Raw materials in this article

Forex in this article

–?? Cryptocurrencies are becoming popular as a store of value

?? Gold is considered a traditional hedge in times of crisis

?? According to Cramer, both assets fall into different categories

Since the original cyber motto Bitcoin was developed more than ten years ago, numerous cryptocurrencies have seen the light of day. Actually, these are supposed to revolutionize the global financial system and ensure decentralized, limitless, inexpensive payment transactions. In reality, however, digital currencies are still a long way from actually replacing traditional fiat currencies. There are still too few areas in which cryptocurrencies are actually used as a means of payment; the technical and regulatory hurdles are simply too great so far.

Cryptocurrencies and gold only appear to be equivalents

Nevertheless, another business field opened up for the cryptoversum relatively early on. Due to the increasing popularity of cyber currencies and the growing interest also from the institutional side, the prices for the digital coins have shot to exorbitant heights in some cases. The best example is probably the Bitcoin, which was traded at weddings via CoinMarketCap at 64,863.10 US dollars. So it’s no wonder that numerous investors not only see an alternative payment method when it comes to cryptocurrencies, but simply smell good business here. – Trading Bitcoin with Plus 500 – that’s how it works. 72% of retail investor accounts lose money when trading CFDs with this provider. You should carefully consider whether you can afford the high risk of losing your money. – Bitcoin has already made a name for itself as a store of value, which is even called gold as a digital alternative to inflation protection. The shiny precious metal, for its part, enjoys the reputation of a so-called safe haven, as the gold price has historically proven to be robust, especially in times of crisis.

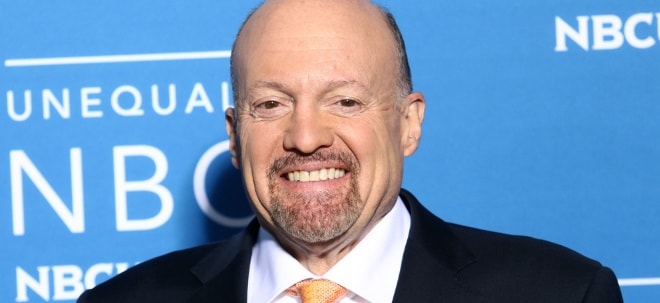

Jim Cramer insists on the difference between gold and cryptocurrencies

According to CNBC moderator and stock market veteran Jim Cramer, however, investors should not succumb to the mistake that both assets are interchangeable. The question of cryptos or gold is not an “either / or question” as he explained on CNBC’s Mad Money program. Although Cramer believed in both systems, there was no reason to regard “these two things as somehow equivalent”. In his opinion, they belong to completely different categories, which is why there is no competition between the two asset classes.

“You don’t speculate with an insurance company”

Gold is without question an “insurance against long-term inflation; it is boring, but absolutely essential,” said the expert. According to Cramer, this is exactly where the crux of the matter lies, namely insurance. Because with an insurance you don’t speculate that it should reliably protect you in times of crisis. However, the opposite is the case with cryptocurrencies. In the past, this would have added massively in value, but also exhibited extremely high volatility, which is why they would not be suitable as a safe haven: “Perhaps cryptos are a store of value when things go up, but they are a colossal mistake, when it goes down. That’s not what I look for in insurance. You don’t speculate with insurance. Cryptocurrencies absolutely have their advantages if you are willing to take the extra risk for big profits, but that has nothing to do with it to protect yourself “.

Therefore, investors would ultimately have to decide what exactly they would aim for with their investment, if protection was at stake, gold was the better choice, if one wanted to speculate that Bitcoin or Ethereum were a good option, he only instructed investors to do both “not to be confused”.

Finanzen.net editorial team

Image sources: JStone / Shutterstock.com, and katz / Shutterstock.com

–