For a few days now, 120 million Whatsapp users in Brazil have been able to send money back and forth via messenger. But how is the new payment service structured? Our guest author Gerrit Glaß tried it out. Protocol: Caspar Tobias Schlenk

I’ve been living in São Paulo for a year and a half now. And every day I notice how much space the simple messenger service Whatsapp has taken up in my life since then. In Germany, I use the app almost exclusively to write with my family and friends or for groups that are about travel or birthday gifts.

The usage behavior in Brazil is completely different – here, for example, a large part of my professional communication takes place via the messenger. As an e-mail substitute, I write with colleagues or contacts from my network. If I want to order a meal around the corner in the evening, this can be done via chat, the Whatsapp number is on the door of almost every restaurant. And even the doctor sends me the results on Whatsapp.

The first attempt failed

A lot depends on the project for Facebook. Last year, the tech company tried to start a payment system in the market with 120 million users. It is the second largest Whatsapp market – after India with 400 million users. In the corona pandemic in particular, many small retailers switched to WhatsApp sales. “We have become a worldwide test case for Facebook because nobody else uses the instrument so systematically in mass operations,” the manager Marcelo Ubriaco was quoted as saying at the time.

But the Brazilian government had concerns – and stopped the project again. The fear: the WhatsApp parent Facebook could become too powerful, the central bank and antitrust authorities feared competition. In the short time that Whatsapp Pay worked, I was in Germany and couldn’t test it. A year later it worked: the service is available.

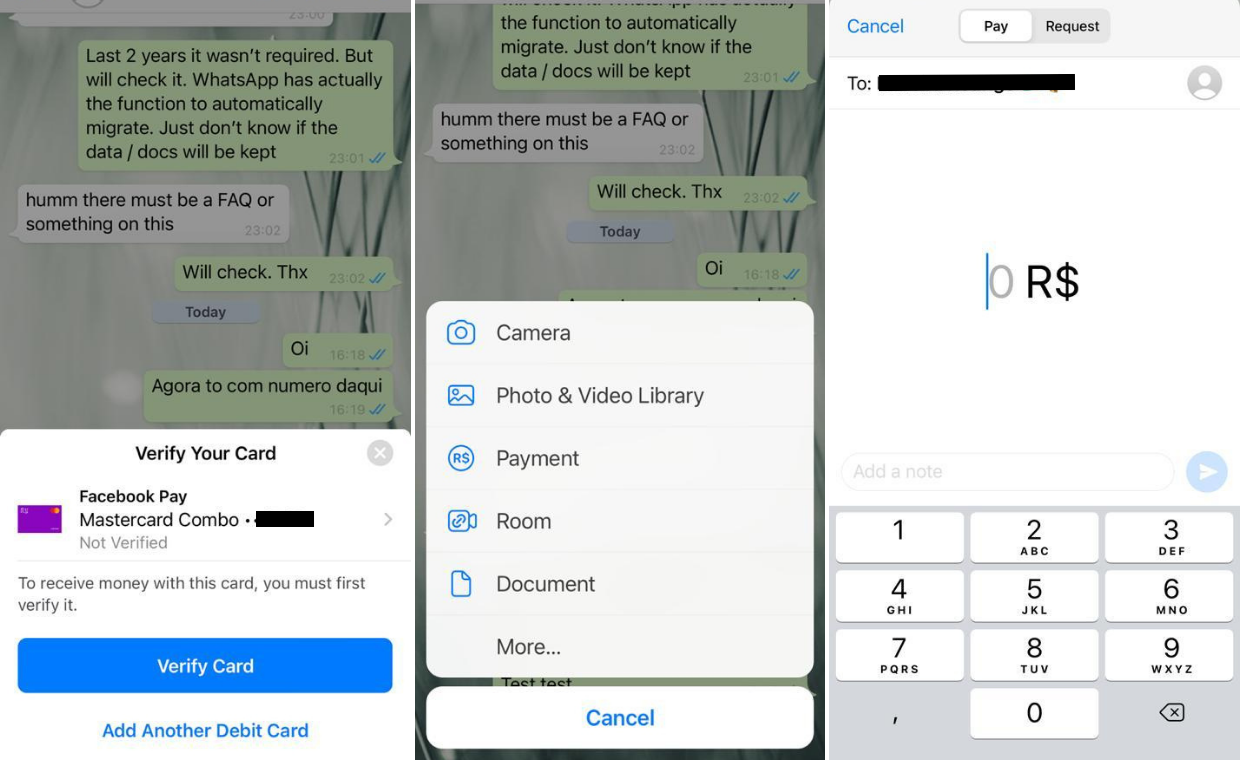

A few days ago I received an email from Nubank. The fintech is one of the first Whatsapp Pay partners. To log in, I have to register with Facebook Pay, which works via my bank details with Nubank: I enter my name and my tax number (which everyone in Brazil knows by heart because it is so important). Then I have to switch to the Nubank app briefly to identify myself and receive a security code – that’s it. Everything in under 120 seconds.

Paypal not that popular

From now on the money can simply be sent. Up to 1,000 reals (equivalent to 154 euros) are possible per charge. The equivalent of 773 euros per month and 20 transactions per day are allowed.

It’s so simple that there is no need to explain it in great detail. When I press the plus sign on my Brazilian friends, the item “Payments” also appears. So I can send some Brazilian reals to my friends. It is also possible with friends who do not have payments yet. Either you register quickly (see picture) or the money goes back after 24 hours.

In Germany, I simply use PayPal for these so-called peer-to-peer payments. The service is not that popular in Brazil, but the state has its own system, PIX, which also works very simply – the Whatsapp management was also convinced last year that the authorities would have stopped the payment service because of this competition.

But especially after lunch with friends, I’ll be using Whatsapp Pay in the future, it’s even less complicated than PIX.

Important features are still missing

However, some important features are still missing. Group payments – for example to collect for a birthday present – are not possible. I see the function in the groups, but then I have to decide on a contact to whom I will send the money. The service is free of charge but limited to transfers to friends and family.

According to the Financial Times, Facebook is already working in Brazil to make payments possible for business. The US company would then presumably also charge fees for this. Due to the delayed start, Facebook has lost a lot of business. Especially in the corona pandemic, the ideal time would have been to start.

It is the path to a super app that is to come. Many market observers are surprised that Facebook has not implemented these steps any faster. The merchant feature is the more important part in the case of Brazil, the P2P feature is certainly there to get people used to the service.

For the technical processing, Facebook relies on the local acquiring partner Cielo, and it also cooperates with Mastercard and Visa. There is also a separate regulated subsidiary for the service that initiates payment from the debit card (Payments Initiator). So far, the debit card infrastructure with the named partners has been used for this (card-to-card transfer). In addition to instant payment, the next banking revolution is expected through open banking. As soon as the regulation is effective, I assume that Whatsapp will position itself as a payment initiation service provider (PSIP) and initiate the payment directly from the bank account without having to resort to the (more expensive) card infrastructure.

Facebook has already experienced a severe setback with its own digital currency Diem (formerly Libra). After violent defensive reactions from various governments, the company recently announced that it would withdraw its license application in Switzerland and focus on the USA.

I didn’t notice a discussion about WhatsApp in Brazil

There was also criticism from the government in both test markets of Whatsapp Pay, although the governments fear the market power of Facebook as a payment service provider. It is unlikely that the company will seek the way to Europe in the near future. There were already concerns in fintech-friendly Brazil – for example about data protection issues. In addition, Facebook wanted to start without its own license – and had to make major improvements.

I don’t notice a discussion about the influence of Whatsapp and Facebook in Brazil. The service has already established itself among my fintech friends. But that is never the problem, the important question is: what about the rest of it?

Gerrit Glaß is Head of Banking at Fintech Avenue. He was recently on the FinanceFWD podcast.

–