DSM (+8%) and Unilever (+9.3%) were today leaders in the AEX (+0.6%). The two generally defensive funds managed to keep the Dutch main index above water. Heavyweight Unilever and DSM were jointly responsible for about 1.5% of the rise in the AEX. Without those two funds, the index would therefore be about 0.9% in the red, more in line with the other European indices.

Unilever managed to reach the green after announcing this morning that activist shareholder Nelson Peltz would take a seat on the board.

The CEO of investment company Trian Fund Management, which has a stake of about 1.5%, will be a non-executive director at Unilever as of 20 July. Investors seem to like Peltz’s board seat. Not unjustly, because in the past he has managed to increase the margins of Procter & Gamble. Let the latter be Unilever’s problem.

‘DSM is in an excellent market position’

An extremely surprising message this morning at DSM was the cause of a significant price jump. The DSM staff will gain about 10,000 colleagues in one fell swoop, because it has announced that it will merge with the Swiss firm Firmenich in a complex billion-dollar deal.

Formally, DSM and Firmenich regard the joining of forces as a merger, but in fact this is not the case. After all, shareholders of DSM will receive a 65.5% interest in the merged company, the Swiss the remaining 34.5% and €3.5 billion in cash.

Also – and this is less surprising – the sale of the remainder of the Materials division was announced. “The announced acquisition/merger will benefit the risk profile and growth for the coming years. DSM has an excellent market position,” said senior analyst Martin Crum in his very extensive analysis of DSM. In it you will find, among other things, his price target and advice.

DSM makes an excellent move as it merges with Swiss firmenich, judges @martinjancrum.

His full analysis can be found here: https://t.co/yD6Ppn2Qjz #DSM #Merger #Firmenich #AEX pic.twitter.com/yjDWUVNNtp

– IEX.nl (@IEXnl) May 31, 2022

Merger battle at Euronav

Speaking of mergers, at Euronav (-3.2%) a real merger battle is underway. To merge with industry peer Frontline or not, that is the question. The Saverys family has increased its stake in Euronav to around 20% and is known to strongly oppose the merger,” explains analyst Martin Crum. Major shareholder of merger partner Frontline has meanwhile also increased its stake in Euronav to a rounded 13%.

And now it gets interesting, according to the analyst. “Fredriksen – the driving force behind the desired combination of forces between the two oil tanker companies – is considering lowering the acceptance threshold to just 50.1%. A full, unconditional merger requires at least 75% of the voting rights, which Fredriksen does not seem to be able to achieve. After all, Saverys already has 20%, may be able to gain some support elsewhere from major shareholders and, moreover, in a vote, all the outstanding capital is rarely represented.”

Disembark at Euronav https://t.co/r9P4K8a2R6 #IEX

– IEX.nl (@IEXnl) May 31, 2022

It can therefore still go either way, especially if the parties continue to buy. This eager buying behavior has benefited Euronav’s share price recently. Shareholders who have reaped the rewards of this may well continue to pick for a while as the merger battle could push the price even further.

This sounds tempting, but Martin Crum is vigilant. He puts you in his analysis of Euronav exactly why.

Macro figures

Some important macro data came out today. Let’s work through these numbers in chronological order. Starting with Chinese macro data. This shows that the contraction of the Chinese economy is decreasing. The index that measures the activity of the Chinese services sector came in at 47.8 in May, compared to 41.9 in April. The purchasing managers index rose from 47.4 to 49.6. The Chinese economy appears to be about to start growing again. An index reading below fifty indicates contraction and a reading above fifty indicates growth.

For the next noteworthy macro figure, we visit our eastern neighbors. Unemployment here fell further in May, but not as much as in April. This month the number of Germans ran without work back by 4,000, while economists expected a decline of some 16,000. Let’s just say everyone is wrong once in a while.

Eurozone inflation up to 8.1%

The eurozone inflation figure was released this morning. Inflation is rising sharply and even faster than expected. In April and March inflation was 7.4%. Experts consulted in advance expected a limited increase to 7.6%, but this was slightly higher: 8.1%. That’s going to be crying at the cash register again.

We also take a quick look at consumer confidence among Americans. This fell less sharply than expected. In April, the consumer confidence index in the United States stood at 108.6 and was expected to fall to 103.9. However, it was limited to a decrease to 106.4.

The event for investing in the Netherlands

On Friday, July 1, 2022, Theater ‘t Spant in Bussum will be the beating heart of investing in the Netherlands. A large number of investment experts, top executives of listed companies and other leaders share their insights, strategies and tips for a day. Tickets are available here.

Annuities

Interest rates are moving up again. In the Netherlands, the ten-year interest rate rose by eight basis points to 1.42%. We would almost get used to it, but remember that such moves are really big in the interest rate market. Right now, the market is pricing in an interest rate hike of a quarter for July this year, a quarter for September and two more quarters for the remainder of 2022.

Monthly lists

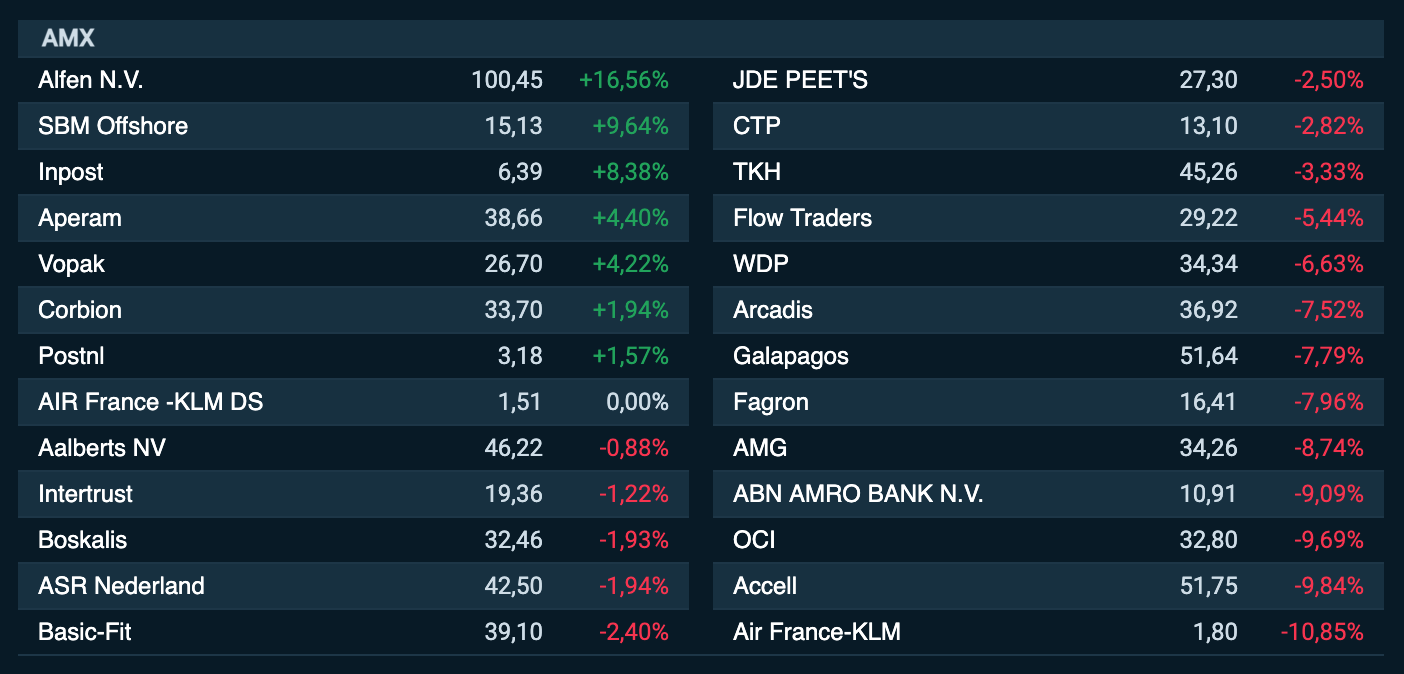

The month of May has already come to an end. That means that we will once again take stock of our monthly lists. Below you will find the performance of our Dutch main index, the mid-cap funds and the smaller ones from the AScX.

AEX

AMX

AScX

broad market

- The AEX (+0.6%) performed today worse outperforming France (-1.4%) and the German DAX (-1.2%).

- The CBOE VIX Index (Volatility) rises to 27.1 points.

- Wall Street is in the negative: S&P 500 (-0.9%), Dow Jones (-0.8%) and the Nasdaq (-0.8%).

- The euro is down 0.5% and is now trading at 1.072 against the US dollar.

- Gold (-0.8%) and silver (-1.1%) are not in demand today.

- Oil: WTI (+0.4%) and Brent (+0.6%) prices in the plus.

- Bitcoin (+0.4%) is rising.

The Damrak:

- Again Tiger Global Management has its stake in Just Eat Takeaway (+0.4%) reduced; this time below the notification limit. At the beginning of this month Tiger Global still had an interest of about 4.8% and that is now about 2.9%. On April 13 this year it was even almost 5.2%.

- Goldman Sachs has today ING (+0.5%) on his buy list. The investment bank has raised its price target for ING from €14.50 to €16.25 and therefore considers the share worth buying.

- Also the advice for Aperam (+0.1%) was increased from holding to buying. In this case, however, it was not Goldman Sachs, but Morgan Stanley who put the AMX fund on the buy list. The price target was increased by €5 to €51.

- alfen (-1.1%) is going to build a large energy storage system for a Finnish wind farm. In addition, analyst Niels Koerts wrote today about Alfen, now that the share has reached its price target of €100. You can read what Koerts now advises in his analysis of Alfen.

- The nearly 16,500 mail deliverers of PostNL (-0.9%) can look forward to October this year. From then on, PostNL will pay out more wages. The postal processor has reached a final agreement with the unions about a new collective labor agreement for deliverers. This includes a wage increase of more than 8% in total. By that time, however, the high inflation will have already eaten some of that away.

- High volumes at OCI (+3.2%). However, we cannot find a clear reason.

I can’t find anything about indices, the forum doesn’t know either and it’s a lot of turnover and very little movement. Couple of big boys who… Anyone? #OCI https://t.co/CIKSp50Hv5

— Arend Jan Kamp (@ArendJanKamp) May 31, 2022

- Gaming and Advertising Company Azerion (+5.5%) saw both revenue and adjusted EBITDA more than double in the first quarter of this year. In Q1, Azerion achieved a turnover of €94 million, more than twice as much as a year earlier. The company remains confident that it will achieve a minimum turnover of €450 million this year. I don’t know if that will work. What I do know is that the CEO of Azerion will be attending the IEX Investor’s Day on July 1. View the program and order tickets here.

Advice

- Aperam: to €51 from €46 and increased to buy – Morgan Stanley

- ING: to €16.25 from €14.50 and increased to buy – Goldman Sachs

- ArcelorMittal: to €46 from €39 and buy – Morgan Stanley

Agenda Wednesday 1 June

00:00 Adyen – Annual Meeting

01:30 Industry Purchasing Managers Index – May Final (jap)

03:45 Industry Purchasing Managers Index Caixin – Mei (Chi)

08:00 Retail Sales – April (Ger)

09:00 Industry Purchasing Managers Index – May (NL)

09:15 Industry Purchasing Managers Index – May (Spa)

09:45 Industry Purchasing Managers Index – May (Ita)

09:50 Industry Purchasing Managers Index – May Final (fra)

09:55 Industry Purchasing Managers Index – May Final (German)

10:00 Industry Purchasing Managers Index – May (eur)

11:00 Unemployment – April (eur)

13:00 Mortgage Applications – Weekly (US)

15:45 Industry Purchasing Managers Index – May Final (US)

16:00 Industry Purchasing Managers Index ISM – May (US)

16:00 Construction Expenses – April (US)

16:00 Vacancies – April (US)

20:00 Federal Reserve – Beige Book (VS)

22:00 GameStop – US Q2 Figures

22:00 Hewlett Packard – US Q2 Figures

–

Coen Grutters is editor of IEX. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. click here for an overview of the investments of the IEX editors.