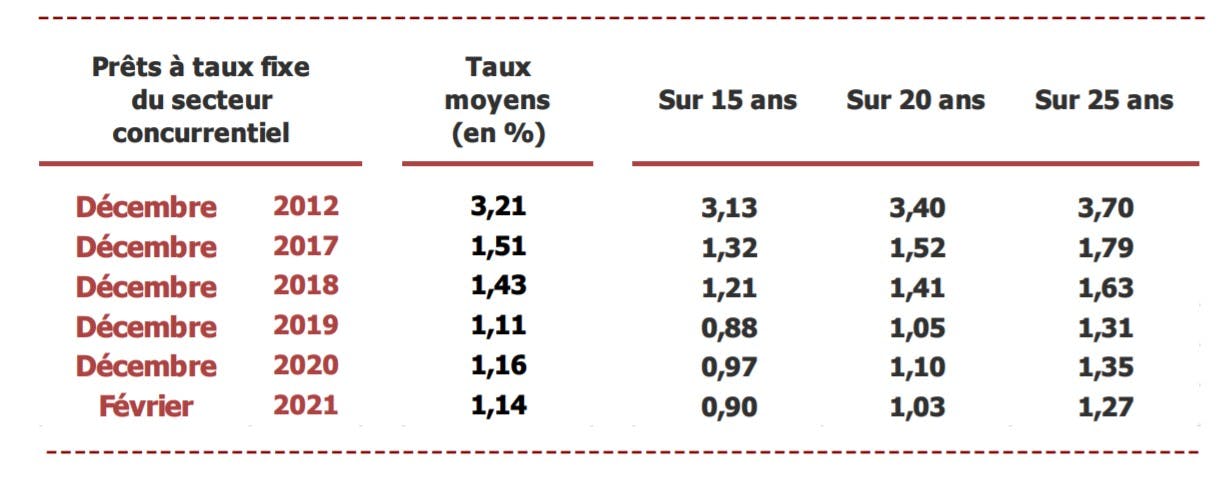

6-The attractiveness of interest rates

Among the market boosters: interest rates have been low for a year to settle in February 2021 around 1, 14 % on average, all durations combined (source: Housing Credit Observatory / CSA). A boon for many households able to buy. Always taking into account the debt ratio not to be exceeded.

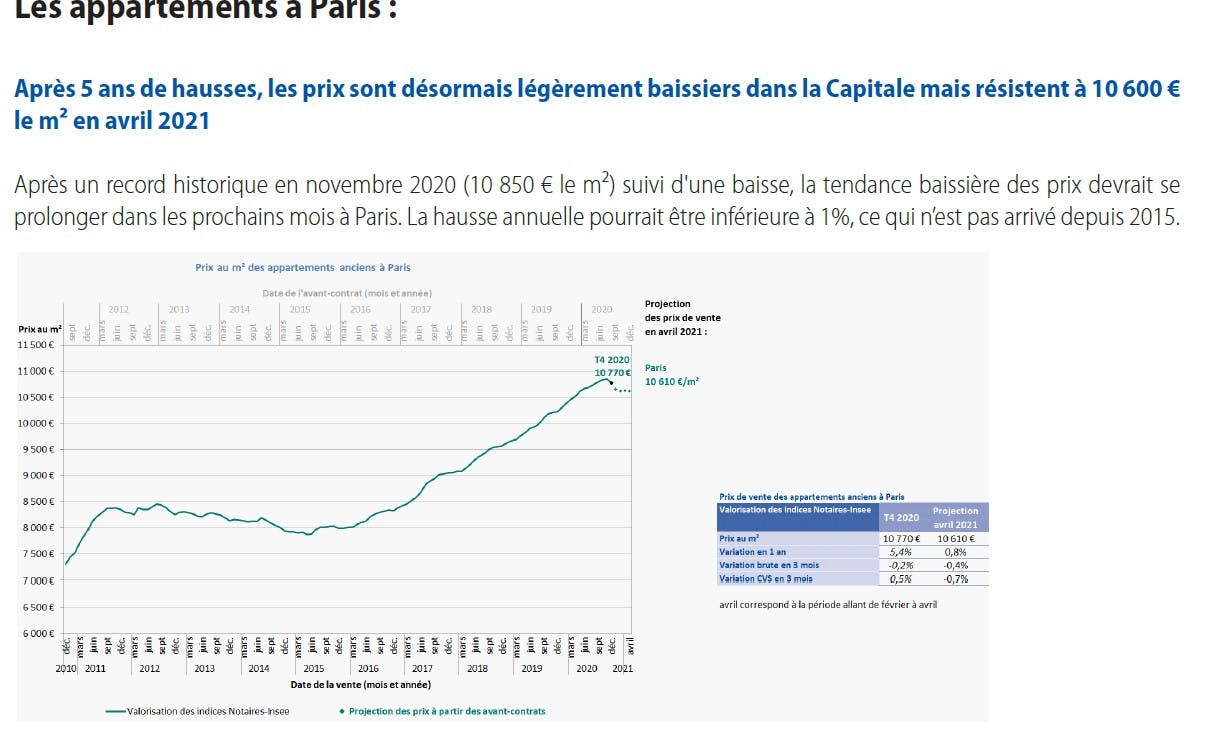

7-The slight drop in prices in Paris

Even if it’s tiny, it’s a first for a long time. Prices in the capital are falling. Over three months, there was a trend reversal (- 0, 5 % To – 0, 7 %). This decrease is very slight but since 5 years, prices rose steadily between 5 and 8% per year.

Explanations with Maître Thierry Delesalle, notary, president of the statistics commission. properties of the Paris Chamber of Notaries.

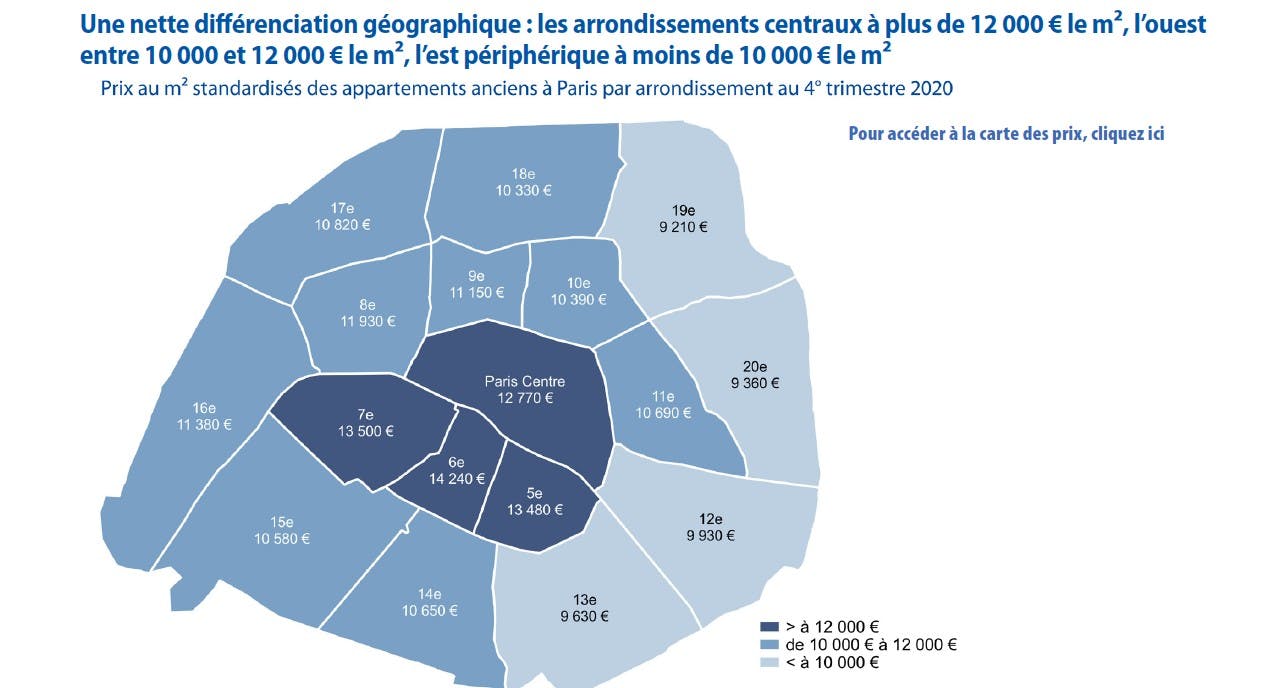

Average apartment prices, district by district

8-Housing policy reforms

Since January 2021, for the APL, the calculation of aid has been modified. It takes into account the income received during the 12 last months, with an update every 3 month. On the rental side, any furnished tourist rental platform must specify if the offer comes from an individual or a professional. The status of professional furnished rental company (LMP) is modified by being subject to social contributions. After Paris and Lille, new cities must regulate rents in the private sector such as Lyon, Villeurbanne, Grenoble, Bordeaux, Montpellier but also in the Paris region (Aubervilliers, Épinay-sur-Seine, Pierrefitte-sur-Seine, Saint-Denis, Villetaneuse , Stains, L’Île-Saint-Denis, la Courneuve) who requested it. Extract Emmanuelle Wargon, Minister of Housing, in January 2021 on the occasion of Club Immo Figaro.

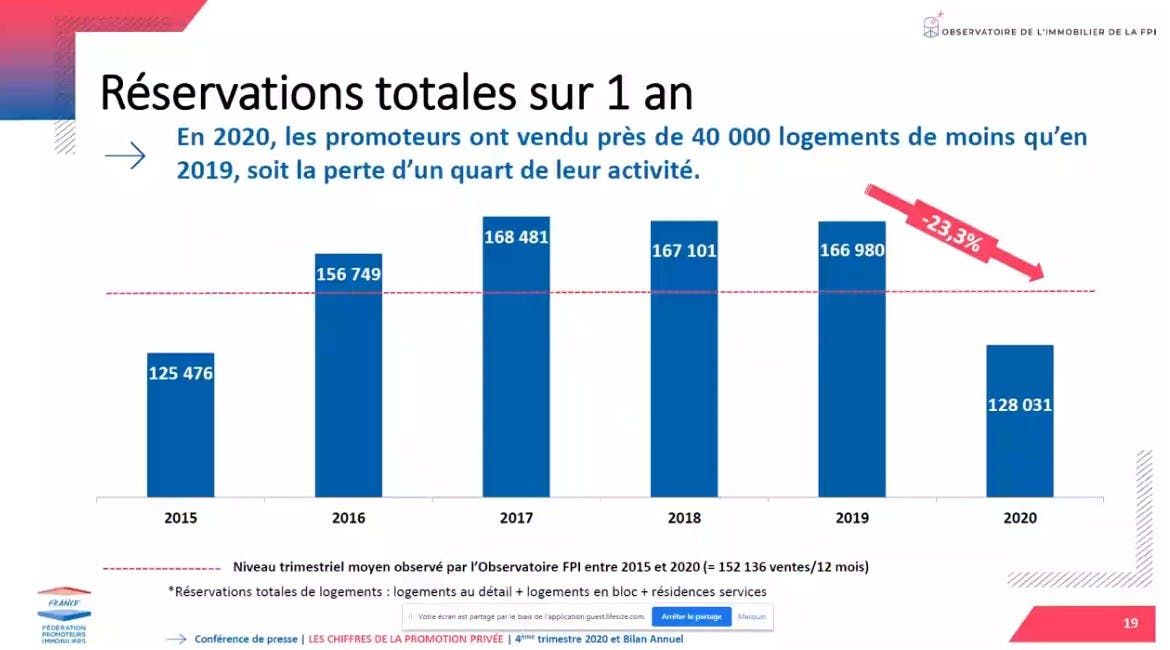

9-The shortage of the new home market

In new buildings, many indicators are in the red: Fall in construction starts, reduction in building permits, postponement of certain real estate projects with the arrival of new municipal teams, shortage of offers and falling reservations … if the activity of the former resists, the new housing, suffers. And this is the case for sales which are declining sharply.

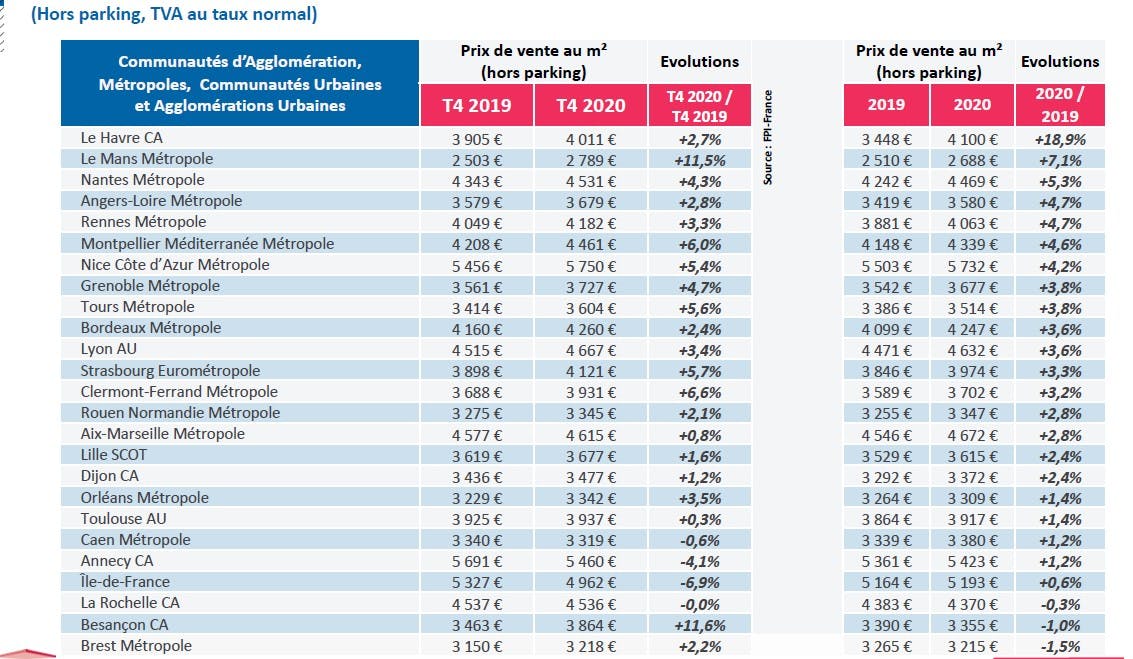

Prices in new buildings are still increasing. What is rare is expensive. In this context, the following table shows the average prices per m2 of living space for reserved collective housing. These statistics are those of the economic barometer of the Federation of real estate developers of France (March 2021).

10-The challenges of the green value of goods

The “green value” is becoming more and more important for the sale and rental of our homes. Establishment of MaPrimeRenov ‘ in order to finance the energy works with in the longer term, rental restrictions on thermal strainers in the old (4 millions 800 000 housing in France are concerned, of which 2 millions rented in the private park). Gradually, goods that have not been renovated to leave the classroom F and G will be completely prohibited for rental. On the other hand, the DPE (Energy performance diganostic) will be corrected on July 1, 2021. A buyer or a tenant can turn against the seller or the owner if the latter lied about the DPE.

And tomorrow ? Indicators to watch

The appetite of the French for real estate cannot be denied. In times of crisis, the safe haven stone has been revealing in every sense of the word. A roof for yourself, for your family, to protect your loved ones … The crisis also highlighted how the French were unequal when it came to housing. This is especially the case in tense areas. Bad housing, overcrowding: 1.8 million inhabitants of Greater Paris live in cramped housing according to an APUR study (Parisian urban planning workshop).

Note that the Ministry of Housing has entrusted the architect Francois Leclerq and the housing specialist Laurent Girometti (former legal director of theANAH) a mission on the quality of housing. For decades, we have the feeling that we are building increasingly smaller housing for economic, town planning, even political reasons… (see also qualitel study).

How will the market evolve? The uncertainties and the lack of visibility make projections hazardous. It is still difficult to measure the effects of crisis. With economic and social fractures widening, many real estate projects could be abandoned, postponed, postponed. Leaving room for the emergence of multi-speed real estate markets, according to geographic sectors and financial situations. After health, the priority remains more than ever the prospect of employment and purchasing power. If the creditworthiness of buyers is the key criterion, the confidence is one of the motors essentials real estate.

–