- Australian dollar falls after RBA governor’s statements

Currency traders watched with distracted ear the statements of Philip Lowe (Governor of Australia’s central bank) that night. The press conference was not to lead to any surprise statements regarding Australian monetary policy. In short, market operators expected the key interest rate to remain at 0.1% but no additional announcement regarding the bond buyback plan. The governor’s speech therefore had its small effect. The man surprised everyone by expanding the current program to 100 billion Australian dollars, earlier than expected. With the current buyout plan ending in April, analysts believed Australia’s central bank would wait another month before discussing a possible increase.

Robert Rennie, Head of Financial Markets Strategy at Westpac said: “In a number of ways, the RBA’s policy statement came as a real surprise to the forex markets.”. The timing of the Australian rate hike also caught the attention of investors. While previous statements by Philip Lowe were forward-looking, without a specific deadline, he seems to have set in stone that the hike will not occur until 2024. Thus, the governor announced tonight that “The Commission will not increase the liquidity rate until real inflation is permanently within the target range of 2-3%. For that to happen, wage growth will need to be significantly higher than it is. is currently. This will require significant employment gains and a return to a tight labor market. The Council does not expect these conditions to be met until 2024 at the earliest. ” By affirming a continued low rate and by showering the hope of a rise before 2024, the Australian dollar has logically given way. By mid-morning, AUD / USD is at 0.763.

Source : trading Economics

- The two-stroke vaccine race

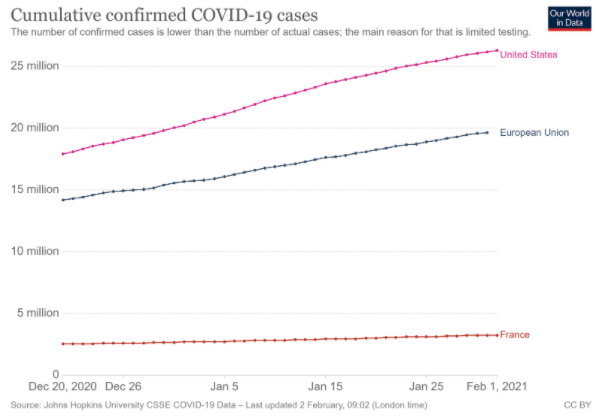

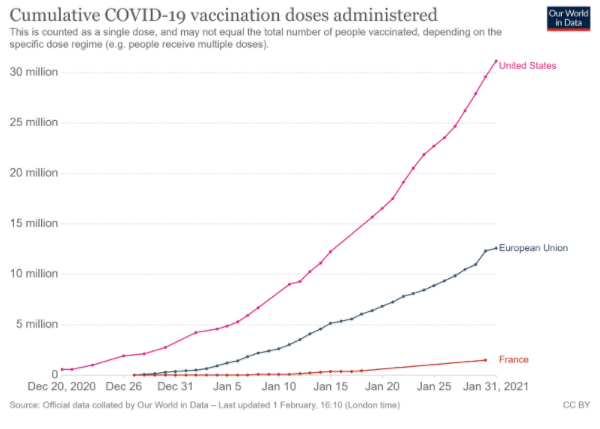

While many countries began their vaccination campaign against the coronavirus at the end of 2020, some are accelerating the pace, like the United States where the trend curve of people vaccinated exceeds that of new cases. Yesterday, they were 31,123,299 vaccinated, or 9.48% of the population. The comparison of the United States and Europe in terms of vaccinations and the economy shows that the Old Continent is bogged down. For example, France has vaccinated only 2% of its population. However, it is necessary to put into perspective the counterperformance of France, which sees its evolution curve for new cases stabilize. Since the start of the pandemic, experts have been talking about a possible collective immunity once 60% of the population has been vaccinated, there is still some way to go but the two-stroke machine is on.

–

—

—

—

—

- Employment is holding up in Europe despite everything

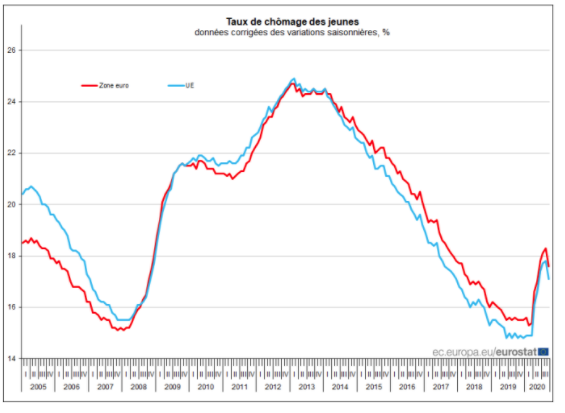

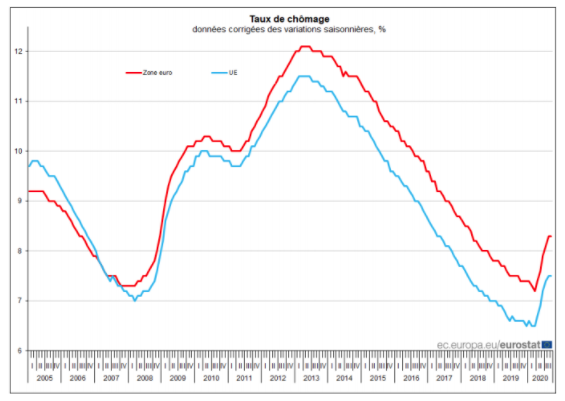

The December 2020 unemployment rate in the euro area was stable at 8.3%, indicating that the impact of the second wave on the labor market remains limited. However, youth unemployment has increased.

Indeed, the unemployment rate was around 8.5% in September, compared to 8.3% in December. The economic impact of the second wave was weaker than expected, with many countries still showing positive trends despite the closures of shops and restaurants during the quarter.

Youth unemployment has risen again and is approaching the levels of the first wave at 18.5%. This concerns more flexible contracts and an uneven number of young people working in sectors affected by the pandemic such as hotels and restaurants.

The modest impact of the second wave on the labor market so far means that the outlook for domestic demand after the economy reopens is positive. With maintained income and sharply increasing savings.

A rapid recovery in consumption is still relevant, as we saw during the first wave of consumption of basic goods. This could also happen for services once immunization strategies bear fruit in the EU and uncertainty about the economy has dissipated.

That said, the new lockdown measures to deal with the third wave and variants of covid-19 in the European Union, increase the risk of higher unemployment mainly among young people through layoffs, but also by through bankruptcy because many companies are on a drip, supported by state funds. There is great concern about the lagged impact when support regimes end.

Leave programs and short-time working have already been extended within the year for most countries, bringing some relief to the outlook for the first half of the year, but the question is what impact an increase in bankruptcies will have. For now, the picture looks solid, but an increase in unemployment due to a decrease in support is a more than likely scenario for 2021.

–

–

—

—–

—

—

(Representation of unemployment rate Source Eurostat) 1 *

1 * In order to fully grasp the unprecedented labor market situation triggered by the Covid-19 crisis, the EU has supplemented the unemployment data with additional indicators, for example concerning: underemployed part-time workers , people looking for work but not immediately available and people available for work but not looking for work.

–

–

–