The sentiment is just as bad right now. After a slightly higher opening, the AEX (-0.8%) again closes sharply in the red. Tensions between Russia and Ukraine are rising again, and then there are traders who prefer not to take their shares into the weekend.

Don’t be fooled

Still, in my view, the conflict is a non-event for the stock market in the long run. You don’t think we’ll do less shopping at the Albert Heijn if Russia invades Ukraine, do you? Or that we ignore the gyms?

The best thing you can do as an investor in this kind of situation is just do nothing. After all, we cannot predict how the conflict will end and even in a worst-case scenario, companies still earn money for their shareholders.

Once again, it is the unprofitable growth companies that have been hit hardest. Just Eat Takeaway (-7,0%), Inpost (-4.4%) in CM.com (-4.2%) are completely destroyed. In the Today’s podcast I explain that there is indeed value in the latter sit.

On the other hand, there are also winners, so pops Fugro (+17.9%) up on strong corporate numbers. After years of ailing, the soil researcher is finally seeing growth again. Last quarter turnover increased by no less than 24% and margins are also improving. Whether this is the start of a turnaround I can’t say yet. The company has disappointed too many times in the past for that.

Iron

The fourth quarter figures of Iron (+3.5%) have relatively few surprises. Although sales fell by 17% on a quarterly basis, such a decline in the fourth quarter is not uncommon. After all, it is traditionally the weakest quarter for the chipper from Duiven.

Furthermore, the order intake for the fourth quarter is positive and Besi will pay out more than €3.33 in dividend for the 2021 financial year. This implies a dividend yield of 4.2%. The share is currently trading at 15 times the expected profit for 2022. You can read in the article below whether the share is worth buying.

Iron: dividendverdubbeling #IRON https://t.co/GoYyhO2Ucd

— IEX Investor Desk (@Investor Desk) February 18, 2022

Heijmans

Where BAM (-2.5%) regularly engages in large projects, the results of these are striking Heijmans (-3.4%) little to fault. Although turnover remained stable at €1.75 billion last year, EBITDA increased by no less than 25%. In short, margins are on the rise.

Although material costs rose sharply, this was offset by higher house prices. The real estate division is therefore currently Heijmans’ most profitable activity.

Another difference with BAM is Heijmans’ strong capital position. While BAM’s solvency ratio remains at 14.5%, Heijmans achieved a score of 30%. The latter can therefore provide for its shareholders and does so. The builder proposes a dividend of €0.88 per share.

You can read in the article below whether the results are sufficient for a buying recommendation.

Heijmans positively on its way to 100th anniversary #Heijmans https://t.co/ed2HbnjSSF

— IEX Investor Desk (@Investor Desk) February 18, 2022

Annuities

Ten-year government bond fees are broadly declining today. We are currently in Risk-off modus.

- Netherlands: -0 basis points (+0.47%)

- Germany: -3 basis points (+0.20%)

- Italy: -1 basis point (+1.84%)

- United Kingdom: -6 basis points (+1.39%)

- United States: -4 basis points (+1.93%)

The weekly lists

- AEX this week: -2.2%

- AEX this month: -1.4%

- AEX this year: -6.7%

- AEX reinvestment index this year: -6.4%

All down

Virtually all stock indices have lost some ground this week. The damage at the Nasdaq (-1.4%) is not so bad at first sight, but that is because the pain had already been taken on Friday last week. Furthermore, the sharp fall in the price of the ASCX (-3.4%). The trigger is the negative grade receipt from builder BAM (-16,5%).

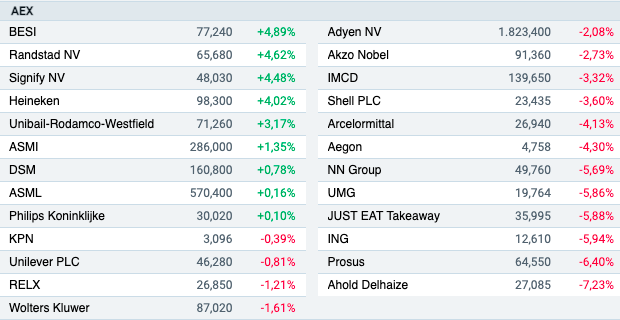

AEX

The chippers are in good shape this week. It’s not often that Iron (+4.9%) is the best AEX fund in a declining market. On the other hand, Ahold (-7.2%) a beating. Traditionally, management expressed an unprecedented cautious outlook. NN Group (-5.7%) surprised with a strong share buyback program worth €1 billion, but sentiment among insurers is just as bad this week.

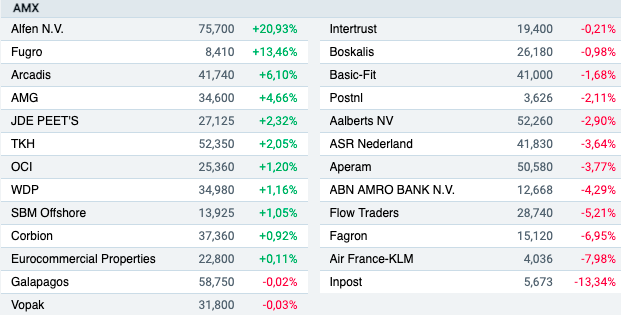

AMX

Elves (+20.9%) expects to grow by 40% this year and that is a resounding surprise. Given the problems in the supply chain, no one expected growth at the energy specialist to accelerate. Last year, the company managed to increase its turnover by 32%. Fugro (+13.5%) finally manages to deliver good fourth quarter figures. The soil researcher has seen more than 60% of the stock market value evaporate in the past five years.

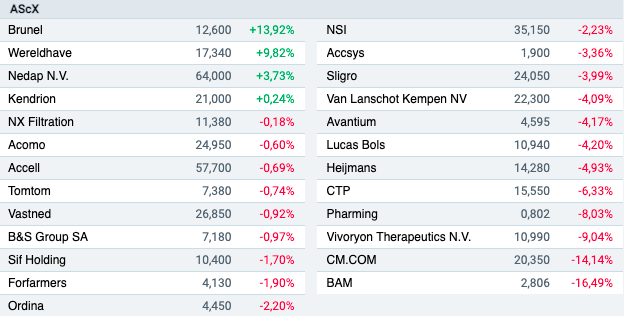

ASCX

The profitability of Brunel (+13.9%) came in higher than expected and the company also announced a dividend of €0.45 per share. This implies a dividend yield of almost 4%. BAM (-16.5%) again had to make a substantial write-down on the Afsluitdijk, although this has not yet been formally announced. The problem is that no one knows how many debits will follow.

Finally, I wish you a nice weekend. This week Arend Jan is making the preview.

–