Jakarta, CNBC Indonesia – The Turkish lira (TRY) exchange rate has fallen 55% against the United States (US) dollar so far this year until last Friday. The lira became the worst currency in the world, as well as making Turkey experience another currency crisis.

Last Monday, the lira slumped even further until it broke TRY 18.3/US$ which was the weakest record in history. But after hearing President Recep Tayyip Erdogan’s “sayings”, the lira skyrocketed to register a 20% gain to TRY 13.5/US$.

|

– – |

Speaking after a Cabinet meeting, Erdogan announced several policies that would ease the burden on the Turkish lira. The leader, who has been in power for 20 years, said the policy meant that Turkish citizens would not have to convert the lira into foreign currency during the lira crash, including providing deposit guarantees.

“We present a new financial alternative for citizens who want to ease their worries when they see savings due to rising exchange rates,” Erdogan said.

John Doyle, vice president of dealing and trading at Tempus Inc. said the Turkish government’s plan to make the lira appreciate sharply.

“The most important thing is that the government said it would compensate for losses in lira deposits if the currency weakened further than the bank’s interest rates. Although the government didn’t say how they would execute the plan,” Doyle said.

“I imagine the market is selling (short) the lira was huge and the measures that Erdogan announced that would protect the savings of domestic investors from fluctuations in the lira gave impetus to closing positions short that,” said Shaun Osborne, head of foreign exchange strategy at Scotiabank.

After Erdogan “said” about US$1 billion was reportedly sold on the market, according to the head of the Turkish banking association. The sale of the US dollar is an indication that market participants are closing positions short.

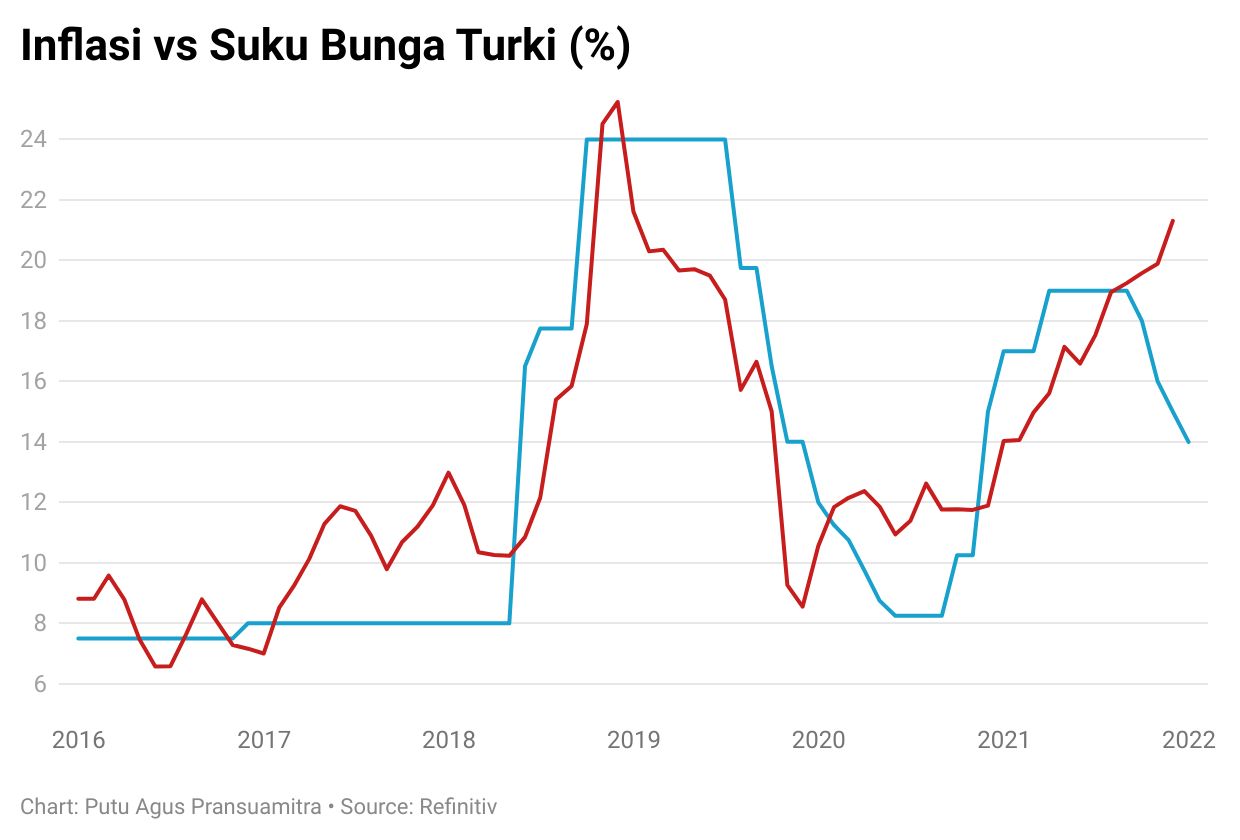

Erdogan also mentioned the interest rate cut by the Turkish central bank (TCMB). TCMB’s aggressive policy of cutting interest rates when inflation was high triggered the lira’s plunge. But according to Erdogan, cutting interest rates will eventually bring down inflation.

“With interest rate cuts, we will see inflation start to fall in the next few months. This country will no longer be a haven for those whose wealth has increased due to high interest rates,” Erdogan said.

When inflation is high, the central bank will generally raise interest rates. But Turkey’s central bank (TCMB) is cutting interest rates aggressively.

Inflation in Turkey in November reached 21.31% year-on-year (yoy) rose from 19.89% (yoy) the previous month and became the highest in the last 3 years. The drop in the lira exchange rate is one of the triggers for accelerating high inflation.

– –– |

Although the lira continued to decline, TCMB last Thursday cut its benchmark interest rate again by 100 basis points to 14%.

So far, the TCMB, led by Sahap Kavcioglu, has cut interest rates for the fourth month in a row for a total of 500 basis points.

The TCMB’s anti-mainstream policy which made the lira exchange rate slump and triggered a currency crisis stemmed from Erdogan’s view that high interest rates were the “culprit of the devil”. Erdoan believes that high interest rates will only exacerbate inflation.

TCMB also “as long as you are happy” and cut interest rates aggressively. Because, if the TCMB’s policy differs from Erdogan’s view, the governor will be fired.

CNBC INDONESIA RESEARCH TEAM

(pap / pap)

– .