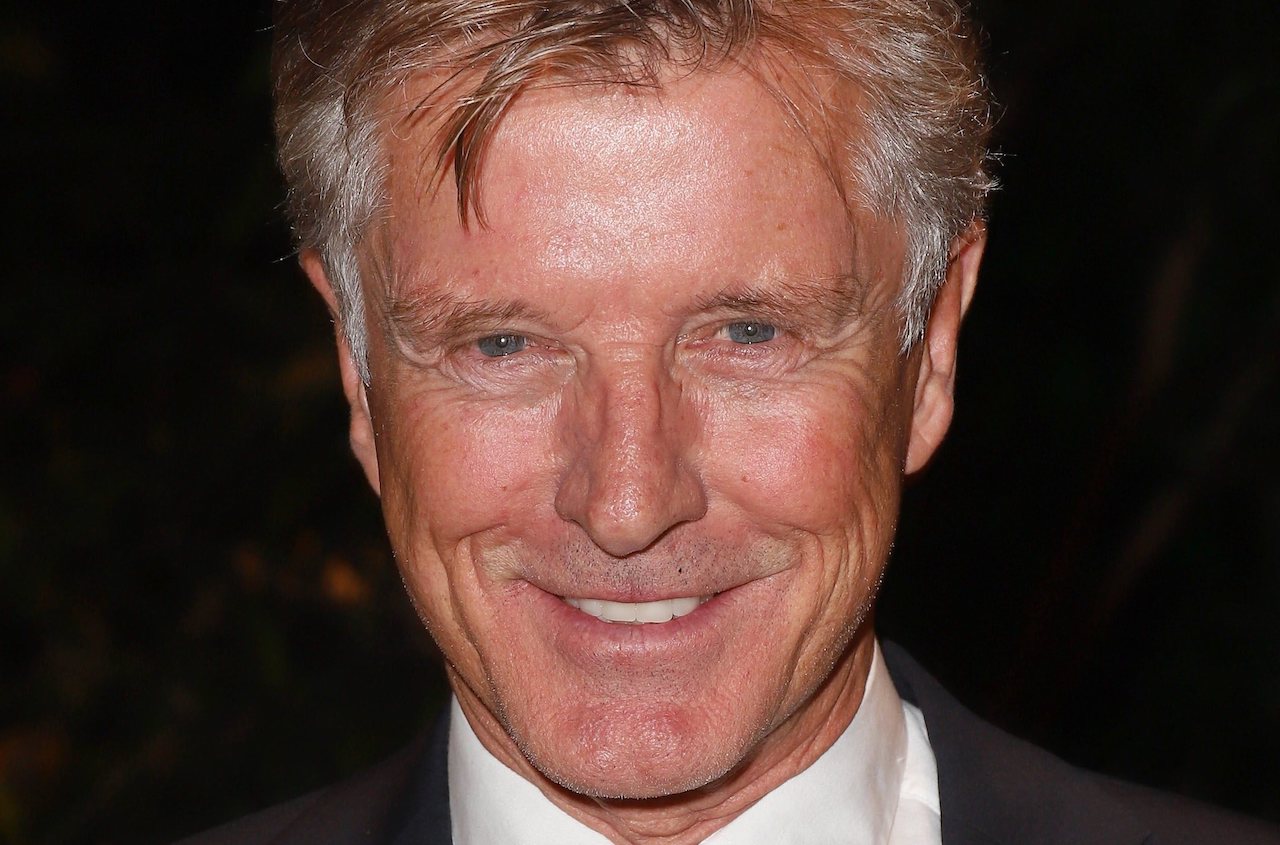

Cash. spoke to Nick Wilder, actor and “Herr Kaiser” from Hamburg-Mannheimer for 14 years, about his experience and strategies in investing.

–

Mr. Wilder, your first major investment – do you remember?

Wilder: Yes, that was in 1980. At that time I was still studying wood management at the University of Hamburg. Alongside my studies, I opened the first Danish windsurfing center in Denmark in 1977 – Windsurfing Danmark. In January 1980 I bought an old shop on the island of Falster right on the beach. Half a year earlier I had inherited a small sum from an uncle. It was just enough to deposit the ten percent deposit. At 28, I took the plunge into the deep end. At that time foreigners were allowed to buy commercial properties in Denmark, but summer houses are still not allowed to this day. I converted the grocery store into a sports shop and at the same time had my first own home with the operator’s house. When you are young you think that it will take forever to repay the rest of the mortgage plus interest. And the interest was around eight percent back then. But suddenly 25 years are over and you are free of debt.

Has the investment paid off?

Wilder: Definitely. Over the years I have renovated the associated house myself and transformed it into a luxury villa. In January 2019, I again sold the property to a German investor. The financial gain was high. Renting out the property as a holiday home was also very profitable for years. But much more important to me was the luxury of living 80 meters from Denmark’s most beautiful beach and having an unforgettable time there. For years it was the ideal retreat for my wife and me. And this happiness cannot be outweighed with money. Yes, it was more than worth it.

But a property does not always have to be profitable. In 2007 Christine and I bought an old apartment in the old town of Casco Viejo in Panama. Actually a very recommendable and safe investment, because the boundaries of an old town are determined by its history and it does not get bigger. When the old town is renovated, the prices usually go up. Panama’s old town was even declared a “Unesco Heritage”. We then put a lot of love and diligence into the renovation between 2007 and 2010. In 2008 the financial crisis surprised us and although the apartment was beautifully illustrated over eight pages in “Agenda”, Panama’s best lifestyle magazine, and praised and praised as “Absolut lounge”, the real estate market was down. In 2011 we were finally able to sell the property again without profit. We were just delighted to have the money we had invested back. So it wasn’t financially worth it, but it was a wild adventure that we wouldn’t want to miss today. Conclusion: Nothing is safe in life.

What are you investing in today?

Wilder: In 1998 I bought a beautiful piece of land above the Missouri here in Montana and built a house on it. As an actor you have a lot of time between shoots and I used my manual skills and built myself the house I had always dreamed of for two years. Then I met my colleague and now wife Christine Mayn. Since 2010 I have been out on the oceans every year in the winter months as “Doc Sander” and shot “Das Traumschiff” for ZDF. I have lived in the USA for over 30 years and also pay tax on my income here. In 2010 our friend and tax advisor Tom Morrison introduced us to a wonderful senior financial advisor: Phil Bird. Phil’s advice to us at the time was to pay into a so-called “401 K” pension fund every year. That immediately saved taxes every year. And only from the age of 70 do you have to gradually take out the savings that have grown tax-free in the meantime. And in old age the tax rate is usually lower because you no longer work. You never really look at this fund and then you are pleasantly surprised at how the money has increased over the years. From 1997 to 2010 I was the advertising character “Herr Kaiser” in Germany. That certainly doesn’t make you a financial genius. But back then taught me to listen and take good advice.

Phil’s second advice then, and it was best, was to invest in ourselves. In the months of May to October we had time to realize our dream here in Montana. In 2010 we decided together to create something in this magical place and in this beautiful nature that is second to none. We started building a guest house not only to share this wonderful place with others, but also to earn money from it. This process took a full eight years, during which we were able to calmly realize all of our ideas: Today there is the “Ting”, a five-star facility that you can visit for 500 dollars a night like in a luxurious resort can rent. But with one big difference: you are the only guest. The corona pandemic in particular shows that we were exactly right with the decision made at the time. Many are still looking for luxury, but if possible where appropriate “social distancing” is possible. Here at “Ting” you are extremely isolated on 16 hectares and have just about everything your heart desires, from a 30 degree warm swimming pool and a bocce court to a small golf course and many other amenities. Including the Montana adventure. We can offset our construction investment against rental income over a period of 27.5 years. So we live in one of the most beautiful places on earth, have the most interesting guests and enjoy the healthy air and the breathtaking nature every day. Yes, this investment pays off every day.

With or without investment advice?

Wilder: Definitely. I would advise everyone to do the same. Unless you are a financial genius yourself and know your way around very well. But you also have to have a lot of trust in your investment advisor. In our case, it’s a good friend, Dan Sullivan, whose father was a successful financial advisor. Dan makes very conservative decisions. This is very important to us. He knows our ideas and financial goals very well. But at the end of the day nothing is safe in life as you can see right now. The markets are very volatile. The older you are, the more conservatively you should invest. And above all, always trust your gut feeling.

Interview conducted by Kim Brodtmann, Cash.

Nick Wilder’s autobiography “Hello, Mr. Kaiser! Life is wilder than you think ”will be published at the beginning of December by In Farbe und Bunt Verlag.

Also listen to our interview with Nick Wilder in the new Cash. Podcast “The two & your money”.

–