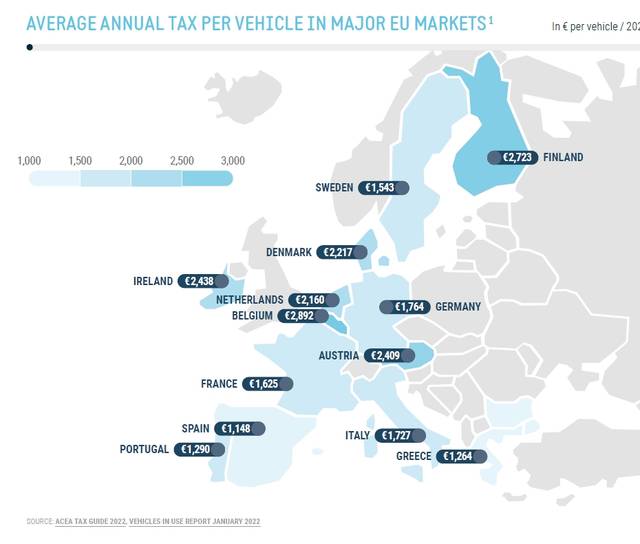

DIVIDED EUROPE (ON AUTOMOTIVE TAXES) – The taxes they are not well-liked at all latitudes. Guiding this name, even so, there are hundreds of unique taxes and charges, but in this complexity the taxes on Automobiles they are definitely an crucial part. Autos are the 2nd premier expense of family members, following the a single on the property, and the associated tax component as a result justifies a closer glance. Hunting at the European Union we uncover, for case in point, that Italy is not amid the nations around the world that they tax vehicles more. The unenviable scepter belongs to the Belgium: in reality, its citizens expend an common of € 2,892 for every year for every motor vehicle, with the Finland to adhere to with 2,723 euros andEire on the podium with 2.438. L’Italy it is pretty much aligned with the other massive countries since its 1,727 euros annuals are midway amongst the 1,764 of the Germany and the 1,625 of the France. You save in Greece and Spain, which is the least expensive: (1,264 and 1,148 euros respectively) and you pay out a whole lot in Austria and Denmark, in fourth and fifth placement with their 2,409 and 2,217 euros. We be aware that nations these types of as Hungary, Croatia or the Baltic Republics are excluded from this comparison due to absence of info. These numbers (presented by the association of European suppliers ACEA) to present additional entire data, should be connected to getting ability and ordinary cash flow but are however indicative.

Personal savings IN THE RUSSIAN MOUNTAINS – Other interesting facts are people onTax price utilized to the cost of Vehiclesprolonged to all EU nations and reshuffling the cards. Hungary is the most high-priced: its 27% exceeds in momentum the pursuers Croatia, Denmark and Sweden (25%) and 24% of Finland and Greece. Even so, 22% of Italy and Slovenia, to some degree reduced, pales in comparison with 17% of Luxembourg, 18% of Malta and 19% of Germany, Cyprus and Romania. Our place (regretably) requires its revenge on excise responsibilities: the details ahead of the authorities intervention to quiet costs (who to uncover out more) they communicate plainly. Italy has in actuality the European document of excise duty on diesel – 610 euros for every 1,000 liters, 61 cents for every liter – and is in next place for petrol, with 72 cents per liter. Hungary, which has the primacy of the VAT rate, is the the very least expensive for both equally fuels (35 cents for petrol and 32 for diesel). At the rear of Hungary in conditions of financial state of excise duties for the two fuels we uncover Poland, Malta and Bulgaria (respectively second, 3rd and fourth) though the maximum excise obligations for diesel, just after the Italian kinds, are thanks to Belgium, France and Eire. The file for petrol excise responsibilities, with 82 cents / liter, is in Holland followed by Italy and Finland, Greece and France.

THE TAX IS Content – These taxes and obligations deliver an avalanche of cash to the condition coffers and THAT has ready a table with these information which are unfortunately not homogeneous given that some refer to 2019, other people to 2020 (the yr of the pandemic) and nevertheless others to 2021. taxman 89.7 billion in Germany and 73.4 billion in France. Their contribution to the Italian tax profits (2019 knowledge) was 76.3 billion, down to 34.1 for the Spanish one in 2021. It is also intriguing to independent the numerous items that represent them from the absolute figures. The income from excise responsibilities on fuels and lubricants in Germany and Italy was just about similar 37.7 and 37.3 respectively: Germany certainly ‘consumes’ a lot more but has lessen excise obligations. The better consistency of the German fleet – in 2019 it was 51.60 million autos in opposition to 44.76 in Italy – and the different taxes arise contemplating, for instance, the profits from VAT on profits products and services, repairs and spare areas – 29, 1 billion versus Italy’s 18.9 billion – and insurance plan taxes, which are worthy of 5.5 billion from 3.9. The whole yearly income in the major European marketplaces is ultimately € 375 billion, an astronomical determine.

–