Jakarta, CNBC Indonesia – Commodity prices began to fall after soaring high due to the issue of geopolitical escalation between Russia and Ukraine. Is this drop just an action profit taking or is the price already stuck?

World oil prices have fallen in the past week. Two crude oil benchmarks, Brent and WTI, slumped by 20% point-to-point (ptp) from the highest peak reached. Brent oil price was recorded at US$ 102.35/barrel. WTI was recorded at US$ 98.52/barrel.

The once mighty coal, which reached its highest price at US$ 446/ton, fell to US$ 336.15/ton or 24.6%. Meanwhile, gas in Europe fell 48.3% to Euro 215/MWh, from a peak of Euro 111.5/MWh.

|

Sumber: Refinitiv Energy Commodity Prices- – |

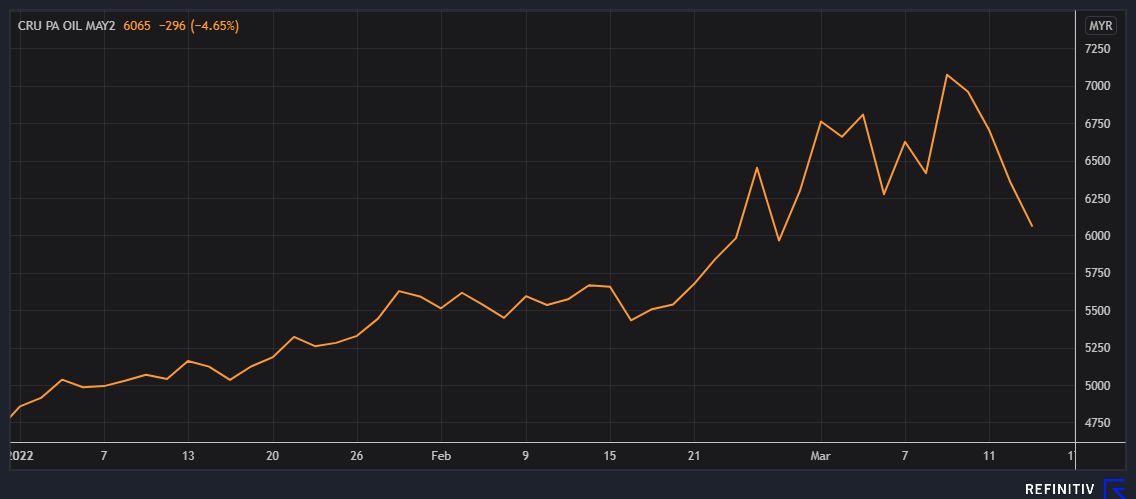

The fall in the price of the main energy commodity has also spread to alternative energy, namely palm oil (CPO). The price of CPO, which refers to the Malaysian futures exchange, was recorded at MYR 6,155/ton, down 135 from the highest price of MYR 7,704/ton.

Sumber: Refinitiv Sumber: RefinitivCPO price- – |

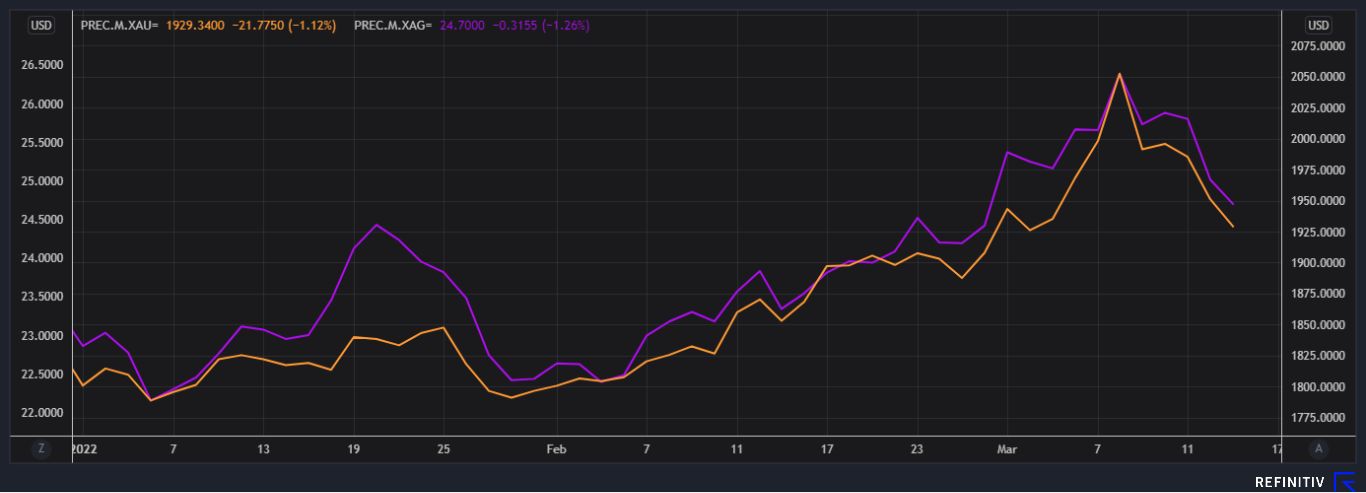

Asset safe haven which became a place to hedge investors’ assets also weakened. Spot gold was down 5.9% and out of the US$2000/troy ounce zone. Currently, the world gold price is recorded at US$ 1,930.51/troy ounce. Meanwhile, silver was recorded at US$ 24.71/ounce, down 3.7% from its peak.

Sumber: Refinitiv Sumber: RefinitivSafe Haven Asset Prices- – |

Recently, commodity prices are sensitive to geopolitical escalation between Russia and Ukraine. Because the impact can affect the availability of world commodity supplies.

Russia’s attack on Ukraine infuriated western countries. So imposed sanctions by ‘kicking’ Russia from the international financial system. The punishment disrupted the flow of trade to and from Russia. Especially for commodities that are the mainstay of exports to the red bear country.

Market players are worried because the supply of world commodities will be threatened with increasingly scarce supplies amid the recovery in production.

Russia is one of the largest commodity supply countries in the world. According to BP Statistics Review, Russia has a 26.2% share of worldwide exports with a total of 197.7 billion cubic meters. Europe is also dependent on 33% of energy products in Europe imported from the Red Bear Country.

Russia is the fourth largest exporter in the world with a market share of 11.4% of the total oil supply. On the other hand, Russia is the third largest coal exporter in the world after Indonesia and Australia. In 2019, Russian exports reached 217 million tons. The amount of black gold production from Russia now reaches 400 million tons per year, or the equivalent of 5% of global coal production.

Then when the issue of war cools, the anxiety of market participants will decrease. So commodity prices began to fall.

Dialogue between Russia and Ukraine began to cool the tension between the two countries. Russian President Vladimir Putin said there was progress in talks between the Kremlin and Ukraine.

On the other hand, the President of Ukraine Volodymyr Zelensky also made positive statements. He said that currently Kyiv had reached a strategic turning point in this attack.

On the other hand, investors began to take profits. Moreover, commodity prices throughout 2022 soared. World oil prices have risen 62% ptp from the beginning of the year to the highest price. Coal skyrocketed 181% ptp. European gas also soared to 135% ptp. CPO soared 46%.

Asset safe haven also in demand because of conflict sentiments in Eastern Europe. Gold prices jump 14% ptp. While silver is up 15% ptpt.

Not to mention the explosion of Covid-19 cases in China. On Tuesday (15/3/2022), China recorded 5,280 new cases of infection. This is a record high in two years, as published Economic Times, citing the National Health Commission (NHC). Cases were driven by the spread of the Omicron variant with 3,000 domestic cases.

The “zero Covid” strategy that does not hesitate tolockdown region becomes a pressure for global commodity prices. This is because China is the largest consumer of global commodities. Lockdown what they do will disrupt world consumption.

CNBC INDONESIA RESEARCH TEAM

(ras/ras)

–