According to the information disseminated in the network, employees of Poczta Polska are to record transactions above a thousand euros – and then report them to the tax office. However, only the first part of this information is true.

The information published on Twitter by an anonymous internet user on July 16 triggered a discussion among internet users and questions about the truthfulness. The content of the post was: “Employees of Poczta Polska are signing declarations that they will report to the Tax Office every payment above 4.5K (a thousand zlotys – ed.). The border is moving closer and closer to Korea”. Almost 1.4 thousand liked the entry. nearly 400 users said. The screenshots of this post were shared on Facebook.

–

–

The commentators who believed the content of the entry wrote: “The criminal regime wants to control everyone …”; “The loop on Poles’ throats is getting tighter and tighter”; “Uuu full control”; “From the series: continuation of the permanent surveillance of PiS in Poland. If anyone knew more details on this topic and would like to share them, please feel free to do so” (spelling of the posts original).

We asked Poczta Polska if it was true, asking for details. A spokesman replied that it was “nonsense”. And it explains where this message could have come from.

–

—-

—-

“Analog SMS” disappear from the offer of Poczta Polska (material from 30/09/2018) Video: TVN facts

–

“The post office is obliged to register the data of the participants of the transaction ….”

Daniel Witowski, the press spokesman of Poczta Polska, in reply to the question from Konkret24, wrote:

–

Our employees do not sign any statements about reporting to the Tax Office the data of customers who have made financial transactions in amounts above PLN 4,500.

–

Daniel Witowski

—

Spokesman he also denied in a comment under the entry of the quoted Internet user: “Nonsense! This is fake news. By implementing the provisions of the AML / CFT Act (on counteracting money laundering and financing terrorism – ed.), the Post Office is obliged to register data of participants in financial transactions for the amount of EUR 1000 or higher (adopted course 1 euro – 4.5 PLN). Postmen do not sign any declarations on reporting customers to the Tax Office “.

Act training. The tax office is not getting this information

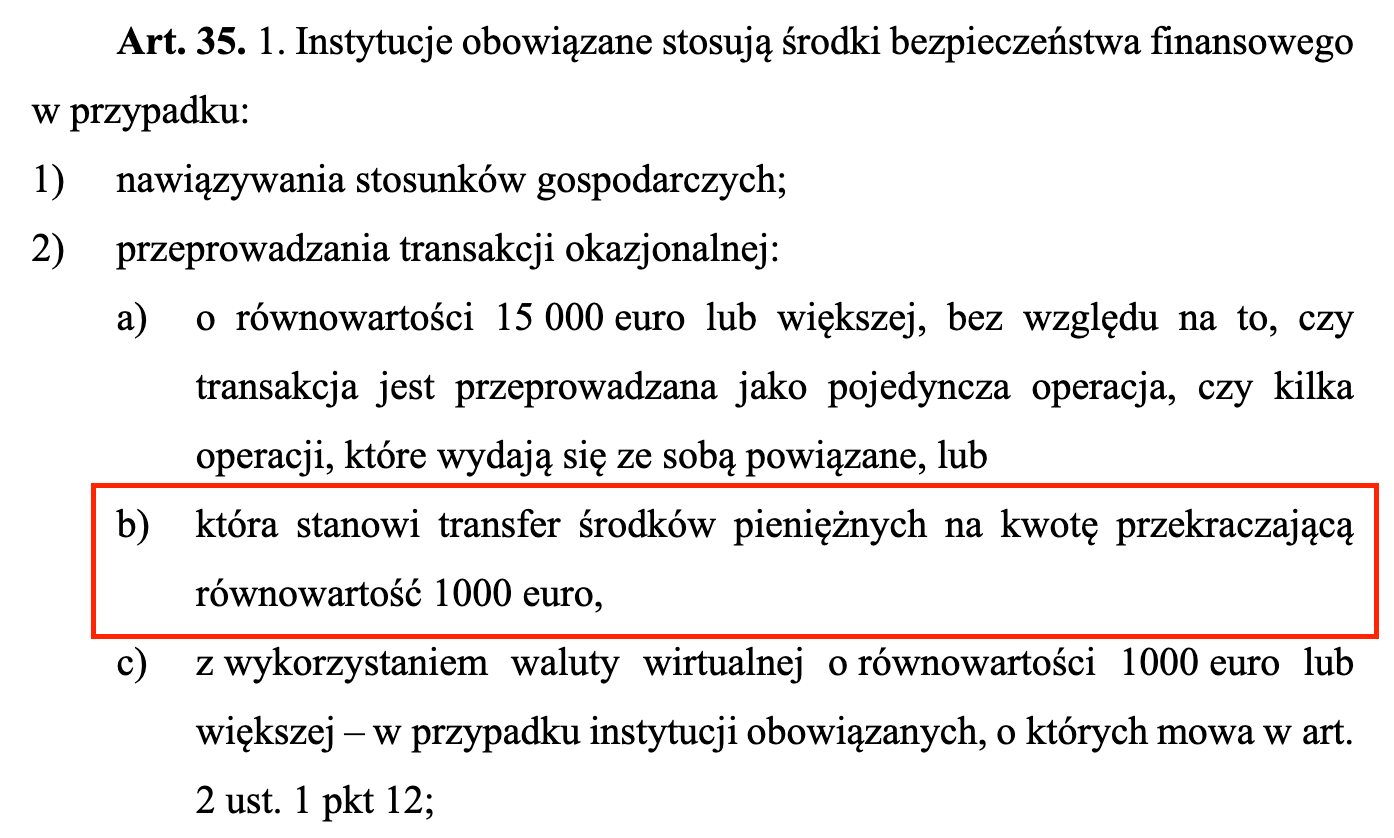

Witowski explains what the aforementioned amount of PLN 4.5 thousand may be related to. PLN and information about signed declarations. “Poczta Polska, as an obligated institution, is obliged to comply with the provisions of the Act of March 1, 2018 on counteracting money laundering and financing of terrorism” – writes in response to Konkret24.

W the act it is stated that an obligated institution, such as Poczta Polska, when carrying out financial transactions with a value of EUR 1,000 and higher, is obliged to register the data of participants in such operations. This is to counteract anonymous money laundering or terrorist financing. “In order to avoid the necessity to check the euro exchange rate every day, the amount of PLN 4500 was adopted (which is allowed by the provisions of the EU Regulation 2015/847)” – explains Witowski.

–

–

However, if the act is from 2018, why did the Twitter post appear now? “At present, a large number of Poczta Polska employees are trained in the knowledge of the obligations imposed on the Company under the Act (on counteracting money laundering and financing terrorism). The postal workers sign a declaration of completing such a course and a commitment to comply with legal provisions” – replies the spokesman .

Thus, the employees of the Post Office could have recently signed a declaration that they would comply with the provisions of the act, and thus register the data of participants in financial operations worth 4.5 thousand zlotys. and higher – only that they have been obliged to do so since 2018, when the Act on counteracting money laundering and financing of terrorism has been in force. It imposes such an obligation also, inter alia, on banks, investment funds and exchange offices.

Contrary to the information from the entry, the data is not transferred to tax offices.

“This is not a sensation, but a requirement of the law”

We asked Robert Gniezdzia, a legal advisor specializing in in economic crimes. At the outset, he admitted: “It is not surprising that Poczta Polska, as a payment service provider, plays an important role in the anti-money laundering detection and prevention system.”

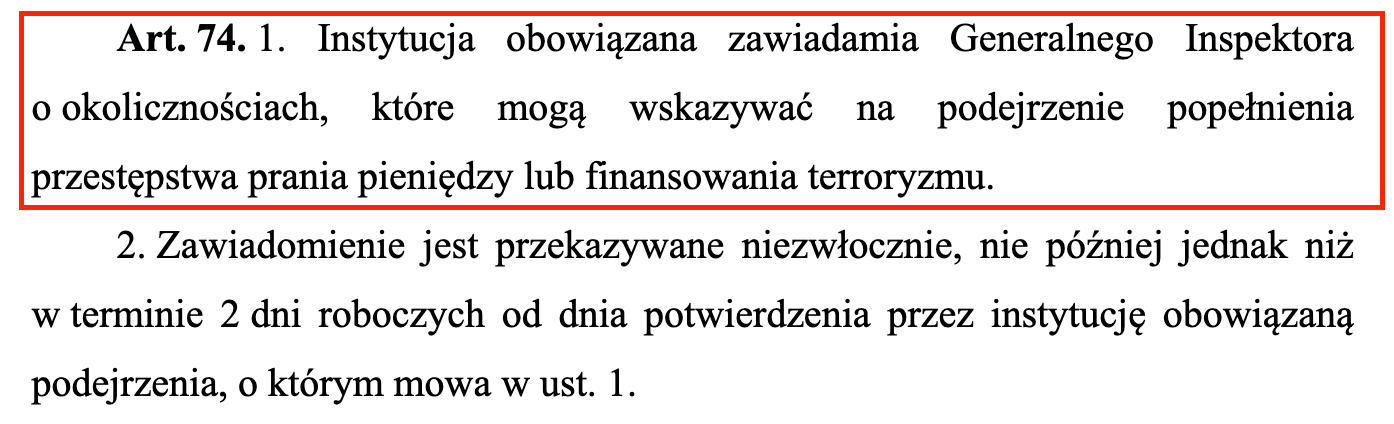

He further replied: “The purpose of the anti-money laundering and terrorist financing regulations is primarily to identify and detect transfers of funds from committed crimes and to identify persons who carry out such operations.” Therefore, the duties of Poczta Polska include identification of clients who perform specific payment operations, as well as determination of the recipients of funds of such transfers. “The obligated institutions, including Poczta Polska, must also inform the competent authorities about certain events that may give rise to suspicion of money laundering carried out through them” – explains the expert.

However, the “competent authorities” mentioned in the act are not tax offices, but the General Inspector of Financial Information. “At the request of the Inspector General, the obligated institution should immediately provide or make available the information or documents relating to the case in its possession,” explains Gniezdzia.

–

–

The lawyer adds that obligated institutions, such as Poczta Polska, do not have the authority to decide whether a given transaction is related to money laundering or not. “This is the competence of law enforcement agencies and ultimately the court. The role of the obligated institution is to identify suspects’ operations that may be related to money laundering and notify the competent authorities about such operations” – explains the lawyer.

The post office was entered into the act because it provides various payment services: mainly domestic and foreign money orders (including postal money orders) and bank deposits. Robert Gniezdzia explains: “The ability to send a remittance to any recipient can be used by criminals to legalize funds from illegal sources. This is facilitated by an extensive network of smaller points where funds can be transferred. This can fragment transactions and attempt to transfer funds. hiding the real beneficiary of the payments made “.

Therefore, postal workers, as well as bank employees, must register payments above PLN 4.5 thousand. PLN and identify suspicious transactions. “This should not be classified as a sensation, but simply a legal requirement” – sums up the spokesman of Poczta Polska.

—

Author: Michał Istel

Source: Konkret24, photo: Shuttestock / Twitter

–