Uphold XRP Cryptocurrency Curse: Lumis’s New Bill Sparks Debate

The cryptocurrency market is once again at the center of legislative attention as Senator Cynthia Lumis introduces the Cryptocurrency Preparation Asset Act, a groundbreaking bill that could reshape the regulatory landscape for digital assets. While the bill focuses primarily on Bitcoin as a preparatory asset, it has sparked intense discussions around other cryptocurrencies like Ripple (XRP), Ethereum, and Solana, which have seen significant price fluctuations in response to the news.

Lumis’s vision for Bitcoin and Beyond

Table of Contents

In a press conference held in Washington, D.C., lumis emphasized Bitcoin’s role beyond mere speculation. “Bitcoin is not just speculative assets, but a means of storage for long-term economic stability,” she stated. The bill aims to leverage existing assets from the Federal Reserve and Treasury without imposing additional taxes,a move that could bolster financial stability in uncertain times.

Though, the exclusion of Ripple, Solana, and USDC from the preparatory asset classification has raised eyebrows. Ripple’s market value has notably plunged following the declaration, highlighting the sensitivity of the cryptocurrency market to regulatory developments.

Bipartisan Efforts and State-Level Initiatives

Passing the bill requires at least 60 votes in the Senate, necessitating bipartisan cooperation. Lumis revealed, “We are currently actively discussing with various lawmakers and are considering forming a two-party partner to pass the bill.”

Simultaneously occurring, state governments are not waiting for federal action. Fifteen states, including Utah, Florida, Ohio, and Montana, are already advancing their own Bitcoin reserve initiatives. dennis Porter, CEO of the Satoshi Action Fund, noted, “Utah has already passed the Bitcoin reserve bill through digital asset tasks, and is likely to enact the first relevant bill for the first time in the United States.”

Lumis predicts that state governments may introduce these reserves before the federal government, leveraging assets like Bitcoin to promote financial stability despite their inability to issue currency independently.

Trump Administration’s Support

The bill has also garnered support from former President Donald Trump, who is actively advocating for the inclusion of Bitcoin in national finances. “We are working closely with the Trump administration, and President Trump agrees that Bitcoin reserves will have a positive impact on the US economy,” lumis confirmed.

Key Points at a Glance

| Aspect | Details |

|————————–|—————————————————————————–|

| Primary Focus | Bitcoin as a preparatory asset |

| Excluded cryptos | Ripple (XRP), Solana, USDC |

| State Initiatives | 15 states advancing Bitcoin reserves |

| Federal Requirements | 60 Senate votes needed, bipartisan cooperation essential |

| Trump Administration | Supports Bitcoin inclusion in national finances |

The Road Ahead

As the Cryptocurrency Preparation Asset Act moves through the legislative process, its implications for the broader cryptocurrency market remain uncertain. While Bitcoin’s role as a preparatory asset is clear, the exclusion of other major cryptocurrencies like Ripple has left investors and industry stakeholders questioning the bill’s long-term impact.

For now, all eyes are on the Senate as Lumis and her team work to secure the necessary votes. Whether this bill will usher in a new era of regulatory clarity or deepen the divide between Bitcoin and other digital assets remains to be seen.

Stay tuned for updates as this story develops.

Ripple Faces Backlash amid Bitcoin Reserve Controversy and Market Turmoil

The cryptocurrency world is no stranger to drama, and Ripple, the company behind XRP, finds itself at the center of yet another storm. Amid growing tensions with the Bitcoin community and a volatile global market, Ripple’s stance on cryptocurrency reserves and its ongoing legal battles have sparked heated debates.

Ripple’s Clash with the Bitcoin Community

Ripple has recently come under fire for allegedly opposing the introduction of bitcoin reserves. This suspicion has fueled controversy, especially among Bitcoin enthusiasts. however, Ripple CEO Brad Garlinghouse has clarified the company’s position, stating, “We support multiple token reserves, including XRP, and do not oppose specific cryptocurrencies.”

The United States is estimated to introduce Bitcoin reserves by 2025, with a projected adoption rate of 43%.This has raised questions about how Ripple’s lobbying efforts might influence this development.

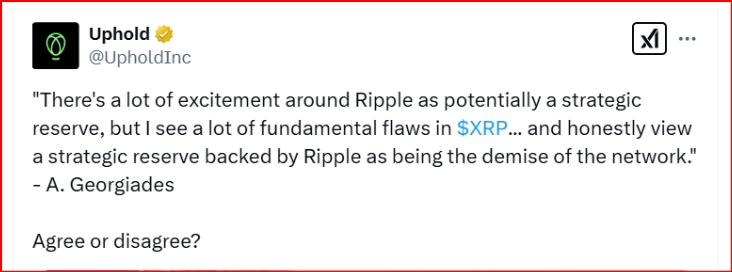

Uphold’s Controversial Post and XRP’s Strategic Reserve Debate

Adding fuel to the fire, digital trading platform Uphold recently faced backlash from the XRP community. Uphold questioned the feasibility of Ripple’s strategic reserve in a post that referenced an interview with Anthony Georgiades, founder of Innovating Capital. georgiades criticized XRP, stating it has “a lot of basic flaws” and arguing that a strategic reserve based on XRP could negatively impact the network.

Uphold, which notably refused to delist XRP in 2021 during its legal battle with the SEC, has been a key player in the cryptocurrency space. Though, its recent comments have reignited debates about XRP’s centralized structure and its suitability as a strategic reserve candidate for the U.S.government.

Global Cryptocurrency Market Plunges Amid Trade War Fears

The cryptocurrency market faced significant turbulence this week as U.S. President Donald Trump announced new tariffs on Canada, Mexico, and China. Invoking the International Emergency Economic Powers Act (IEEPA) of 1977, Trump imposed a 10% tariff on Chinese products and a 25% tariff on imports from Mexico and Canada.

This move has sparked fears of a global trade war, sending shockwaves through both the U.S. stock market and the cryptocurrency market. The global cryptocurrency market cap plummeted by over 3%, dropping from $3.49 trillion to $3.35 trillion—a loss of approximately $140 billion in just 24 hours.

the cryptocurrency fear and greed index also fell to 47, shifting investor sentiment from “greed” to “neutral.”

Key Points at a Glance

| Topic | Details |

|——————————-|—————————————————————————–|

| Bitcoin Reserve Controversy | Ripple accused of opposing Bitcoin reserves; CEO denies opposition. |

| uphold’s backlash | Uphold criticized for questioning XRP’s strategic reserve potential. |

| Market Impact | Global cryptocurrency market cap fell by 3% amid trade war fears. |

| Investor Sentiment | Fear and greed index dropped to 47, shifting from “greed” to “neutral.” |

The Road Ahead

As Ripple navigates these challenges, its role in shaping the future of cryptocurrency reserves remains a topic of intense scrutiny. Meanwhile,the global market’s reaction to geopolitical developments underscores the interconnectedness of customary finance and the crypto ecosystem.

For now, all eyes are on how Ripple’s lobbying efforts will influence the adoption of Bitcoin reserves and whether the company can mend its strained relationship with the Bitcoin community.Stay updated on the latest developments in the cryptocurrency world by following our coverage.

Exclusive Interview: Insights on Bitcoin Reserves, Ripple Controversy, adn Market Turmoil

Editor’s Questions and Guest Responses

Editor: The proposed Cryptocurrency Preparation Asset Act has sparked notable debate. Can you clarify Bitcoin’s role as a preparatory asset and why other cryptocurrencies like Ripple (XRP) were excluded?

Guest: The focus on Bitcoin stems from its established position as a decentralized and widely recognized store of value. The act positions Bitcoin as a preparatory asset to perhaps stabilize national finances, given its resilience and adoption rate. As for Ripple (XRP) and others, concerns around centralization and regulatory uncertainties likely led to thier exclusion. This decision has, understandably, raised questions among industry stakeholders.

Editor: With 15 states advancing Bitcoin reserves, what challenges do you foresee in achieving bipartisan cooperation at the federal level?

Guest: Bipartisan cooperation is essential, especially with 60 Senate votes needed. While state-level initiatives show growing acceptance, federal adoption requires addressing concerns around volatility, security, and long-term viability.The Trump administration’s support for bitcoin inclusion is encouraging, but bridging ideological divides remains a significant hurdle.

Editor: Ripple has been accused of opposing Bitcoin reserves. How do you interpret the CEO’s clarification on supporting multiple token reserves?

Guest: Ripple’s CEO, Brad Garlinghouse, clarified that the company supports a diverse approach, including XRP and potentially Bitcoin. The accusations likely stem from Ripple’s focus on positioning XRP as a strategic reserve candidate. This controversy highlights the competitive dynamics within the cryptocurrency space and the challenges of aligning diverse interests.

Editor: Uphold’s criticism of XRP’s strategic reserve potential led to backlash. What’s your take on this debate?

Guest: Uphold’s comments reignited long-standing debates about XRP’s centralized structure and its suitability as a reserve asset. While Uphold has been a key player in the XRP ecosystem, its critique underscores the need for openness and robust dialog in evaluating cryptocurrency reserves. The XRP community’s response reflects its commitment to defending the asset’s value proposition.

Editor: The global cryptocurrency market took a hit amid trade war fears. How does this impact investor sentiment and Bitcoin’s role as a preparatory asset?

Guest: The market’s 3% drop, fueled by geopolitical tensions, underscores the interconnectedness of customary finance and cryptocurrencies. While Bitcoin’s volatility remains a concern, its potential as a hedge against economic uncertainty coudl strengthen its case as a preparatory asset. The shift in the Fear and Greed Index to ”neutral” signals cautious optimism among investors.

Conclusion

The evolving landscape of cryptocurrency reserves,Ripple’s ongoing controversies,and global market volatility highlight the complexity of this sector. As Bitcoin’s role as a preparatory asset gains traction,collaboration and clarity will be essential in shaping the future of digital finance. stay tuned as these developments unfold, and follow our coverage for the latest updates.