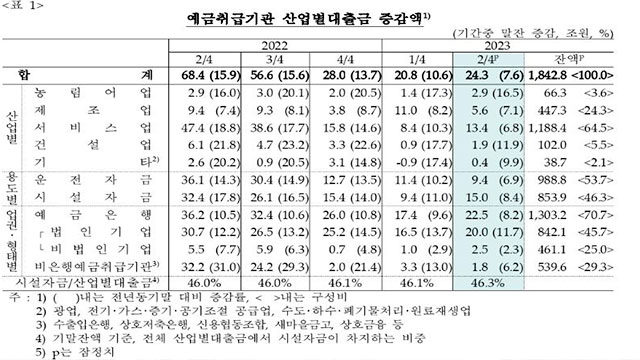

In the second quarter of this year, loans to companies from depository institutions stood at 1,842 trillion won, an increase of 24 trillion won from the previous quarter.

According to the data of ‘2023 2nd quarter loans by industry for deposit handling institutions’ announced by the Bank of Korea today (7th), loans by industry for deposit handling institutions at the end of the second quarter were tallied at 1,842.8 trillion won.

The increase was 24.3 trillion won, which is larger than the increase in loans in the previous quarter (20.8 trillion won), and it is the first time in four quarters that the increase has expanded.

The Bank of Korea explained, “As deposit banks maintain an accommodative lending attitude and the advantages of direct financing compared to bank loans decrease, companies prefer bank loans to corporate bond issuance.”

By industry, the growth rate of loans decreased in the manufacturing sector, while the service sector expanded.

Manufacturing loans totaled 447.3 trillion won, up 5.6 trillion won from the previous quarter.

As of the end of March, it had increased by 11 trillion won, but the rate of increase slowed again this quarter as the financial situation of exporting companies improved.

Loans to the service industry increased by 13.4 trillion won from the previous quarter to 1,188.4 trillion won, and it was analyzed that the rate of increase increased in 4 quarters.

The Bank of Korea explained, “The rate of increase has expanded, centering on the finance, insurance and real estate industries.”

In the finance and insurance industries, the decline in loans decreased by only KRW 800 billion, down from the previous quarter (KRW -4.8 trillion), due to a slowdown in the decline in bill purchase loans in trust accounts and an increase in deposit bank borrowings by specialized credit companies.

In the case of the real estate industry, thanks to the recovery of real estate transactions, the amount of increase slightly increased from 5.1 trillion won in the previous quarter to 6 trillion won this quarter.

In the construction industry, the amount of increase increased from KRW 900 billion to KRW 1.9 trillion in 3 months due to the decrease in the number of unsold houses and the government’s measures to stabilize the PF market, such as the ‘PF loan agreement’.

By type of company, the amount of increase in loans increased for both corporations (KRW 16.5 trillion → KRW 20 trillion) and unincorporated companies (KRW 1 trillion → KRW 2.5 trillion).

The Bank of Korea explained that while the rate of increase in loans decreased mainly in the manufacturing industry in the case of corporate companies, the overall rate of increase increased as the electricity and gas industry and finance and insurance industries switched to growth.

In the case of unincorporated businesses such as individual business owners, the scale of increase in the wholesale and retail business and lodging and restaurant business decreased slightly, but the rate of increase increased as the real estate business turned to an increase.

The Bank of Korea’s loan statistics by industry are statistics that classify loans in other sectors by industry, excluding household loans, and are mainly corporate loans, but also include loans to the government and public institutions.

[사진 출처 : 연합뉴스 / 한국은행 제공]

■ Report

▷ Kakao Talk: Search for ‘KBS Report’, add channel

▷ Phone : 02-781-1234, 4444

▷ Email: [email protected]

▷ Subscribe to KBS News on YouTube, Naver, and Kakao!

2023-09-07 03:00:00

#trillion #won #loans #industry #quarter #Expansion #increase #year