Sentiment on the financial markets is improving. Things are not going very fast yet, it is not yet an end-of-year rally, but many funds can finally recover from the price hits that have been suffered since the summer.

Some relaxation on the inflation/interest rate front gives investors courage. Here and there there is already cautious speculation about the first interest rate cuts. Too early according to central banks themselves, but the market could be right here.

Most economies are not in such a flourishing position. This applies first of all to Europe, but as the Biden administration stops its absurdly high spending, the American economy will also have to take a big step back.

Damrak

Over to the Damrak where the biggest gainers won more in percentage terms than the biggest losers had to give up. It is mainly mid- and small caps that still have to make up quite a bit of lost ground: one liquidity crunch It is precisely those types of shares that are hit the hardest.

The AEX has had a great week and on balance was able to add just under 2%, who knows, maybe there will be something of an end-of-year rally. It has been a downright difficult stock market year for most investors.

The index ultimately closed at 758.59 points, a daily plus of 0.6%.

Top three risers/fallers

Bron: IEX.nl

X-Fab

X-Fab has had another strong quarter and profitability was even better than expected. Chips for the most important end market, automotive, in particular showed strong growth. The shareholder structure was also changed, but this will make little difference to private investors. Is the chipper interesting:

X-Fab groeit hard IEX Premium via @IEXnl

— IEX Investors Desk (@Beleggersdesk) November 17, 2023

Melexis

Belgian chip company Melexis is doing quite well and is benefiting, among other things, from strong demand for chips in electric cars. A Capital Markets Day held provided interesting insights:

Melexis expects significant growth in IEX Premium in the coming years via @IEXnl

— IEX Investors Desk (@Beleggersdesk) November 17, 2023

Arcadis

Arcadis is fully engaged in its work and is benefiting from major developments such as the energy transition, water scarcity and climate change. Even in the current less economic times, the demand for Arcadis solutions remains high a high level:

Arcadis positive about future profit growth opportunities IEX Premium via @IEXnl

— IEX Investors Desk (@Beleggersdesk) November 17, 2023

Brunel

Although the stock market climate appears to be clearing up somewhat, the market is merciless for companies that fail to meet expectations or report setbacks. A few weeks ago that fate also befell Brunel. An update from the Investors Desk:

Secondment provider Brunel less sensitive to recession than large broadcasters IEX Premium via @IEXnl

— IEX Investors Desk (@Beleggersdesk) November 17, 2023

IEX BeleggersPodCast

Of course, this Friday will not pass without the IEX BeleggersPodCast. This time with a surprising, different line-up, but certainly worth a listen. on the contrary.

Today’s topics included TKH, Prosus, Besi and Renewi, as well as (briefly) the elections and the regular question round:

IEX BeleggersPodcast: TKH Prosus Renewi IEXnl via @IEXnl

— IEX Investors Desk (@Beleggersdesk) November 17, 2023

Wall Street

In the US there was a somewhat messy start to the day. The message that Applied Materials (- 9%) have a criminal investigation pending, did not go down well. Figures from GAP (+ 30%%) were well received.

At the end of Europe, the Dow Jones was fractionally lower, as was the S&P 500 and the Nasdaq lost 0.2%.

Annuities

A marginal relief on the bond market with most interest rates falling fractionally. Too bad for Flow Traders, but most investors won’t complain about it.

- Ten-year interest rate in the Netherlands 2.90% (minus 2 basis points)

- Ten-year interest rate Germany 2.57% (minus 2 basis points)

- Ten-year interest rate France 3.14% (minus 1 basis point)

- Ten-year interest rate Italy 4.33% (minus 2 basis points)

- US ten-year interest rate 4.13% (minus 2 basis points)

- Ten-year UK interest rate 4.46% (plus 1 basis point)

Broad market

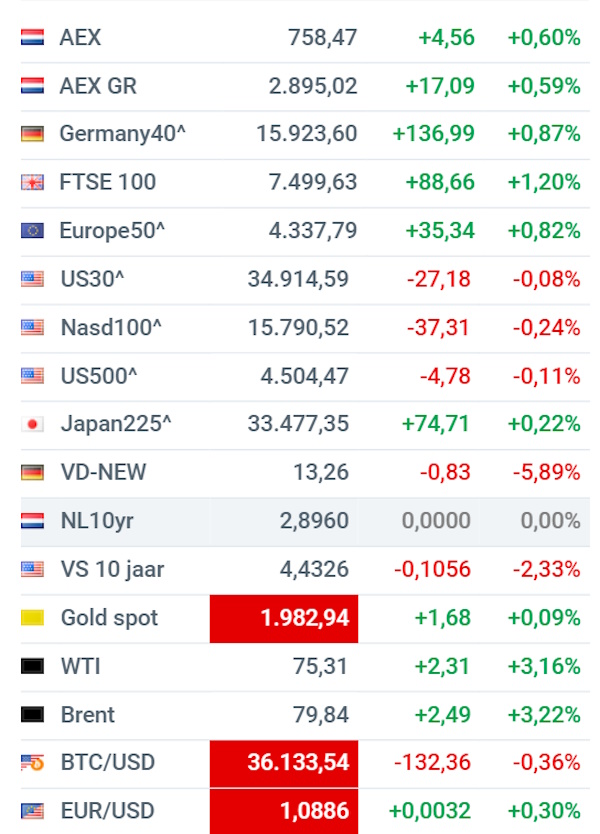

Lots of green to be seen on the broader market, most European indices were able to post another nice profit. The VIX is now in hibernation mode, gold is holding up well just below $2,000 and oil has rebounded strongly after a number of days of declines. Meanwhile, the euro is already approaching 1.10 versus the dollar.

Bron: IEX.nl

The Damrak

- Adyen (+ 2.2%) is on an unstoppable rise, much to the delight of Premium members who can thus add a nice return

- Shell (+ 1.8%) is rebounding somewhat in tandem with a nicely recovering oil price

- Unilever (-0.8%) cannot yet convince with its new CEO and will have to consider more drastic steps

- AMG (+ 3.8%) were among the winners of the day, but still have a long recovery path to go

- Just Eat Takeaway (+ 1.2%) has finally broken out according to the TA books, we are curious

- SBMO (+ 1.2%) is one of the many mid-cap funds that are like the proverbial dead bird, despite a low valuation

- Accomodation (-3.3%) has been under pressure for some time, the trading house unexpectedly saw the CEO resign

- Brunel (+ 2.5%) is rebounding somewhat, after negatively received Q3 results earlier this month, which put the fund down about 15%

- On the local market Euronext (+ 0.5%) in a real closing rally.

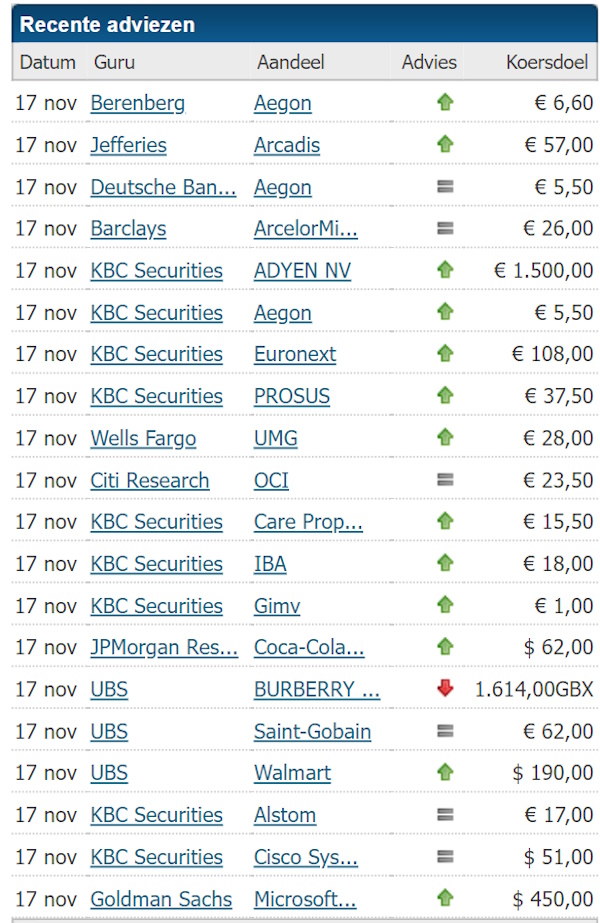

Advice (source: Guruwatch.nl)

Agenda 20 november

08:00 Producer prices – October (Dld)

4:00 PM Leading Indicators CB – October (US)

22:00 Zoom Video Communications – Third quarter figures (US)

And then this

Inflation? Or will it soon become deflation…?

Deflation could be coming this holiday season, Walmart CEO says

— CNBC (@CNBC) November 17, 2023

Alibaba is not splitting off cloud and that is not going well with investors

Deflation could be coming this holiday season, Walmart CEO says

— CNBC (@CNBC) November 17, 2023

Germany is lagging far behind

Good Morning from #Germany where public sector investments have lagged behind for decades. Germany’s net fixed capital formation from the public sector avg just 0.1% of GDP a year over the past 3 decades, far lower than other AAA-rated economies (1.0%), and behind other large… pic.twitter.com/yqVJlHIapB

— Holger Zschaepitz (@Schuldensuehner) November 17, 2023

Lagarde likes a European SEC

Europe needs its own SEC, says Christine Lagarde

— Financial Times (@FT) November 17, 2023

The London Stock Exchange is also looking to buy back its own shares

London Stock Exchange Group to launch £1 billion share buyback as it capitalizes on data push

— MarketWatch (@MarketWatch) November 17, 2023

Private equity may have to bite the bullet for longer

Private equity managers leave Zurich with a frightening thought after they gathered with many of their top investors this week: this year’s slump in dealmaking may continue well into 2024

— Bloomberg Markets (@markets) November 17, 2023

Martin Crum is a senior investment analyst. The information in this column is not intended as professional investment advice or as a recommendation to make certain investments. Crum can take positions on the financial markets.

2023-11-17 16:46:16

#Sentiment #picking #stragglers #selectively #arrested #IEX.nl