On the 7th, Eunjin Ahn explained the word’stock’ while playing a game where you guessed the words while wearing headphones at SBS’Running Man’.

He didn’t hesitate to shout out top-selling stocks such as Samsung Electronics, Kakao, Tesla, etc., and then “go straight up” and perfectly express the rise of stock prices with his fingers soaring into the sky.

The next was Hwaryongjeomjeong. He showed a gesture that seemed to be hitting the floor, and repeated that only the stocks that I had previously shouted would go up, saying, “(the stocks I bought) are still there.” He then connected his hand gestures to his cell phone and tapping on the keyboard.

Other performers laughed at this explanation, saying, “(Ahn Eun-jin) shares 100%.”

|

‘Danta Beast’ Dongmin Jang “500% return”

In the entertainment industry, there was a fever for stock investment, called the’Donghak Ant Movement’.

The web entertainment ‘Ant is Today’s Thom Thom Chapter 2’, released every Wednesday on Kakao TV, has become a popular content by showing the scenes that celebrities experience while investing in stocks.

It is a program that combines stocks and entertainment in which not only the trial and error of an entertainer who simply stocks but also an expert participates as a mentor to learn how to read the market trends and investment strategies.

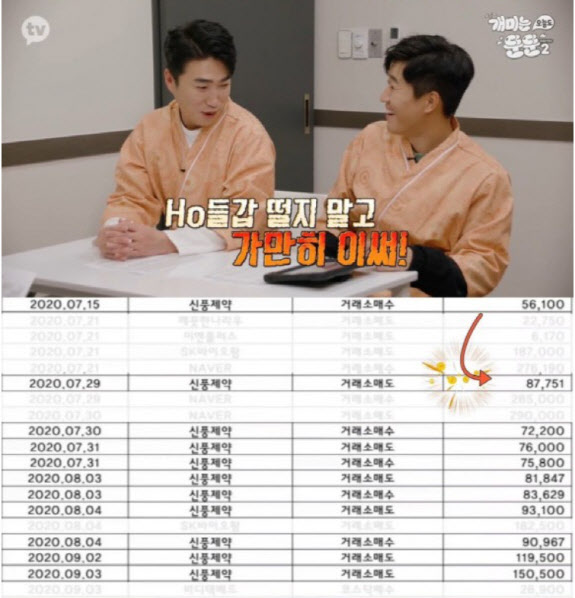

On the broadcast on the 3rd, experts who looked at the stock trading history of comedian Jang Dong-min last year admired that there are all the items that have enjoyed the times. Jang Dong-min revealed that he had learned how to trade by himself after experiencing the experience of being blindly bought after listening to acquaintances and being cut in half.

In his trading statement, there was Shinpoong Pharmaceutical, which was the hottest bio stock last year from Naver and Kakao and where fire ants gathered.

|

He was nicknamed’Danta Beast’ due to frequent trading, “I set a target rate of return and invest in stocks. Don’t be disappointed even if your profits are lost. I think there is a need to be tied to the sport. If you look at the 10% yield and enter, you will sell even 7% profit.”

At the same time, he said, “It seems to be about 6 times the amount of the original investment.”

However, Jang Dong-min was also concerned that the trading pattern he had learned alone was not dangerous. In response, an expert said, “When other ants paid their mentors, they tried to read their own rapidly changing world. If 2020, which was a historical bull market, was in a downturn, it would have been a stop loss while continuing to bite with such a trading pattern.” Diagnosed.

Another expert pointed out, “The current trading pattern is a way to sacrifice time to focus on the main business,” and pointed out that “but it is an investment focused on bio stocks that are fluctuating.”

Then Jang Dong-min said, “I am trying to turn my eyes to the semiconductor.”

Jeon Wonju “I don’t sell even with a 60-70% yield”

Actor Jeon Jeon-joo was the best investor in the entertainment industry that surprised ants the most recently.

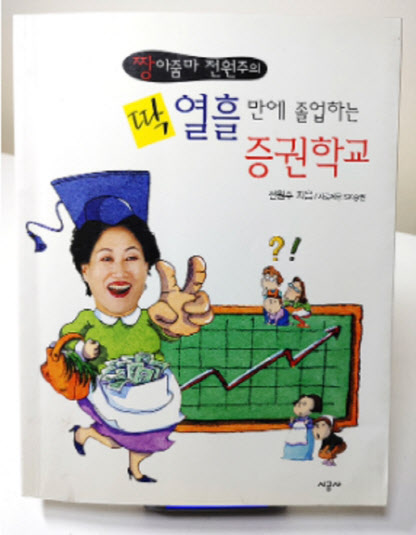

When Jeon Joon-joo, who has a loud laughter and a warm charm like a neighbor’s aunt, is known as a master who published an investment guidebook called’Securities School that graduates in just 10 days of aunt’s aunt’s house in 1999, he said, “Please conduct a YouTube broadcast.” The request of the back was followed.

|

In this book published 22 years ago, Jeon Joon-ju was warning against brain trafficking, saying, “Do not hatch controversy.” He said that he had already invested 5 million won in stocks in 1987 and called it up to 30 million won. He said that he has invested in the company since the 2000s when SK Hynix’s stock price was around 2,000 won and has been holding it for 10 years.

As well as stocks, shopping malls, savings, etc., the country’s current wealth is about 3 billion won, emphasizing study and diversification investment.

In an interview with a media in 2006, “I went to a lecture at Hynix, and after seeing the company atmosphere, I thought that it would happen, so I bought stock.” “When Hynix’s return on investment reached 60-70%, a brokerage employee told me to sell it, but it is still holding it. I said.

In an interview at the time, Jeon Jeon-joo said, “In 1997, when I entrusted a stock investment of 100 million won to an employee of a securities company, it was cut in half. At that time, it was very dark in front of me.” He revealed the opportunity to study, saying, “Afterwards, I must visit banks and securities companies every ten or fifteen days to meet with experts to check the management status and yield.”

He also consistently advised through various broadcasts, “If you do not be greedy, diversify and invest patiently and carefully, you can earn money.”

Jeon Jeon-ju emphasized, “Have fun collecting rather than having fun, and invest one by one by studying stocks a lot.” “Don’t like luxury, people should become luxury.”

– .