The pandemic has brought huge challenges to the vehicle industry. The car is a big enough purchase, and so it is quite understandable that if it is postponed in uncertain times.

Researchers in the British car industry from AutoAnalysis estimated in April that vehicle sales could fall by 2.6 million units in Europe as a result of the pandemic and by two million in the United States. This will mean that new car sales in Europe will not generate at least $ 66 billion in revenue and $ 52 billion in the United States.

Despite such a rather gloomy picture, in this market storm clouds are still seen a small golden edge. The implication is the potential impact of the pandemic on changing consumer habits. This is evidenced, for example, by a New York resident surveyed by the Financial Times, who states that she has just bought a Honda car online: “I haven’t had a personal car since 1999. I didn’t want to. However, now I need a way to safely to move. “

Will change the trend

Huge changes in the car market in recent years are due to demographics. It is assumed that the so-called desire to get to a personal car was expressed Baby Boomers generation (post-war demographic explosion), but young people do not feel the need. In recent years, young urban dwellers have increasingly looked at various personal car alternatives, where the idea of, for example, car sharing, which comes with the development of various mobile applications, has gained popularity. In fact, various alternatives to moving have become increasingly acceptable among young people, and the need for a personal car, with more and more distant ideas, such as starting a family, has become less urgent.

However, this trend can be curbed by Covid-19, which is also the focus of the Financial Times. Moreover, this is suggested, for example, by what is happening in China, whose economy is opening up relatively quickly after the pandemic wave, and there is an increase in demand for private vehicles. In April, new car sales in the country unexpectedly increased by as much as 4.4% year-on-year, according to data available from the China Association of Automobile Manufacturers. Sales of Chinese vehicles fell by 43% in March and by 80% in February.

“One month after the deepest point of the Covid-19 in China, there was interest in switching away from public transport,” Volkswagen said.

“We suspect that Chinese consumers’ recent interest in private transport will continue as long as there is fear of Covid-19,” Bernstein car analysts also told the Financial Times.

In fact, if in the past private car buyers could be attracted, for example, by engine power or comfort, now it can be done by promising health benefits. Of course, it must be borne in mind that the world economy will be in a sharp recession this year, which could, in the worst case, turn into an economic depression. At such times, a lot of hope should not be cherished by highly cyclical businesses. However, such data give the car industry little hope that the times could be a little less bad.

“There’s something you could almost call a ‘stubborn buying activity.’ People are tired of sitting at home and wanting to go out and buy,” added Volvo management.

Also of interest to the British

The question, of course, is whether this trend will resonate in Europe and North America.

The Financial Times, for example, points out that the UK government has urged its citizens to avoid public transport as much as possible. One way to do this, of course, is to travel by private car.

Against this background, on the day the Prime Minister of the United Kingdom Boris Johnson issued such a government announcement, for example, the activity of those interested in the online vehicle trading platform “Auto Trader” had jumped to a new record. A survey is also highlighted in which about half of the country’s driving license holders who do not yet own a vehicle are considering purchasing it, in order to avoid using public transport immediately after the end of the pandemic restrictions.

“What started as a tiny flow turned into a whole stream. The world has woken up dramatically,” said Citygate Automotive, another car dealer.

“The pandemic has the potential to reverse a trend that previously meant young people have no interest in buying a private car. 35% of them now say they are looking for a way to buy one,” added analysts at consulting firm Capgemini. It is also interesting that from March 15 to March 21 in the United States, compared to the previous week, the number of Internet searches for the phrase “Is this a good time to buy a car” increased sevenfold.

However, it is not excluded that what will happen will be only a short-term bounce. “It is inconceivable that we will replace public transport with private transport in all major cities. What is happening may stimulate demand in the shorter term,” said Christian Dalheim, Volkswagen’s sales manager.

Almost stopped

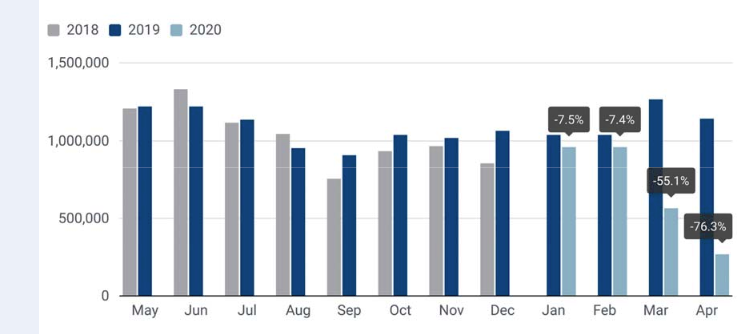

Data from the European Automobile Manufacturers Association (ACEA) published this week on vehicle registration in the old continent (European Union countries) was more than weak. In April, year-on-year registration of new cars decreased by 76.3%. In total, in the first four months of the year, it has planned almost 40% lower. Prior to that, it could not be said that this market was on a stable footing. In 2018, this market in the European Union stagnated. Last year, on the other hand, carmakers in Europe had to adapt to stricter emissions regulations, which required the recall of cars and entailed additional costs.

Schedule: New car registration in the EU. Source: ACEA

In four months, car registrations fell sharply in all major markets, by 31% in Germany, 43.4% in the United Kingdom and around 50% in France, Spain and Italy. In our country, they have collapsed by a quarter during this period.

Measurements in Estonia are similar, but in Lithuania the registration of new vehicles has decreased slightly less dramatically in four months – by 17.3%.

In general, there is no country in Europe where the situation does not signal the collapse of this market or even a complete halt. Conditional competition is rather about the smallest cons. In April, new car registrations fell by more than 90%, for example in Belgium, Italy, the United Kingdom, Spain and Ireland, by 97.6%, 97.3%, 96.5% and 96.1% respectively. In contrast, the smallest disadvantages in Europe just mentioned in April were Denmark (-37%), Sweden (-37.5%) and Finland (-38.6%).

It is also possible to compare which machines Europeans have chosen or, given the unique nature of the pandemic, on the contrary, who have not been particularly active. ACEA data show that the car registration of the Volkswagen Group (which also owns the Audi, Škoda, Seat and Porsche brands) has shrunk by a third in the first four months of the year, which is quite OK, given that for many others the decline has been sharper. In Europe as a whole, 26.8% of registered cars come from plants belonging to the Volkswagen Group. This is an increase of 2.4 percentage points over the year.

This year, the registration of new cars of the PSA group (owned by Peugeot, Opel, Citroen brands) will decrease faster – by 44.4%. It has also fallen by as much as 47% for the Renault group and by 48% for the FCA group (owned by Fiat, Jeep, Lancia, Chrysler, Alfa Romeo), while Ford has by 47%.

Hyundai, whose branded car registrations fell by 31%, the BMW group (down 27.3%) and the Toyota group (down 24.4%) performed less badly. New Daimler (Mercedes, Smart brands) car registrations have fallen by 37.2%.

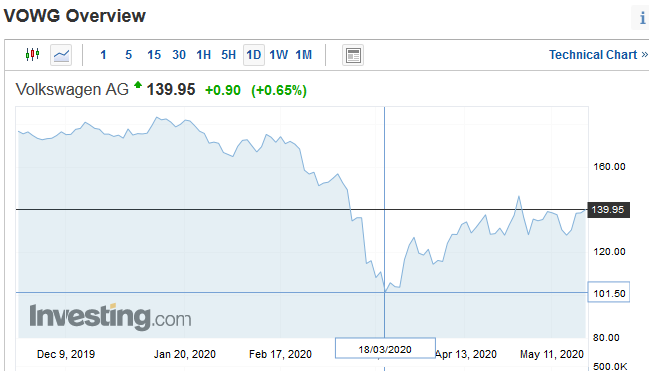

Of course, what is happening also affects the equity of stock investors. Volkswagen’s share price on the Frankfurt Stock Exchange has fallen by a fifth to 138 euros this year. However, since mid-March it has fallen by 36%.

–

–

Graph: Volkswagen share price

France’s Renault picture is sadder – the company’s share value has fallen by 60% this year. In addition, the company’s shares have not been affected by the Volkswagen-type recovery. Ford’s stock price curve looks similarly depressing on the US New York Stock Exchange.

–

–

Graph: Renault share price

Japan’s Toyota Motor stock, on the Tokyo Stock Exchange, has become “17%” cheaper this year alone.

–