monthly rent, are posted. News 1″ data-type=”article”/>

At a real estate agent office in Seoul, prices for apartments for sale, including jeon and monthly rent, are posted. News 1

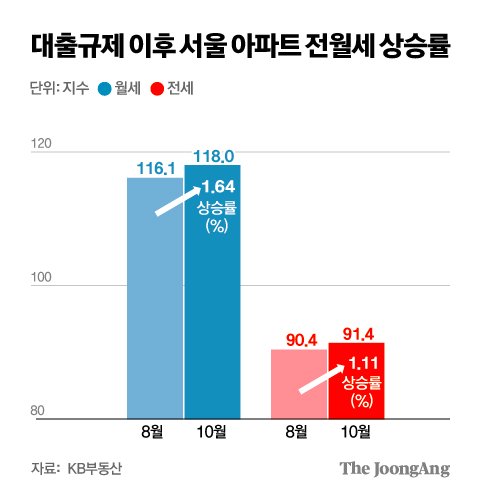

As the lending threshold in the financial sector has increased, with loan interest rates rising and limits decreasing, the Seoul apartment monthly rent index has hit an all-time high. It is pointed out that this is a ‘balloon effect’ that appeared as regulations on sales and lease loans were strengthened.

According to KB Real Estate’s monthly housing price trend on the 30th, the Seoul apartment monthly rent index this month was 118.0, up 0.9 points from September. This is the highest figure since December 2015, when KB Real Estate began compiling related statistics. The monthly rent index for apartments in the metropolitan area is also the highest ever at 119.6. KB Real Estate’s monthly rent index calculation targets medium-sized apartments (exclusive area of 95.86m²) or smaller.

The proportion of monthly rent in apartment lease and monthly rent transactions in Seoul also increased from 35.9% (6,339 out of 17,656 cases) in August to 41.9% (5,644 out of 13,470 cases) in September. (Seoul Real Estate Information Plaza) Since last month, when the second stage of stress DSR (total debt service ratio), which further tightened the limit, was implemented, the increase in the Seoul apartment monthly rent index (1.64%) was greater than the jeonse (1.11%). This can be interpreted as the result of the increase in interest rates for jeonse funds, which has increased the interest burden, and for those who own more than one house, it has become difficult to change jeonse as loan channels are completely blocked.

In fact, with the fall moving season, apartment rents are on the rise, especially in school districts with high demand. On the 5th, a contract was signed on the 5th for the 84㎡ exclusive use of Eunma Apartment in Daechi-dong, Gangnam-gu, Seoul, with a deposit of 500 million won and monthly rent of 1.75 million won. Compared to the same floor and same area traded three months ago (July) with a deposit of 500 million won and a monthly rent of 900,000 won, the monthly rent has increased by 850,000 won.

Reporter Kim Joo-won

In the case of jeonse, the proportion of loans is high, so it is greatly affected by interest rates and limits. As interest rates rise and the cost burden increases, more tenants choose monthly rent instead of jeonse. The representative of a real estate agency in Jamsil-dong, Songpa-gu, Seoul, explained, “As interest rates for jeonse loans rise, the number of tenants who use calculators to compare the costs of jeonse and monthly rents and then choose carefully has increased.”

Monthly rents for other housing types, such as villas and officetels, are also on the rise. Korea Real Estate Board’s monthly rent price index for Seoul townhouses and multi-family homes last month rose 0.15% (101.67 → 101.82) from a month ago. Compared to January (100.91), it rose 0.90%. The Seoul officetel monthly rent index in September also increased by 0.13% (101.21 → 101.34) compared to the previous month.

The monthly rent for one-room units (townships/multi-generational units) with an exclusive area of 33㎡ or less is also rising more than the rent price. As a result of Dabang, a real estate transaction platform, analyzing the rental and monthly rent levels for rowhouses and multi-family studios in Seoul last month, the average monthly rent based on a deposit of 10 million won was 730,000 won, and the average rental deposit was 213.88 million won. Compared to a month ago (August), the average monthly rent increased by 2.6% (20,000 won), but the average rental deposit only increased by 0.4% (760,000 won).

Kwon Il, head of the Real Estate Info research team, said, “Jeonse prices have been rising for over a year and are at a high level, and loan regulations have suppressed demand in the Seoul apartment sale and lease market, so more tenants are turning to monthly rent.” He added, “The financial sector is tightening its purse strings. “If this continues, the ‘balloon effect’ where demand is concentrated on monthly rent may continue,” he explained.

Reporter Kim Won [email protected]