More than five years after having their identities stolen by fraudsters who made countless credit applications in their name, teachers are scrambling to clear their names from a financial institution.

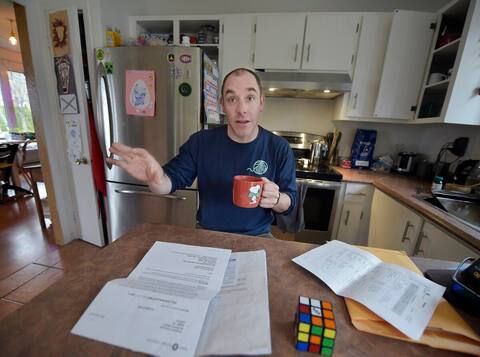

“I’ve got my helmet full! I’ve been fighting to get out of it for years, I have the papers that prove that I was defrauded, and it still haunts me, ”denounces François Charland.

In December 2017, the Quebec teacher realized that his identity had been impersonated when a Bell representative contacted him to tell him that three different accounts had been opened with his information.

Fraudsters had in fact obtained about fifteen credit cards and cell phones in his name thanks to a data theft which affected some 50,000 teachers across Quebec.

“As the situation was known, all accounts were promptly closed and my debts were cleared…except BMO. In 2021, after days of silliness, I was finally told that everything was beautiful, ”says the man.

The worst possible odds

But Mr. Charland was not at the end of his troubles with the financial institution. As he was preparing to renew his mortgage in the last few days, he was told that he had an R9 credit rating due to a debt in collection with BMO.

This is the worst possible odds, equivalent to bankruptcy.

Dave Mallette, a teacher from Repentigny who was also affected by the data theft, finds himself in an almost identical situation. A problem with BMO in 2021 supposedly settled, followed by the discovery of the pot of roses during mortgage renewal this year.

“I had to renew my loan with the bank with which I was already at a bad rate… I’m exhausted”, he breathes, recounting his “nightmare”.

Relaunched several times on this subject, a BMO spokesperson finally contented herself with saying that she could not share information related to a client.

Not out of the woods

But even if they ended up winning their case with the financial institution, Mr. Mallette and Mr. Charland would not necessarily be out of the woods.

Like the approximately 50,000 other teachers affected by the 2017-2018 data theft, their personal information is still circulating, said cybersecurity expert Patrick Mathieu.

“As long as there is no Canadian digital identity, we will go around in circles, caught trying to put out fires. Their social insurance number and their information have already leaked, it’s too late,” he explains.

Equifax’s credit monitoring system allows for some vigilance, says Mathieu, but in many cases it will be difficult to stop fraud before it occurs.

A major data theft

- More than 51,400 teachers affected

- 360,000 teachers were and still are at risk

- Three Montrealers arrested and charged in 2020

Source: Government of Quebec and Sûreté du Québec

Frauds au Canada in 2022

- $531M: Financial losses in Canada related to fraud

- $42 M: Financial losses in Quebec related to fraud

- 57,578: Victims of domestic fraud

- 92,078: Reports of fraud to countries

- 1is : Quebec has been at the forefront of identity fraud in Canada for the past two years.

Source: Canadian Anti-Fraud Center

2023-05-14 23:15:47

#Data #theft #credit #rating #reduced #fraud