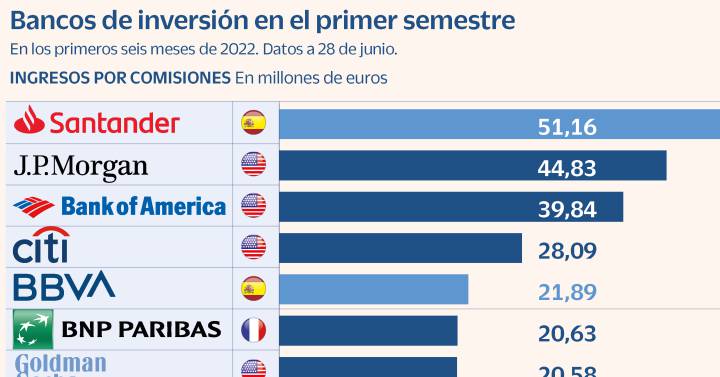

Difficult semester for investment banking. The turmoil hitting the equity and debt markets has led entities to work in a complicated scenario that shows no signs of improving in the coming months and that has the recession in the euro zone as the main threat. A scenario in which Santander, JP Morgan and Bank of America have managed to impose themselves on the rest of the entities, according to data as of June 28 from Dealogic.

The Spanish financial entity has managed to remain in first position, since it won at the end of March, by achieving commissions of 51 million in the accumulated of the first six months of the year.

Ignacio Domínguez-Adame, head of Santander Corporate & Investment Banking (SCIB) in continental Europe, acknowledges that “in a certainly complicated market, both in debt and equity, we are achieving significant leadership. Obviously, there are many open fronts but we also see liquidity on the part of investors and strength in the balance sheets of European companies.In this sense, we are cautiously positive for the second half of the year”.

JP Morgan, which led the ranking throughout 2021, continues in second position with close to 45 million euros thanks to its work on the merger of MásMóvil with Orange and its role as advisor to Repsol in the sale of 35% of its renewables business, Siemens Energía in the takeover bid for Gamesa and ACS, in Hochtief’s takeover bid for Cimic and in the expansion of Hochtief. While Bank of America climbs five positions compared to the first quarter and is third in the classification, with income from commissions that is close to 40 million in the accumulated of the first half of the year.

Ignacio de la Colina, CEO and president of JP Morgan for Spain and Portugal, acknowledges that after the first half of the year in which there has been a “paradigm change”, they do not expect “substantial changes for the second half of the year. Yes Well, there is the possibility of a greater stabilization of conditions that allows greater activity, especially in the equity and sub-IG debt markets. There is capital to finance acquisitions, but it is true that the market is more demanding and selective.”

For his part, Joaquín Arenas, president of Bank of America for Spain and Portugal, considers that “the market will stabilize when it is more confident that inflation will stop or decrease. Then activity will recover.” In his opinion, “the combination of inflation and the rise in interest rates forces companies to promote active portfolio management” and points out that “the trend towards divisions and separations continues”. During the semester, he has advised Ferrovial on the acquisition of JFK Terminal 1 from Carlyle, and has advised on the FCC takeover bids for Metrovacesa and Zardoya Otis for Otis Elevator Company

Between the three banks they add revenues of 136 million, 34% less than what the first three entities in the ranking obtained just a year ago.

Citi, for its part, dropped one place in the classification and reached 28 million, while BBVA climbed to fifth position (22 million). The first ten entities thus manage to record commission income of 284.5 million thanks to 159 executed operations. Although, the amount almost doubles (544.2 million euros), if all the firms are included.

The worst quarter in 13 years globally

Thieretazo. The war in Ukraine and the fear of a recession have impacted the commission income of global investment banking, not only in Spain. According to data from Refinitiv, the sector has closed its worst quarter in 13 years, seeing its commissions reduced by 74%, to 2,600 million dollars, about 2,480 million euros. The money raised through IPOs and capital increases was reduced by 25% compared to the target 12 months ago, to 94,000 million dollars, 90,000 million euros.

Premieres in portfolio. Among the most anticipated stock market debuts this year is that of Porsche, the ARM chipmaker and the Galderma dermo-aesthetics firm, but the investment banking sector rules out reaching the figures recorded in 2021, the best year in years after the outbreak of the pandemic.

–

–

–