Essential views

- The excessive variety of corporations listed at Nordex means that an important choices are influenced by shareholders from most people.

- The two largest shareholders maintain 51% of the corporate

- The institutional stake in Nordex is 27%.

To get an concept of who actually controls Nordex SE(ETR: NDX1), it is very important perceive the possession construction of the corporate. We will see that public corporations personal the lion’s share of the corporate at 47%. In different phrases, the group has the utmost upside potential (or decrease danger).

Whereas public corporations have been the group that benefited most from final week’s €251 million enhance in market capitalisation, institutional traders additionally shared in these beneficial properties, making up 27%.

Let’s take a better have a look at what the assorted shareholder teams inform us about Nordex.

You will see the newest Nordex dividend yield

What does institutional possession inform us about Nordex?

Establishments normally measure themselves towards a benchmark when reporting to their very own traders. Because of this, they typically turn into extra enthusiastic a couple of inventory as soon as it’s included in a significant index. We count on that the majority corporations on the board may have institutional traders, particularly if they’re rising.

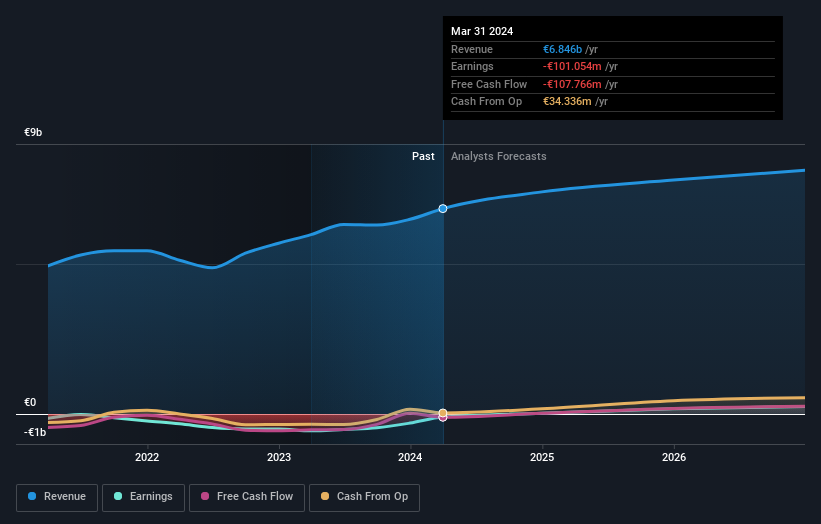

Establishments are already represented in Nordex’s share index. You may have a big stake within the firm. This will point out that the corporate has a sure degree of credibility within the funding neighborhood. Nevertheless, he shouldn’t depend on the affirmation that’s supposed from institutional traders. They’re additionally improper generally. It isn’t unusual for a big drop in share value if two giant institutional traders attempt to promote out of a inventory on the identical time. So it is value taking a look at Nordex’s previous revenue growth (see under). In fact, different elements should even be taken into consideration.

We word that hedge funds should not have a big funding in Nordex. Taking a look at our information, we will see that Acciona, SA is the most important shareholder with 47% of the excellent shares. Merrill Lynch & Co. Inc, Banking Investments and JPMorgan Chase & Co, Non-public Banking and Funding Banking Investments are the second and third largest shareholders, with 4.1% and three.8% of excellent shares, respectively.

A more in-depth have a look at the shareholder register confirmed that two of the most important shareholders within the firm have a big share at 51%.

Institutional possession analysis is a good way to measure and filter anticipated inventory efficiency. The identical could be achieved by analyzing the opinions of analysts. The inventory is roofed by a number of analysts, so you may simply verify the expansion projections.

Property inside Nordex

The definition of “inside” could range barely from nation to nation, however members of the board of administrators are all the time included. The administration is in the end liable for the board. Nevertheless, it’s not uncommon for managers to be board members, particularly if they’re one of many founders or the CEO.

Most individuals take into account insider possession to be a constructive factor as a result of it may be an indication that the board is effectively aligned with different shareholders. Nevertheless, in some instances an excessive amount of energy is concentrated on this group.

You’ll be able to have a look at the historical past of modifications within the inventory value of Nordex SE. As it’s a giant firm, it’s good to see this degree of settlement. The insiders have shares value 91 million euros (at present costs). Most would say that this reveals an alignment of pursuits between shareholders and the board. Even so, it is perhaps value a glance did these folks promote.

Widespread public property

With a share of 23%, the general public, which principally consists of particular person traders, has a particular affect on Nordex. Though this curiosity is essential, it is probably not sufficient to vary firm coverage if the choice will not be consistent with different main shareholders.

Public corporations as homeowners

We assume that public corporations personal 47% of Nordex. It is arduous to say for certain, nevertheless it seems they’ve intertwined enterprise pursuits. This could possibly be a strategic funding, so it is value monitoring this space for modifications in possession.

The following steps:

I discover it very fascinating to see who owns an organization. However to get an actual perspective, we have to take into account different info as effectively.

I all the time get pleasure from taking a look at them Earnings growth at. You are able to do the identical by utilizing this free card with the menu historic revenue and earnings on this detailed graphics cry

If you wish to know what analysts are predicting when it comes to future progress, it is best to verify this low-cost Analyst description view

Word: The figures on this article have been calculated utilizing the final twelve months of knowledge, which refers back to the twelve month interval ending on the final day of the month wherein day on the monetary report. This is probably not per the annual report figures for the total yr.

Do you could have any suggestions about this text? Fearful concerning the content material? flip round you your self on to us. she is You can too e mail the editorial crew (at) simplywallst.com.

This text from Merely Wall St is normal in nature. We offer commentary primarily based solely on historic information and analyst forecasts utilizing an unbiased methodology, and our articles will not be meant as monetary recommendation. It isn’t a suggestion to purchase or promote shares and doesn’t keep in mind your targets or monetary scenario. Our objective is to give you long-term evaluation primarily based on basic information. Word that our evaluation could not keep in mind the newest price-sensitive firm releases or qualitative merchandise. Wall St merely has no place in any of the shares talked about.

Do you could have suggestions about this text? Fearful concerning the content material? Contact us immediately Connection. Alternatively, you can even ship an e mail to [email protected] from you

This text has been translated from its unique English model, which you could find right here.

2024-07-11 21:47:07

#Public #corporations #Nordex #ETR #NDX1 #gained #establishments #benefited