(Original title: The two real estate giants continued to increase their daily limit, and the northern capital overwhelmed the new crown drug leader with more than 300 million yuan! The major paper maker has entered a new energy, with over 700,000 hand-sealed daily limit, and the cross-border stockpile list of lithium batteries has been published)

Major funds have largely merged into the pharmaceutical sector, and many real estate stocks have earned back-to-back board runs.

On Nov. 14, A-shares exhibited a pattern of opening high and moving low as a whole. The Shanghai Composite Index broke above 3100 points in the open and fell in the afternoon, closing down by 0.13%. The two major sectors of medicine and real estate took the rebound banner, among which many pharmaceutical stocks had their daily limit, including Fengyuan Pharmaceutical, Guizhou Sanli, Dali Pharmaceutical, Jinling Pharmaceutical, Longjin Pharmaceutical, etc., all registered daily limit.

Spurred by a string of positive news over the weekend, the housing sector continued its strong rally last Friday. The two major real estate behemoths, Gemdale Group and Seazen Holdings, continued to edge higher; Vanke A is up 4% today and its share price has regained its 60-day line. Yuetai, Macrolink, Zhongtian Services, Tiandiyuan and other stocks closed at the daily limit for 2 consecutive trading days.

According to the statistics of Securities Times Databao, only 4 major industries have net inflows of major funds today, namely pharmaceutical biology, banking, non-bank finance and household appliances. The net inflow of pharmaceutical biology is 4.749 billion yuan, al first place .

Today, 40 stocks received major net inflows of over 100 million yuan, with Ling Pharmaceutical, China Ping An, Midea Group, Zhongsheng Pharmaceutical and Oriental Yuhong leading the net inflow. Among the crown new concept drug stocks, Ling Pharmaceutical’s main net inflow was 1.071 billion yuan, ranked first. A net purchase of 311 million yuan of shares was made through special venues for Shenzhen Stock Connect.

Everbright Securities believes the market is currently at a relatively low valuation level after undergoing intense adjustments early on. In the absence of new external risks, the market currently exhibits a relatively high cost trend.

Cross-border disposal of lithium batteries

Meiliyun daily limit

As one of the hottest subdivisions on the new energy track, the lithium battery industry is attracting more and more listed companies to join. New players crossing the border for the first time are often sought after by the transfer market.

After trading was suspended for more than two weeks, Meiliyun resumed trading on November 14. The stock price increased by the one-word limit. In the morning, the daily limit closed more than 3 million lots; the market closed in the afternoon, closed orders were 715,200, accounting for more than 10% of the company’s circulation.

During the suspension period, Meiliyun issued an announcement that the company intends to use the assets and liabilities related to the papermaking business as an asset to be replaced by the equivalent parts of 100% stake in Tianjin Juyuan and 100% of the capital of Suzhou Lishen held by Tianjin Lishen. . It is reported that the two companies to be injected are focused on the lithium-ion battery business.

According to the data, Meiliyun was listed on the Shenzhen Stock Exchange as early as 1998. At the beginning of its listing, its main business was paper manufacturing, it was the largest listed paper manufacturing company in northwest China at the time. In recent years, the company has gradually changed from the traditional paper industry to multi-line development in the paper industry, cloud computing industry and photovoltaic industry. This major asset replacement means that the company will say goodbye to the paper business that has been operating for more than 20 years and turn to the new energy business.

More than 30 cross-border lithium battery industry listed companies

The overall trend has outperformed the broader market

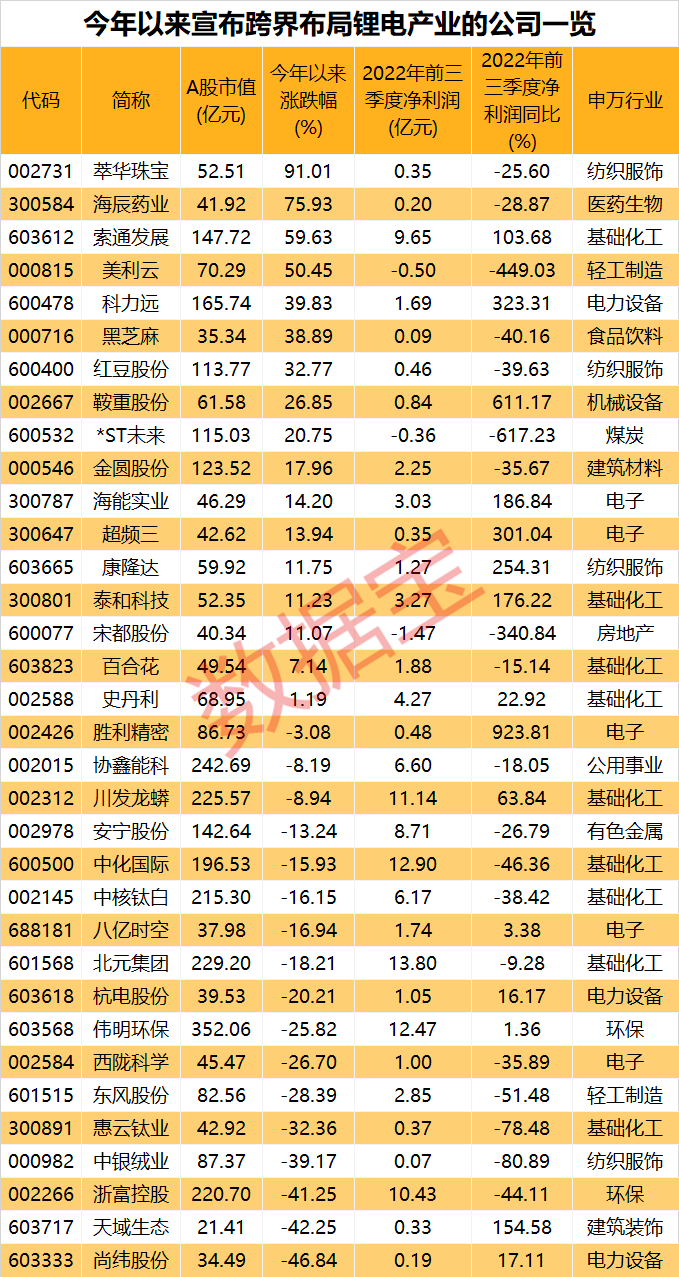

Since the beginning of this year, more than 30 listed companies have announced that they will distribute lithium battery-related businesses across borders, including Black Sesame, Kang Longda, Jinyuan, Bayi Space, Weiming Environmental Protection, etc.

On the morning of November 11, Cuihua Jewelry, whose main business is gold jewelry, announced its intention to acquire 51% stake in Sichuan Sterui Lithium Industry Co., Ltd. in “cross-border” liquidity of 612 million yuan. The company said it will vigorously develop the lithium salt products business, and plans to implement the new energy lithium battery industry.

On the evening of November 8, Eternal Asia issued an announcement to sign the “Strategic Cooperation Agreement” with Jinyuan. This framework agreement is signed to jointly invest in the development of lithium resources and other related projects, aiming to obtain complementary benefits and coordinated development upstream and downstream of the new energy industry.

According to Databao statistics, the fields of cross-border layout of listed companies include lithium batteries, positive and negative electrode materials, electrolytes, separators, lithium resources and battery recycling. Many of these cross-border layouts are leading companies in other fields, and there are also cases where a company has invested more than once.

From the point of view of performance data, in the first three quarters of this year, the net profit of cross-border lithium battery companies accounted for more than half of the year-on-year decline. According to Databao statistics, since the beginning of this year, the share prices of companies announcing the cross-border layout of lithium batteries have risen by an average of 3.56%, outperforming the Shanghai Composite Index by more than 18 percentage points during the same period. Cuihua Jewelry, Haichen Pharmaceutical, Suotong Development, Meiliyun, etc. increased by more than 50% during the year; Huiyun Titanium Industry, Zhongyin Cashmere Industry, Zhefu Holdings, Tianyu Ecology and Shangwei Shares decreased by more than 30% during the year.

The price of lithium battery raw materials has reached a new high

The cross-border layout must be considered for the long term

With the rapid development of the new energy vehicle industry, the price of upstream raw materials for lithium batteries has also increased. According to data from SunSirs, as of November 13, the price of industrial-grade lithium carbonate reached 591,000 yuan/ton and the price of industrial-grade lithium hydroxide soared to 580,000 yuan/ton, both reaching record highs.

In fact, the inter-bank implementation of lithium batteries by listed companies has repeatedly attracted inquiries or concerns from regulators. In addition, the market has mixed praise and criticism for the behavior of enterprises to distribute lithium batteries among banks, and some enterprises have repeatedly been labeled as “hot spots”.

According to the statistics of Databao, Dongfeng Stock, Hongdou Stock, ST Future, Black Sesame, Haichen Pharmaceutical, Cuihua Jewelry, etc. they all received inquiries or letters of concern from the exchange.

For example, Cuihua Jewelry, shortly after the company announced the cross-border lithium battery, received a letter of concern from the Shenzhen Stock Exchange. On the morning of November 14, the Shenzhen Stock Exchange asked the company to carefully verify and supplement the 8 major issues in the letter of concern, including whether the target company’s valuation of this transaction has a high appreciation rate, and the valuation ha increased significantly compared to the previous capital increases and capital transfers, reasons, rationale and the detailed source of funds for the transaction consideration.

On November 11, when Cuihua Jewelry announced its crossover, the company’s stock price opened to the limit, and then the stock price plummeted, with the stock price falling 6.5% that day. On Nov. 14, the stock rose slightly by 1.03%.

According to industry experts, whenever the lithium battery industry is at the peak of the cycle, it will always attract a bunch of new entrants. The behavior of cross-border implementation of the lithium battery industry itself has a certain rationale: some enterprises should usher in a breakthrough “abandoning the old and embracing the new”. However, the effectiveness of the transformation must be considered in the long run, because even if they take the “fast train,” some companies may still face failure to “get off the bus halfway.”

Disclaimer: The Securities Times strives to provide truthful and accurate information and the content mentioned in the article is for reference only and does not constitute substantial investment advice, so act at your own risk

Download the official APP “Securities Times” or follow the official WeChat public account, you can keep abreast of stock market trends, get insight into policy information, and seize wealth opportunities.