In the Baltics, average monthly electricity prices also decreased in October. In the trade areas of Latvia and Lithuania, electricity prices were 37.72 EUR / MWh, where Latvian prices decreased by 6%, while in Lithuania there was a decrease of 5%. In Estonia, electricity prices decreased by 5% to 37.62 EUR / MWh in October. In the Baltics, the hourly price range ranged from 2.29 EUR / MWh to 174.91 EUR / MW.

–

Content will continue after the ad

Advertising

–

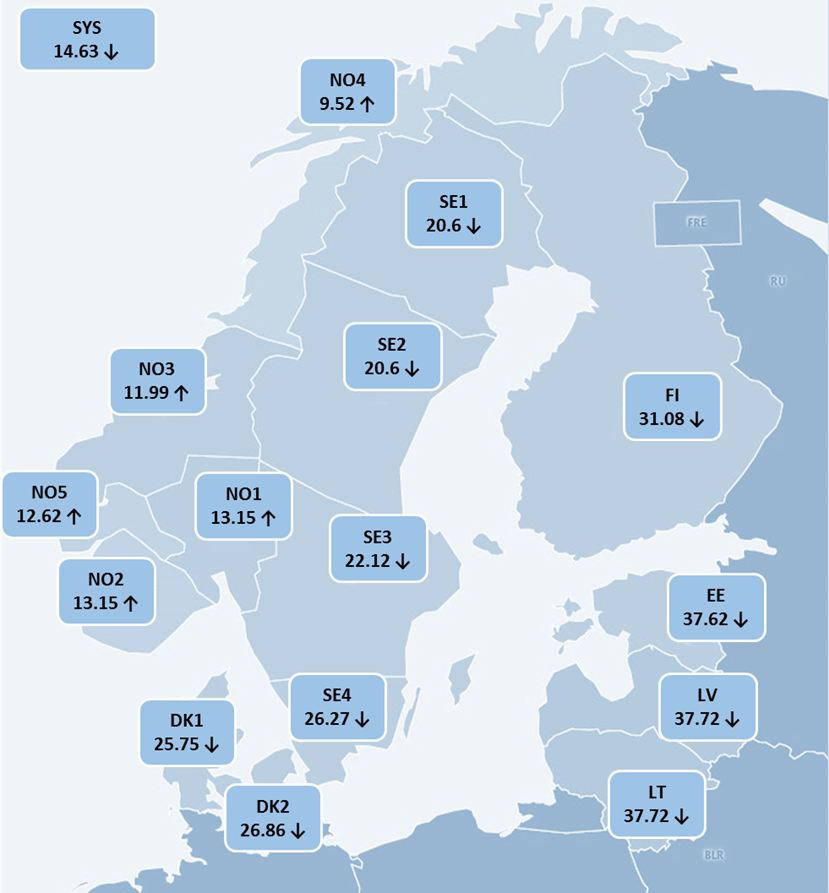

In October, the price of the electricity system decreased by from 15.73 EUR / MWh to 14.64 EUR / MWh or by 7% compared to September. The low level of electricity prices continued to be maintained by the rich hydrological situation in the Nordic countries, as well as seasonally warmer weather conditions, and electricity consumption in the Nord Pool region was lower compared to October of the previous year. High rainfall affected the filling of reservoirs in Scandinavia, which averaged 90.5% per month (the norm is 83.3%). Volatile development in wind farms, in turn, affected hourly price dynamics. In the previous month, development in wind farms was 5% higher than in September and 34% higher compared to October of the previous year.

In the Baltics, electricity prices were affected by electricity prices in neighboring countries – 16% higher energy flows from Finland and 24% higher from Sweden ‘s SE4 area, as Estlink – 2 and Nordbalt interconnections returned from annual maintenance.

Wholesale electricity prices in October in Nord Pool retail areas

Source: “Nord Pool “

Future fall in electricity prices

At the beginning of October, futures contract prices rose sharply, but fell sharply for the rest of the month, following changes in the hydrological balance (storage of water in reservoirs, soil and snow). Weather forecasts for higher precipitation contributed to an increase in the hydro balance to 18.5 TWh above the norm, compared to 2019 it was 6.4 TWh below the norm. The rich hydrological situation indicates the development of potentially high hydropower plants in the Nordic countries.

At the beginning of October, futures contract prices jumped, but fell sharply for the rest of the month, following changes in the hydrological balance (storage of water in reservoirs, soil and snow). Weather forecasts for higher precipitation contributed to an increase in the hydro balance to 18.5 TWh above the norm, compared to 2019 it was -6.4 TWh below the norm. As a result, the rich hydrological situation predicts the development of potentially high hydropower plants in the Nordic countries.

In October, the future contract of the electricity system (Nordic Futures) prices for the November futures contract decreased by 15% to 20.70 EUR / MWh, the closing price of the contract fell to 13.95 EUR / MWh. In the 1st quarter of 2021, the average system price of the contract decreased by 8% to 26.31 EUR / MWh, the closing price of the contract decreased to 21.30 EUR / MWh at the end of the month. The average futures price of the 2021 system also decreased by 8% to 22.28 EUR / MWh in October, and at the end of the month the contract price was 18.80 EUR / MWh.

The average price of Latvian electricity futures for the November futures contract decreased to 45.45 EUR / MWh, the closing price of the contract was also 45.45 EUR / MWh. In September 2021, following the market trends, the Latvian futures price decreased by 2% to 43.31 EUR / MWh.

Generation in the Baltics covered 50% of total electricity consumption

In the Baltics, electricity consumption decreased by 2% to 2,302 GWh in October compared to October of the previous year. In Latvia, electricity consumption was 611 GWh, which was unchanged compared to October 2019. In Estonia, consumption decreased by 5% to 672 GWh compared to the same month a year earlier. In Lithuania, consumption decreased by 1% to 1,019 GWh.

In October, the amount of electricity generated in the Baltics decreased by 8% to 1,142 GWh compared to the previous month. As generation in the Baltics declined, imports from neighboring countries increased. In Latvia, electricity generation decreased by 2%, with an average of 326 GWh produced per month. In Estonia, production volumes decreased by 3% to 421 GWh. In Lithuania, on the other hand, electricity generation fell by 18% to 395 GWh.

Last month, generation covered 50% of total electricity consumption in the Baltics, 63% in Latvia, 63% in Estonia and 39% in Lithuania.

Decreaseds “Latvenergo” TEC development

In Latvia, the total precipitation was slightly below the October norm. The average monthly inflow into the Daugava was 250 m3/s jeb 33 m3/ s below the 30-year average inflow level.

In October, electricity generation at Latvenergo’s hydropower plants decreased by 4% to 112 GWh compared to generation in September, but it was 25% lower than in October 2019. Electricity generation for Latvenergo TEC decreased by 17% to 110 GWh compared to September. The decrease in development was due not only to the seasonally warmer weather, which affected demand, but also to the fact that the first TEC-2 power unit was not available on the market due to maintenance work.

Fluctuations in the raw materials market have determined changes in demand

The price of the Brent Crude Futures crude oil futures contract fell by 2% to USD 41.52 / bbl in October, and at the end of the month the contract closed at USD 37.46 / bbl.

The main factor influencing prices in the oil market in October was the rapid spread of the Covid-19 pandemic in Europe and the United States. This not only significantly affected the demand for petroleum products, but also caused fluctuations in related markets.

Coal future contract (API2 Coal Futures Front month) the average price in October increased by 4% to 56.59 USD / t, the closing price of the contract was 51.80 USD / t.

In October, fluctuations in coal prices were affected by restrictions on extraction from Colombia and South Africa, as well as volatility in demand in Europe and Asia. At the same time, there was a disruption in China’s domestic coal extraction and transportation, as consumption increased and coal prices rose. In addition, China had also imposed bans on coal imports from Australia, but no official statement from the government confirms this.

In October (Dutch TTF) The average price of the November natural gas futures contract increased by 9% to 14.14 EUR / MWh, and the contract ended at a higher price of 14.49 EUR / MWh.

In the natural gas market, prices were affected by a decrease in supply mainly from Norway and changes in demand. At the same time, higher prices in the Asian market limited imports of liquefied natural gas to Europe. In addition, the filling level of natural gas storage facilities in Europe at the end of the month was 94.5%, which is below the 2019 level of 97.3%.

European emissions quota (USA Futures) The price of EUA “Dec.20” decreased by 9% in October to 25.18 EUR / t, and the contract price decreased to 23.71 EUR / t at the end of the month.

In October, the price movement in the carbon market was determined not only by changes in demand, but also by political events. One of the factors influencing the price is the uncertainty about the agreement after “Brexi“and the future of relations between the United Kingdom and the European Union. The new wave of Covid-19 in Europe had a significant impact on the market, which could have a significant impact on future economic development and thus demand.

–