[코스피 3000시대]Concerns about’bubble’ still in short-term overheating

In one year after shooting 2000, it faces the financial crisis… When ants live, institutions-foreigners sell

Individual buying alone can only drive stock prices

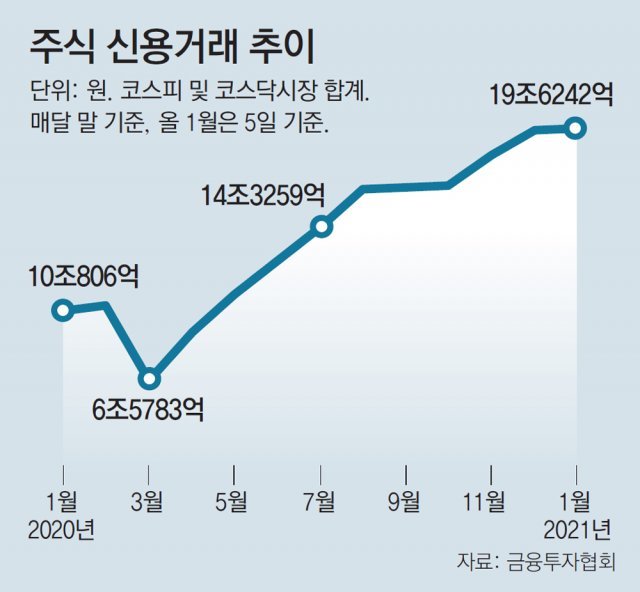

‘Debt investment’ is also close to 20 trillion… Could be a primer

On this day, KOSPI opened the era of’three thousand pi’ by taking the 3,000 line during the intraday, but the’solely market’ of individual investors continues. There are still concerns about bubbles (bubbles) caused by a short-term surge in stock prices amid the real economy slowdown. Thanks to the abundant liquidity released in the financial markets, there is a growing sense of caution that the nightmare that broke through the 2,000 mark in 2007 and then crashed into the global financial crisis a year later could be rekindled.

–

○ Will the nightmare 13 years ago after filming ‘2,000 Lines’ relive?

On July 25, 2007, when Moody’s, an American credit rating company, raised Korea’s national credit rating from’A3′ to’A2′ on July 25, 2007, KOSPI exceeded the 2,000 mark for the first time in history. It was evaluated that the company’s performance improvement and abundant liquidity were the top contributors to the 2,000 mark. However, the 2,000 line collapsed in one day, and a year later, it fell to 938.75 on October 24, 2008 due to the global financial crisis.

View larger

View larger-This year too, excess liquidity exceeding 3150 trillion won (as of last October) is pushing the stock market up. In order to overcome the new coronavirus infectious disease (Corona 19) crisis last year, governments and central banks around the world dropped interest rates to virtually “zero” levels and actively implemented fiscal policies, and money released on the market is being focused on the asset market. The rate of increase in the KOSPI last year was 6.9 times compared to the rate of increase in the money supply in the third quarter of last year (July to September). On the other hand, Japan’s Nikkei stock price was 5 times, and the US Dow Jones Industrial Average, which reached the 30,000 mark for the first time, only 1.6 times. This means that the Korean stock market has risen more than the released money. Bank of Korea Governor Lee Ju-yeol warned against the current situation, “With the high level of debt and the widening gap between finance and real, the market could be shaken significantly even with a small impact.”

○ Limitation of’Donghak Ant’ single investment

Individual investors alone are not enough to settle in the 3,000 era. The KOSPI rose more than 250 points in 7 trading days until the 5th. Individual investors net bought more than 3 trillion won during this period, while institutions and foreigners sold more than 3 trillion won. All individual investors made a net purchase except for the month of November of last year. On the other hand, the agency continued its net selling march all year except March. The months when foreign investors showed net purchases were only in January, July and November. Hwang Se-woon, a research fellow at the Capital Market Research Institute, said, “It is only possible to evaluate that the inflow of funds from foreigners and institutional investors must be in parallel to achieve a stable level of 3,000.”

On the 6th, the balance of credit loans, which is the amount of’debt investment’ (investment from debt), that is invested in stocks by receiving loans from securities companies rose to 19,6242 billion won, the largest ever. It has increased by more than 10 trillion won from a year ago (9,376.9 billion won). The single-shot trading of’jurini’ in their 20s and 30s (a term that means stocks and children are novice) is also a factor of insecurity. As a result of a survey of its customers by NH Investment & Securities, the turnover rate of new accounts in their 20s and 30s from January to November last year reached 5248% and 4472%. The average balance of these accounts is about 5.83 million won and 15.12 million won, which means that stocks have been traded over 300 million won and 600 million won only in the last 11 months due to debt and short hits.

○ Announcement of corporate performance, high in March when short selling restrictions

The stock price rose from March 19 last year, when 97.7% of KOSPI stocks bottomed out due to the Corona 19 incident. As Samsung Electronics alone accounts for 24% of the total market capitalization of the KOSPI, there are also observations that the market could enter a reconciliation phase when companies’ performances of last year begin to be announced. Young-ik Kim, an adjunct professor at the Graduate School of Economics at Sogang University, said, “If you compare and analyze the indicators that are deeply related to the stock price, the stock market is now overvalued by 20-30%.” said. The so-called’Buffett Index’, which divided the KOSPI market capitalization by Korea’s nominal gross domestic product (GDP), rose to 104.2% as of December last year. If this index exceeds 100%, the index is considered overvalued.

The restrictions on short selling, which can be lifted from March, can also be a test bed. Seok-won Choi, head of SK Securities Research Center, said, “In a situation where the stock price is high, the number of people trying to make money by selling will increase, so the burden of short selling will arise.” Kim Jeong-sik, professor emeritus at Yonsei University’s Department of Economics, said, “If the economic downturn caused by Corona 19 worsens, the stock price that is disparate from corporate performance is likely to collapse. It can lead to a crisis.”

Reporter Park Hee-chang [email protected]· Kim Ja-hyun

Copyright by dongA.com All rights reserved.

—

–