–

On the 17th (local time) the New York Stock Market closed the Dow down 0.15%, but the S&P 500 rose 0.18% and the Nasdaq up 0.5%.

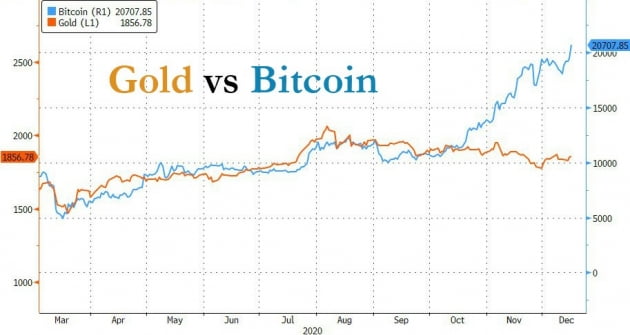

While fiscal stimulus measures are imminent, the US Central Bank (Fed) has not changed monetary policy. The stock market fell slightly after the Fed’s December Federal Open Markets Commission (FOMC) statement, but recovered during a press conference by Fed Chairman Jerome Powell. And for the first time ever, Bitcoin has surpassed $20,000.

–

–

–

From the morning, news came out that the conclusion of the stimulus package was nearing. Leaders from both parties were reported to be nearing a $900 billion stimulus agreement after meetings the night before. It was reported that this would include a check payment of $600 per person. It is reported that the provisions of granting immunity privileges to companies in the corona-related lawsuits and measures to support the state and local governments that the two parties faced will be excluded. The stimulus package is expected to come out within 72 hours after detailed discussion, or by Friday.

However, the stock market responded quietly. A Wall Street official said, “We have reflected a lot of things in advance, such as a sharp rise in the stock price the day before, as expectations for the agreement increased a few days ago, and the scale is not much below 1 trillion dollars.”

On that day, JPMorgan warned that small-cap stocks rose too much, which limited the Dow’s rise. Energy industry stocks also fell. On the other hand, technology stocks showed an uptrend.

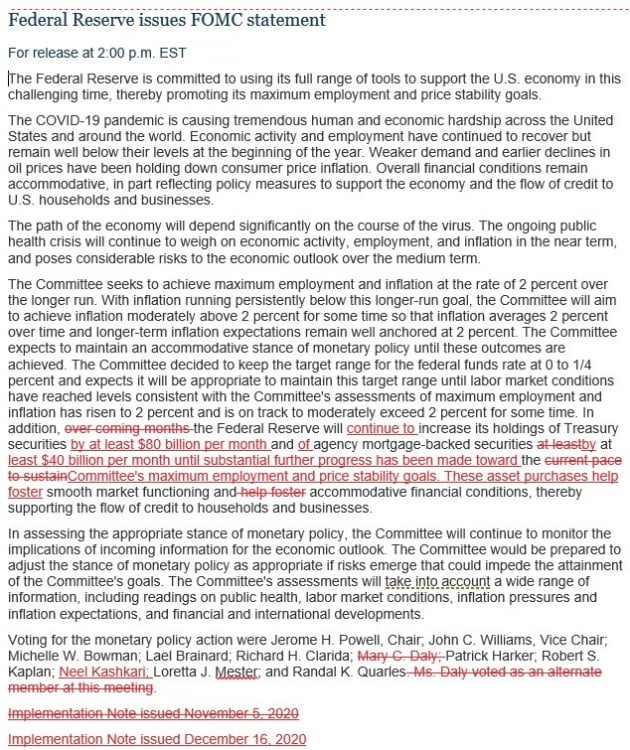

The FOMC announcement, which came out at 2 pm, did not change the asset purchase policy as expected. The 10-year Treasury bond interest rate jumped from 0.91% per annum to 0.95% per annum for a while, as the maturity expansion of purchased bonds, which some had expected, was excluded. Stock prices also paused. However, when the press conference by Chairman Powell started at 2:30 pm, interest rates and stock markets returned to their original state. A Wall Street official commented, “There was no policy change, but it was a meeting where Chairman Powell sat down with words.”

–

–

–

Organizing the message from the Fed

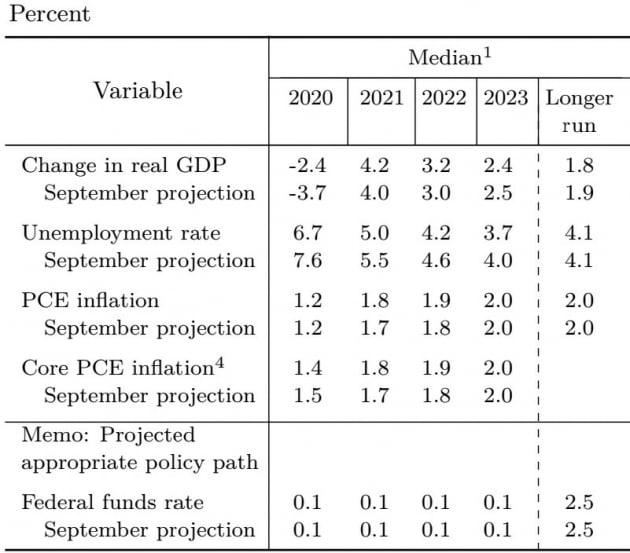

① The economy will recover next year, but it will take about 3 years to normalize.

The Fed predicts that this year’s gross domestic product (GDP) will decrease by 2.7%. This is an improvement from -3.7% in September. We also raised our expectations for next year and 2022 growth rates from 4.0% to 4.2% and from 3.0% to 3.2%. The forecast for 2023 increased from 2.5% to 2.4%.

The forecast for the unemployment rate was lowered from 7.6% this year to 6.7%, and in 2021, 2022, and 2023, respectively, from 5.5% to 5.0%, 4.6% to 4.2%, and 4.0% to 3.7%.

–

–

–

Even if you look at the newly added qualitative indicators in the dot plot, there were four members who said in their own survey last September that’the economic outlook was more balanced than before,’ but this month it increased to 10.

Chairman Powell said, “Compared to September, fewer commissioners are seeing a downside risk. We expect a strong trend in the economy in the second half of next year.”

A Wall Street official explained, “The improved economic outlook seems to be the reason for not making policy changes, such as expanding maturity of purchased bonds.”

However, if you look closely at the FOMC outlook, it must be 2023 for the growth rate to return to the 2% level and the 3% unemployment rate before the corona outbreak. It means that it will take three years for the economy to normalize.

② So, until 2023, we will maintain easing policies such as zero interest rates.

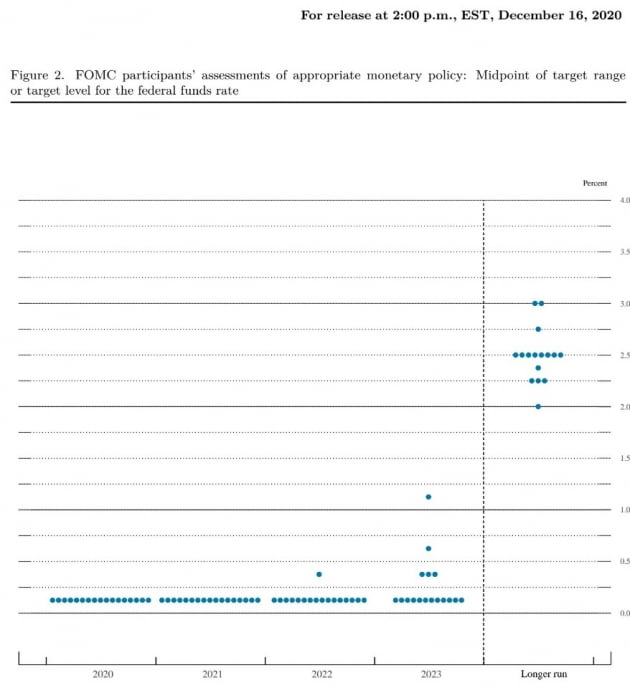

The median standard interest rate on the dot plot remained at 0.1% until 2023. This means that the commissioners are not expected to raise interest rates by this time.

–

–

–

None of the committee members saw that interest rates would rise next year. There was only one committee member who saw interest rates rise once in 2022, and five members saw interest rates rising more than once by 2023. Considering that there are 13 members of the FOMC, it can be interpreted as basically saying that the zero interest rate will be maintained until 2023.

In 2023, interest rates are expected to rise more than once, and the number of committee members increased from 4 to 5 in September. Wall Street interpreted it as “considering the improvement of the economic outlook, there should be about 10 people who have expected an interest rate hike in 2023, but only 5 people are a very easing signal.”

Regarding asset purchases, the Fed said in a statement that it would maintain bond purchases of at least $80 billion in government bonds and at least $40 billion in mortgage securities per month until “significant progress” is made toward meeting the Fed’s full employment and price targets. This was interpreted as a sign that the Fed would buy bonds longer than suggested in September. In a previous statement, the Fed said it would maintain current level bond purchases’for the next few months’.

–

–

–

The Fed did not change its policy that day, but Chairman Powell confirmed several times his stance that he would act whenever necessary. “It is possible to expand asset purchases to further support the economy,” said Chairman Powell.

③ If you want to taper (reduce asset purchase), you must inform us in advance.

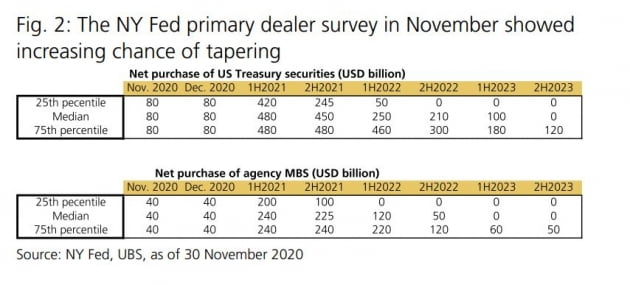

Some markets have already started worrying about taper. In a recent survey conducted by the Federal Bank of New York on government bond market primary dealers, they believe the Fed will cut bond purchases in the second half of next year (median). In particular, about a quarter of them think they will make that decision in the first half of next year.

There is a trauma on the market in May 2013, when former Fed chairman Ben Bernanke suddenly mentioned tapering and suffered a seizure. At the time, the stock price had plummeted.

Chairman Powell eased these concerns on this day. “If tapering is done, we will give you guidance in advance for a considerable period of time.”

–

–

–

④ No inflation concerns for the time being

“It may take time for inflation to rise globally,” said Powell. “Even with easing monetary policy, empirical evidence still shows that there is pressure for deflation.”

“It’s not easy to increase inflation. It will take some time. “It took a long time to get inflation back to 2% in the last crisis.”

In its economic outlook, the Fed lowered its inflation indicator, the core personal consumption expenditure (PCE) price index forecast, from 1.5% this year to 1.4%, and only raised 0.1 percentage points from 1.7% next year to 1.8%. It is forecasted to be 2.0% only in 2023.

In a statement, the Fed reaffirmed that it will maintain the easing policy until inflation exceeds 2% gently over a period of time and the long-term average inflation reaches 2%.

⑤ The stock price is not overvalued

When asked about the’current level of stock price’, Chairman Powell said, “Although asset prices such as stock prices have skyrocketed, it is not a risk given the low interest rate.” He said, “The PE is on the high side, but the 10-year Treasury Bond interest rate is high. “It can be said that it is justified in a world where is at a level below the historical level.” Powell added that even looking at the Fed’s model, the stock valuation is reasonable.

A Wall Street official explained, “The Fed was less doubly than expected, but Powell’s words were doubly enough.”

Bitcoin has surpassed $20,000 since this morning, thanks to the growing possibility of a fiscal stimulus agreement and the Fed expected to continue its easing policy.

–

–

–

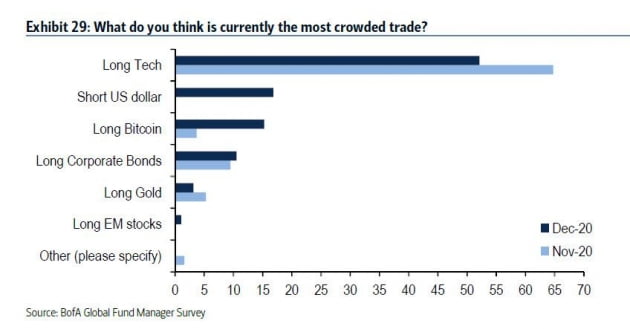

As shown in Bank of America’s December fund manager survey, the incorporation of bitcoin by institutional investors is the biggest background. Since last October, as PayPal has accepted Bitcoin payments, prices have risen in earnest.Since then, famous hedge funds and investors such as Stanley Drunken Miller, Paul Tudor Jones, Renaissance Technology, and Guggenheim Partners have been buying Bitcoin as an asset. On the day, Bloomberg reported that Alan Howard, famous for its volatility fund, was also investing in bitcoin.

–

–

–

Scott Minard, chief investment officer of Guggenheim Partners, who is known as the’stock market pessimist’, appeared on Bloomberg TV on the same day and said, “Bitcoin can reach $400,000.”

–

–

–

Reporter Kim Hyun-seok [email protected]

–