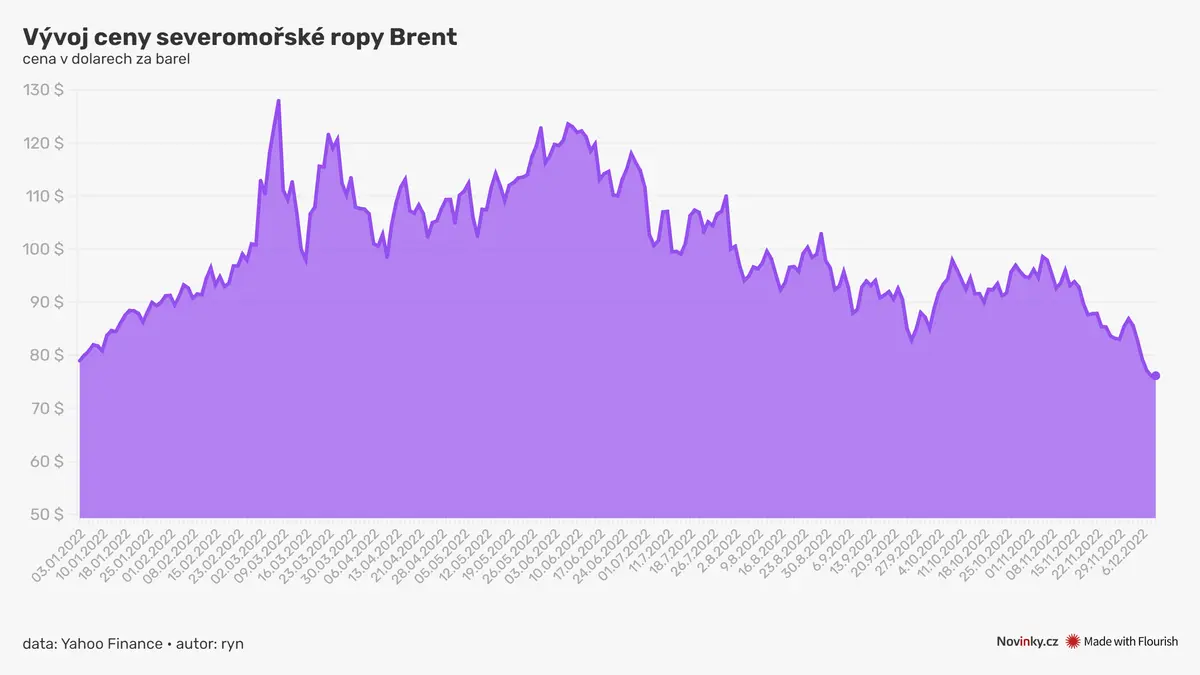

A barrel of Brent sold for $76 (CZK 1,750) on wholesale markets on Friday afternoon, which is the lowest price this year. The last time the Brent price was like this was on Christmas day last year. In one week, the price of this oil fell by 8.5%.

Similarly to Brent, WTI also found itself in the same situation, its price at the same time standing at less than 72 dollars (1,655 CZK) per barrel, which is also the lowest value this year. The last time this oil was this cheap was last December 21st.

Both Brent and WTI are set for a weekly loss of about 10%, the worst weekly percentage declines since August and April respectively, according to Reuters.

Tankers are piling up on the Bosphorus and Dardanelles due to new demands from Turkey

Economic

Also, the market now has a less common situation called contango, when the spot price is lower than the prices of futures contracts for delivery (so-called futures contracts). In this case, these are prices for contracts with delivery in six months. This suggests that traders are seeing weaker demand.

Low prices have remained in the market despite two unfavorable news stories in recent days. In the US, a Canadian company reported a leak in the Keystone pipeline, which sent the price up for a while, but it eventually fell as the market believed the pipeline shutdown wouldn’t last long. And he reacted in the same way in the case of the queue of tankers that the Turkish authorities detained at the Bosphorus and the Dardanelles before entering the Mediterranean Sea.

“Evidently, nothing can improve the mood on the oil market,” PVM analyst Tamas Varga commented succinctly on the situation.

Slow growth in China

Oil is at yearly lows mainly due to weak growth estimates of world economies. The strict covid policy in China, despite the recent partial restrictions, will lead to the fact that economic growth will be restrained for several months, writes Reuters.

Economists contacted by this agency unanimously expect the US central bank (Fed) to cut interest rates in December, i.e. by 50 basis points instead of 75, but the US economy is headed for a recession next year, albeit a short one, according to analysts.

The European Central Bank is also likely to raise interest rates by half a percentage point to two percent next week, another Reuters poll showed. It also emerged that the eurozone economy is almost certainly already in a recession.

The global economic slowdown will hit Europe hardest next year, according to the OECD

Economic