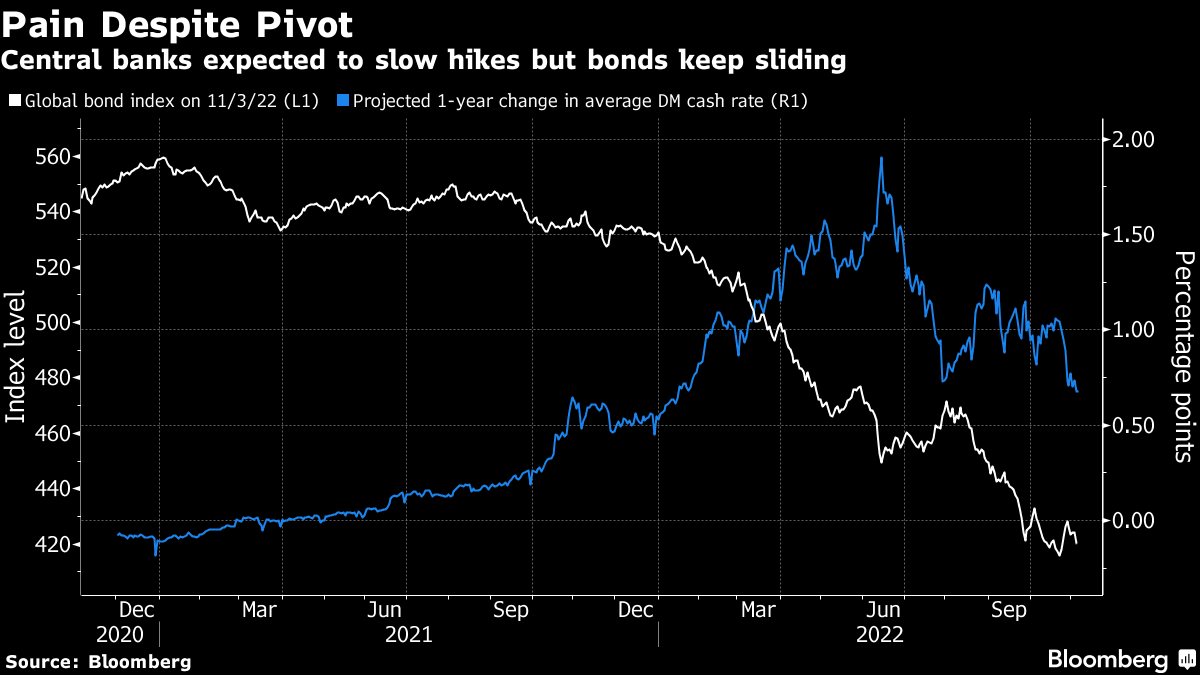

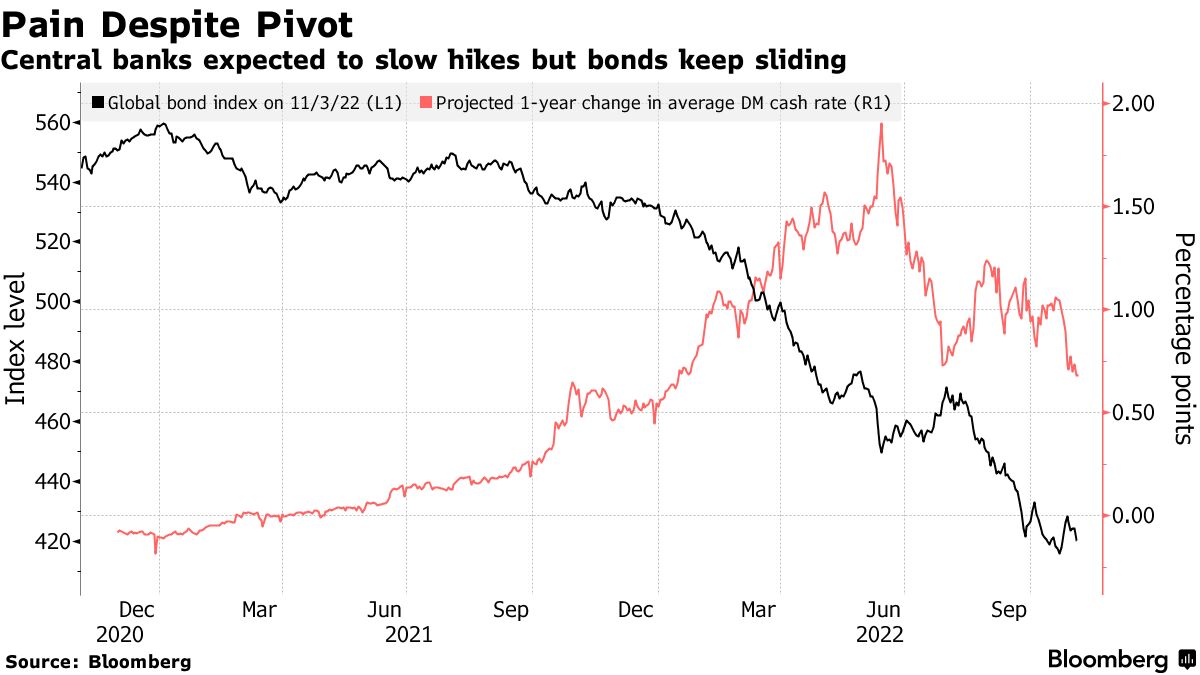

The most aggressive and simultaneous monetary tightening of the past 40 years is entering a new phase. Some central banks have begun to slow the pace of rate hikes and divergences are becoming apparent over how many further rate hikes will be implemented in the future.

The shift towards less aggressive and less monolithic interest rate hikes continues to be affected, in part, by the aftermath of the coronavirus pandemic and the Russian invasion of Ukraine, reflecting the growing differences between countries and regions in the global economy. There are also differences in sensitivity to credit tightening, depending on the debt burden.

The economy remained resilient despite a series of interest rate hikes by Fed Chairman Jerome Powell. Powell said in a press conference following the Federal Open Market Committee (FOMC) meeting on Wednesday that he expects the pace of interest rate hikes to slow down, but that the terminal rate (the final destination of interest rates) will be more high than expected. Many Wall Street market watchers expect the US policy rate to rise above 5% next year.

Conversely, Fed officials in Britain, Australia and Canada have either already cut rate hikes or have signaled they will in the coming months. This is due to fears that the economy could slide into recession if it followed the United States in raising interest rates.

But the turnaround from what TS Lombard economist Dario Perkins calls the “peak of monetary policy synchronization” may not be without problems.

Source: ST Lombardo

Developing countries with high dollar-denominated debt and developed countries that are heavily dependent on imports such as dollar-traded energy have already been hit hard by the dollar’s rise this year due to rate hikes of US interest.

In a note to clients last week, Perkins wrote that if the Fed pushes for another rate hike as central banks in countries and regions where economies aren’t as strong as the US decide not to follow suit, “the situation will become more turbulent”. It’s possible, “he said.

This divergence of attitude has become clear since last week. Both the FOMC and the Bank of England’s Monetary Policy Committee (MPC) voted to raise interest rates by 0.75 points, but President Powell and Governor Bailey gave different tones on future policy.

Powell said the upcoming Fed meeting on December 13-14 will pave the way for a possible reduction in rate hikes, but said there is still “way to go” before stopping rate hikes. The target range for the Federal Funds (FF) rate has now been raised to 3.75-4%.

On the other hand, Bailey sharply rejected market expectations of such rate hikes on fears that continued large rate hikes could lead to a deeper recession.

news-rsf-original-reference paywall">Original title:After the Fed goes out of fashion in the world economy “Messier”.(extract)