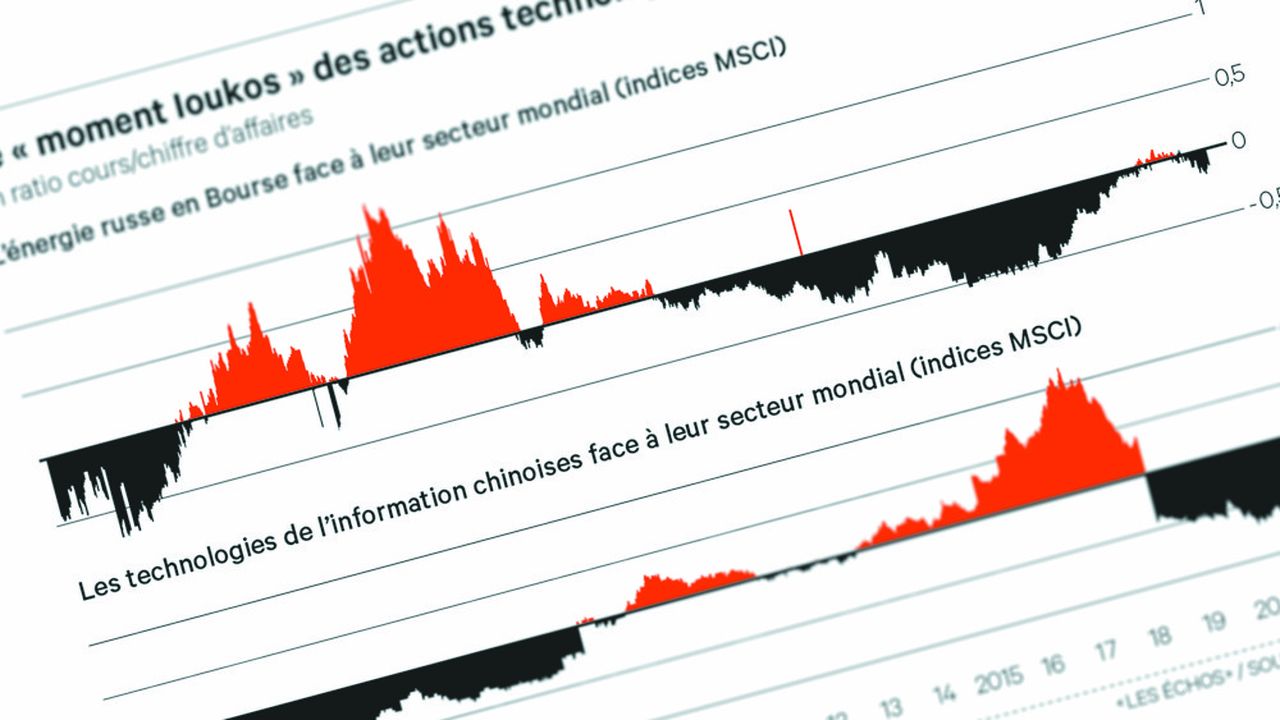

Chinese stocks have amassed panegyrists, but Vincent Deluard, StoneX’s Global Macro Strategy Director, is not one of them. Pressure from Beijing on Jack Ma’s empire led to a “derating” of technological stocks similar to that of Russian energy stocks at the time of the Yukos affair. But the hardest part is yet to come with the demographic shock. Conversely, the objective of making the yuan a reserve currency will make positive real interest rates on Chinese debt more attractive.

The broker balances with American stocks by making the double assumption that the United States will arbitrate in favor of Wall Street at the expense of the strength of the dollar, and will tolerate more inflation. One way to reinvent the “60-40” allocation and maintain a balance of terror in the portfolios.

A Fed more tolerant of inflation?

StoneX points out that if the Federal Reserve wanted to return to the US growth path before the 2008 financial crisis, ie 14 trillion nominal GDP to catch up, this “normalization” would require a decade of inflation at 6%. Companies would see their profits increase in nominal terms, and their stock prices too, if key rates remained at zero.

–

–

Decode the world after

Every day, the writing of Les Echos brings you reliable information in real time. It gives you the keys to deciphering the news and anticipating the consequences of the current crisis on companies and markets. How is the health situation evolving? What new measures is the government preparing? Is the business climate improving in France and abroad You can count on our 200 journalists to answer these questions and on the analyzes of our best signatures and renowned contributors to inform your reflections.

I discover the offers-