Jakarta, CNBC Indonesia – Finance Minister Sri Mulyani Indrawati estimates that a financial crisis will hit several countries in the near future. Indonesia itself was already prepared from an early age through various policies.

“History shows that when interest rates rise and there is a tightening of liquidity, it can potentially create a financial crisis,” he said in an interview with Channel News Asia, Tuesday (14/6/2022).

This was proven when in 1980, when the US raised its benchmark interest rate up to 20%, Brazil, Argentina and Mexico experienced a financial crisis. The same thing happened again in 1990 where US interest rates rose to 9.75%. The 2007 period is also an example.

|

Photo: Ministry of Finance. Ministry of Finance.- – |

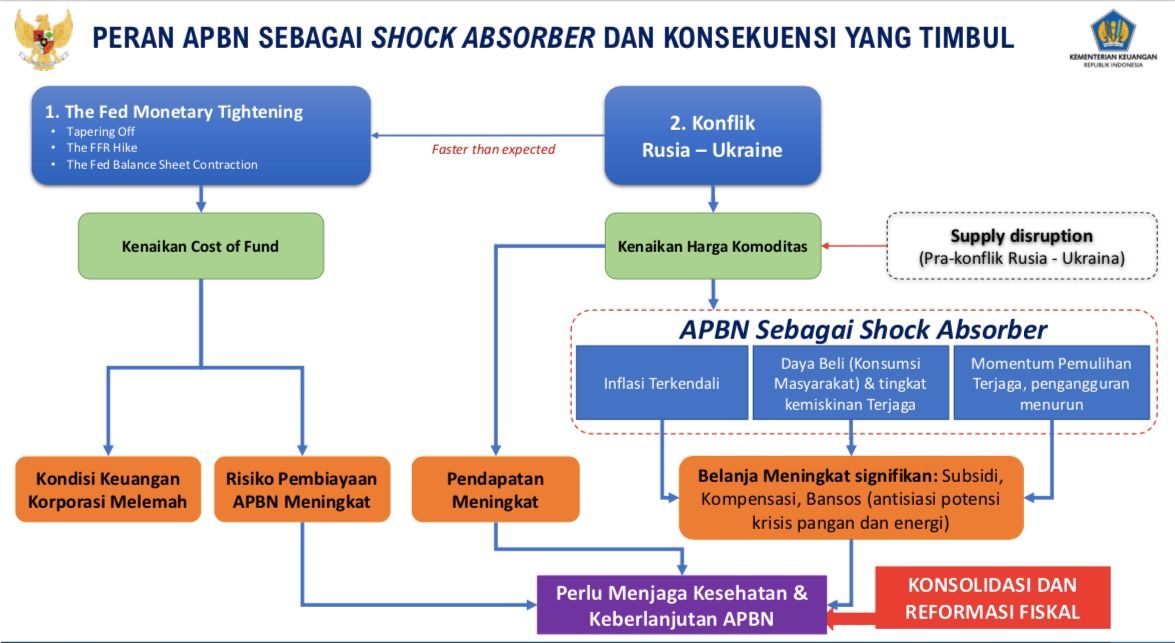

The current situation, said Sri Mulyani, is indeed very difficult. The unfinished covid-19 pandemic is continued by the wars between Russia and Ukraine. Many countries now have to deal with soaring energy and food prices, causing inflation to skyrocket.

On the other hand, the US is also aggressive in raising its benchmark interest rate. Market participants have recently become increasingly panicked as US inflation has jumped to 8.6% (yoy). There is a chance that the Fed will raise interest rates up to 75 basis points when it announces its monetary policy on Thursday.

Countries with narrow fiscal space will experience heavy pressure and can even collapse. Adding debt, the consequence is that the costs incurred are very expensive because of the increase in bond yields. However, burdening the public with price hikes is the risk of a spike in inflation and must be responded to with monetary tightening. Eventually a recession became inevitable.

“The food crisis and energy crisis plus the financial crisis, because many countries during the pandemic have very limited fiscal space while the economy has not recovered,” he added.

Indonesia itself is quite lucky. The increase in international commodity prices such as coal, nickel and palm oil has a positive impact on the economy. Starting from exports, foreign exchange reserves, supply of foreign exchange to additional state revenues.

This will also help the government to contain energy prices through subsidies and increase social assistance for the community. Therefore, inflation can be controlled even though there is an increasing trend. Finally, Bank Indonesia (BI) doesn’t need to rush to raise its benchmark interest rate, which can slow down the pace of economic recovery.

“There is additional revenue that we can reuse to maintain people’s purchasing power,” said Sri Mulyani.

Photo: Doc, Ministry of Finance Photo: Doc, Ministry of FinanceDoc, Kemenke- – |

It is also important then to be anticipated by the government is financing. The state budget is still in deficit, meaning it still needs funds from the market to meet spending needs.

The 2022 state budget deficit is estimated to reach 4.50% of GDP or IDR 868 trillion, lower than the previous 4.8% of GDP or IDR 840.2 trillion. Meanwhile, in 2023 it is estimated to be below 3% of GDP.

“We are reducing the deficit so we are not in a position to pursue financing in the market when the market is volatile,” he concluded.

Next Article

2021 US Economy Jumps 5.7% Highest Since 1984

–

–

(me/dru)

–