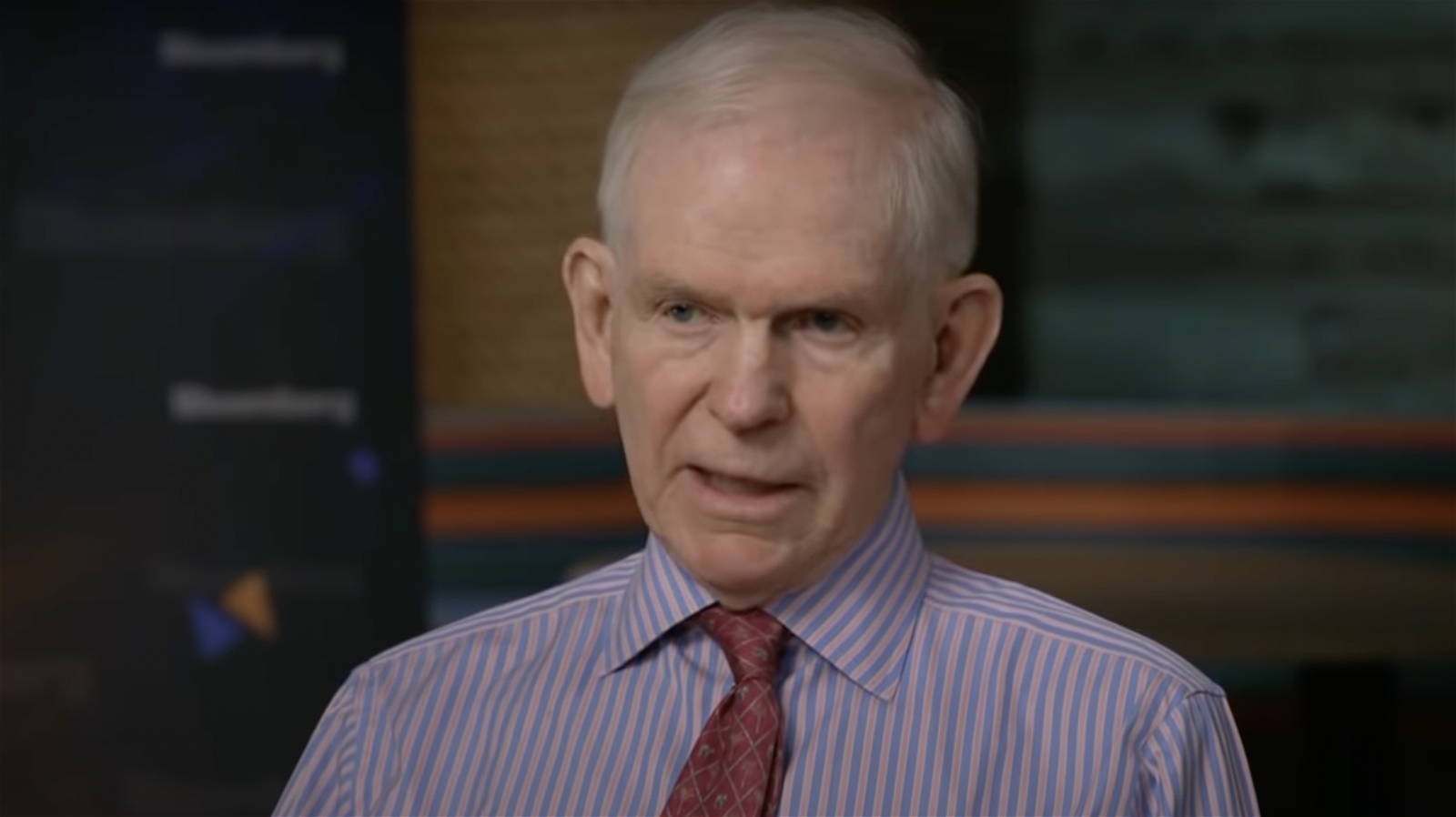

In the wake of the bursting of a ‘super bubble’, the S&P 500, the largest US stock market index, will fall 50 percent. That’s what bearish top investor Jeremy Grantham says.

–Why is this important?

Grantham is a widely followed investor and market historian. He has a significant track record of identifying market bubbles. He foresaw the market decline of 2008 and the bursting of the Internet bubble in 2000.Market historian has repeatedly warned investors that they are trapped in a historic bubble, know Business Insider. Grantham says the US benchmark index could slide to about 2,500 points – down roughly 44% from Thursday’s closing price, and 48% from its January peak. Meanwhile, the tech stock index Nasdaq Composite could see an even sharper decline, Grantham believes.

“Super Bubble”

“Around this time last year, it looked like we were going to have a typical bubble with the resulting average pain for the economy,” he wrote. Grantham in a note which was published Thursday on the website of his asset manager, GMO.

In about 4,000 words, Grantham explains the reasons why he is convinced that the latest “super bubble” will burst, just like its predecessors in 1929, 2000 and 2008.

“Over the course of the year, the bubble blown up to the super-bubble category, one of only three US stocks in modern times have been through, and the potential pain has increased accordingly.”

What made everything even worse, according to the experienced investor, is how the stock market bubble was accompanied by extremely low interest rates and high bond prices. In addition, there is still a bubble in the housing market and a “starting” bubble in commodities.

Blue chips

Grantham points in his writing to the hastening of the bull market in 2020 to February 2021, when the Nasdaq rose a mind-boggling 58% from 2019.

He also points out an incident that occurred in 1929 and 2000 and is replaying today: the underperformance of speculative stocks while blue chips, shares of reputable companies, are starting to climb.

In addition, he mentions the “crazy investor behavior” with, for example meme stocks, as an indicator of a bubble of historic proportions. His conclusion: “When pessimism returns to the markets, we face the largest potential markdown of perceived wealth in US history.”

Japan

The stock guru compares the current bubble with the one experienced in Japan in the 1980s. The impending doom here came from the confluence of two asset bubbles: real estate and stocks. In contrast, in the US, three major asset classes – stocks, bonds, real estate – and a fourth pseudo-class – commodities – are involved for the first time.

“And if valuations in all of these asset classes even return to historical standards by two-thirds, the total loss of wealth in the US alone will be in the order of $35 trillion,” he said.

Grantham’s advice? “Avoid US stocks, invest in value stocks from emerging markets and some cheaper developed countries, such as Japan,” it said. “Plus: have some cash for flexibility, as well as a little gold and silver.”

(jvdh)