Favorable economic environment

The Mauritian economy is experiencing measured but stable growth. Thanks to a policy that has a positive influence on the business climate (the country also ranks first on the African continent in this area according to the Doing Business 2020 ranking, published by the World Bank) and a particularly efficient judicial system, Mauritius is a very favorable destination for setting up a business.

A true bridge between Africa, Asia and Europe, the country offers a strategic positioning of choice for accomplishing business projects. France is the leading investor there and French investment flows represent nearly a third of total flows.

The country also has a very attractive tax regime. The common law tax rate (Income Tax) amounts to 15%, to which must be added 2% social levy (Corporate Social Responsability Fund) for companies. In addition, there are double taxation treaties in Mauritius, and in particular with France.

Steps to start a business

Setting up a business is quick and easy and can be done in just three days. There are two main forms of commercial companies: the Public Company (or public company) and the Private Company (private company). The public company can call on public savings and the number of shareholders can be greater than 25. Concerning the private company, the number of shareholders must be less than 25 and it benefits from a relaxation of the procedures, in particular in matters of holding meetings and preparing the annual report. For private companies, there are two categories:

• The Small Private Company (or small private company): the turnover must be less than 50 million rupees, or 1.25 million euros. These companies are exempt from certain obligations such as appointing a company secretary and an auditor.

• The One Person Company (or one-person company): this must be made up of a shareholder who must be the sole director.

To create a business, you must first make sure that the chosen company name is available from the company register. The latter will then give you a name reservation certificate valid for two months. Through the online system CBRIS, it is possible to do all the registration procedures remotely.

In general, investors use the services of a company secretary who will register the company, provide hosting and legal secretarial services, keep company records up to date and inform shareholders and directors of the company. regulations to be observed in the country.

The French Chamber of Commerce and Industry à Maurice helps entrepreneurs throughout their efforts thanks to a network of French investors, the realization of market studies and diagnostics or the organization of prospecting missions.

In which sectors to invest?

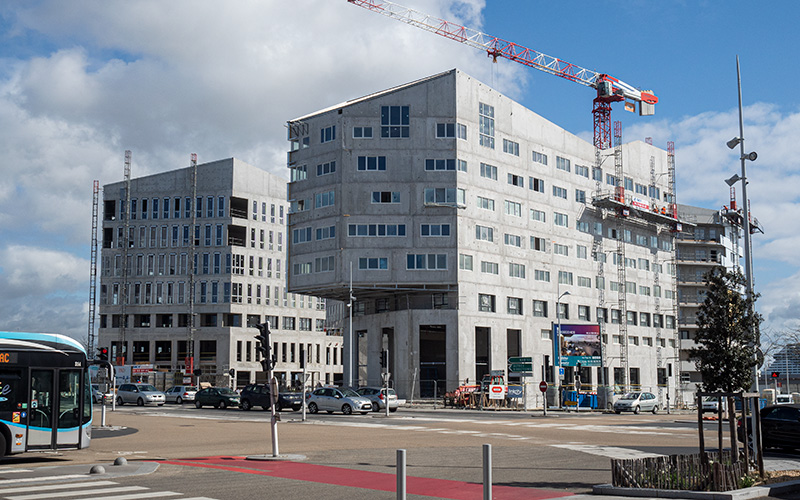

The country’s economy is largely generated by the service sector, in which tourism occupies an important place. The construction sector, which accounts for nearly three quarters of foreign direct investment, finds excellent outlets in luxury goods – villas, golf courses and similar facilities.

Financial activities also show good development margins. The Mauritian financial center is stable and attractive and Mauritius plans that this sector could represent 15% of its GDP by 2030. Mauritius finance is looking for lawyers, accountants or even endowed fund managers. international experience. The country also aims to be a pioneer in the field of FinTech and blockchain technologies. The development of financial technologies is booming and it tends to be done more and more at the local level.

Other sectors are particularly promising, such as real estate, biotechnologies and even health. The localization of the operations, logistics or purchasing platforms of companies or groups operating in Africa is also in full development.

–