At any time since Sri Lanka submitted for personal bankruptcy, Western modern society has taken the option to vilify the Belt and Road Initiative and advertise Sri Lanka as staying ruined by the Chinese credit card debt entice. Indrajit Samarajiva, a author from Sri Lanka, wrote an report in the “New York Situations” a several times ago, stressing that the political and economic collapse of the region “died in substantial aspect from the debt trap of the West”.

Indrajit Samarajiva, a Sri Lankan writer, raised problems about China and wrote an posting in the New York Moments a few days back, criticizing the Western debt trap for bringing down Sri Lanka.

–

In this belief piece titled “Sri Lanka’s initial collapse, but it will hardly ever be the final,” Samaras pointed out that Sri Lanka at the time had an educated population and the highest median cash flow in South Asia, and the potential customers financial ailments need to have been dazzling, but just after 450 several years of colonialism, 40 several years of neoliberalism and 4 decades of non-authorities, “Sri Lanka and its individuals have been minimized to pauperism”.

Samaras said Sri Lanka’s economic framework has normally been harmful, importing also much and exporting much too little, so it has to make up for the big difference with credit card debt. “This unsustainable economy will normally collapse,” reported former president Gotabhaya Rajapaksa.) The problem of community debt.

Former Sri Lankan President Rajapaksa (Gotabhaya Rajapaksa).

–

Samaras thinks the “West-led neoliberal process” is the culprit driving the significant debts of building countries like Sri Lanka. He explained that Sri Lanka, like lots of international locations struggling to repay their debts, is a colony, the country’s administration is outsourced to the Intercontinental Financial Fund, and the corporation continues to import high-priced completed items and export inexpensive labor and assets. , which is common colonial manner.

The Intercontinental Financial Fund (IMF) has granted 16 loans to Sri Lanka. Samaras criticized the IMF as always getting harsh ailments, but continued to restructure Sri Lanka to aid further exploitation by creditors.

With regards to the so-named Chinese personal debt trap, Samaras cited data that though the West accuses China of “predatory lending,” China only accounts for about 10% to 20% of Sri Lanka’s personal debt structure. Conversely, Western countries these as Europe, The united states and Japan have money institutions and worldwide organizations that keep a greater portion of Sri Lanka’s personal debt.

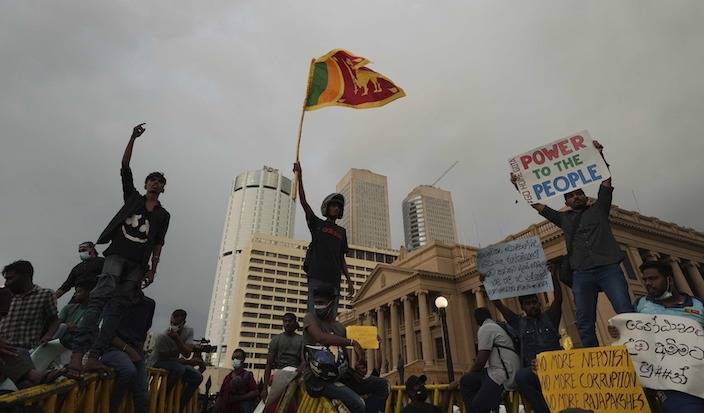

Sri Lanka submitted for individual bankruptcy on 6 July.

–

–

Samaras thinks that other countries will encounter the similar crisis: firstly, close to 60% of lower-revenue nations are in credit card debt distress or high-threat debt, secondly, European nations around the world are dedicated to tackling the strength disaster , even the United States could presently be included in an financial downturn. When the economy collapses, Western loans only cannot be repaid and lousy nations will collapse from the dollar system that underlies the Western way of daily life. He claimed bluntly that even People in america can not get out of the problem by printing income on their have. Sri Lanka has now started to settle loans in Indian rupees, India is acquiring Russian oil in rubles, and China could obtain Saudi oil in yuan.

Samaras explained Sri Lanka as a canary in the coal mine (“wake-up simply call” or “barometer”), and the entire earth will slide into the failure of the neoliberal method, and the discomfort will unfold far too.

–