NEW YORK (awp international) – The latest record hunt for some US indices continued on Wednesday with moderate gains on the New York stock exchanges. As the central investor debate continues to revolve around monetary policy perspectives, investors’ risk appetite was limited ahead of an eagerly anticipated central bank symposium. The leading index Dow Jones Industrial gained 0.11 percent to 35,405.50 points. His record is now more than a week old.

For the S&P 500 and Nasdaq 100 indices, however, the momentum was enough to just outperform the previous highs. The market-wide S&P listed for the first time just over 4500 points, at the end it rose by 0.22 percent to 4496.19 points. The technology-heavy Nasdaq barometer went 0.07 percent higher at 15,368.92 points after its temporary jump over 15,400 points.

It is eager to see what the monetary authorities will discuss at the Jackson Hole Conference, which is being held online again. But chief economist James McCann from Aberdeen Standard Investments looks calmly at a speech by US Federal Reserve Chairman Jerome Powell on Friday, he does not expect clearer signals until September. “Whether the market likes it or not, this will probably not be a speech with clear words,” said the expert.

The news remained relatively calm below the standard values. The better stocks in the Dow included JPMorgan and Goldman Sachs, two banks with gains of 2.1 and 1.1 percent, respectively. Brokers justified this with rising market interest rates and referred to the yield on ten-year US bonds, which on Wednesday reached its highest level in almost two weeks.

Two hours before the end, Western Digital’s price jump by 15 percent at times made headlines because of merger hopes. According to circles, the memory manufacturer is in advanced talks with the Japanese group Kioxia Holdings. At just under 70 dollars, the speculation was set at its highest level since mid-July: In the end, the price jump was 7.8 percent to 65.50 US dollars.

In the market it was said that such a deal could stir up the order in the global memory industry. Against this background, the papers of hard drive competitor Seagate reacted hesitantly by remaining roughly at their level before the news with a plus of one percent. In the memory chip area, however, the shares of Micron Technology ultimately brought it to an almost three percent plus. They rose to one of the best values in the Nasdaq 100 index.

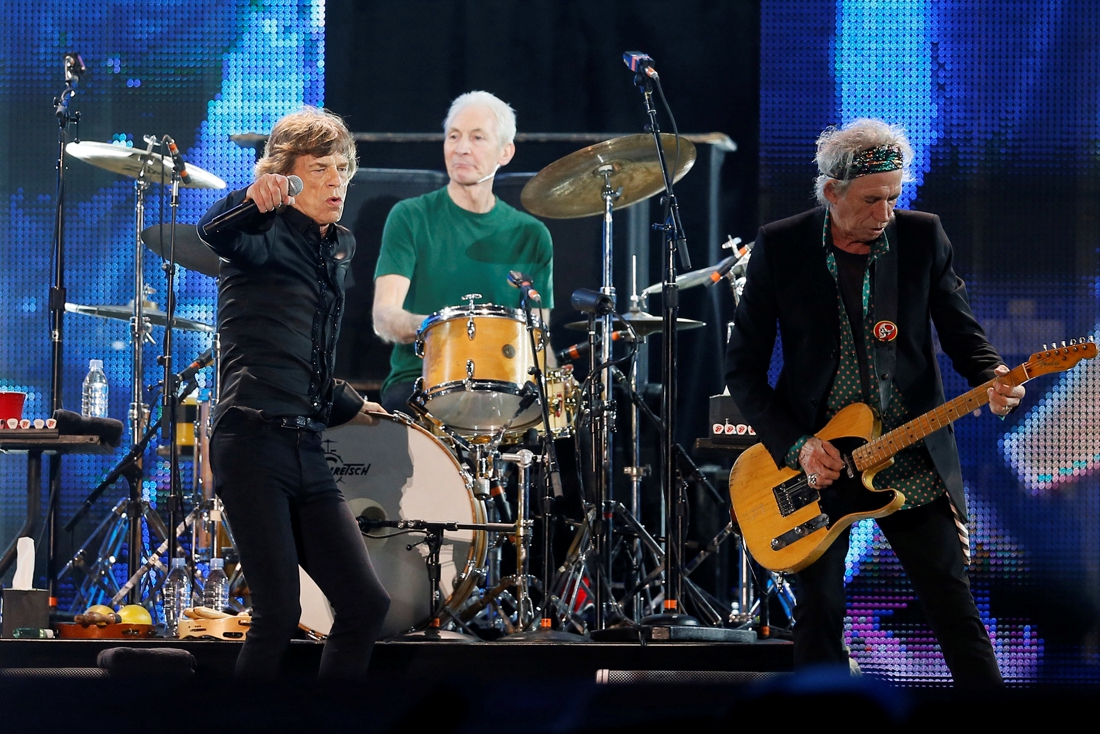

Otherwise, the music played in the small cap range with quarterly figures. Dick’s Sporting Goods shares soared 13.3 percent. The sporting goods retailer had positively surprised with its forecasts in the second quarter and also announced a special dividend. The picture was completely different in the textile industry at Urban Outfitters, as a price slide of 9.5 percent shows. The quarterly forecast was disappointing here.

Analyst comments also moved in the second-tier range. The Boston Beer papers went 3.5 percent downhill after the Cowen analysts expressed skepticism in the course of a downgrade. Conversely, Okta stocks on the Nasdaq 100 top were up 5.3 percent. For the experts at Raymond James, the authentication software specialist is now a “strong buy”.

After a recovery rally, the situation in China stocks, which are listed in the US, calmed down. For the shares of the e-commerce platforms Pinduoduo and JD.com, which had jumped particularly strongly the day before, things were now mixed up again: For the former, it was down by 1.3 percent, for the latter by 1.2 percent.

The euro gained again a little. The common currency approached the $ 1.18 mark in New York trading at $ 1.1771. The European Central Bank (ECB) had set the reference rate at 1.1736 (Tuesday: 1.1740) dollars. The dollar cost 0.8521 (0.8518) euros.

By contrast, US government bonds posted losses. The futures contract for ten-year Treasuries (T-Note-Future) fell by 0.29 percent to 133.59 points. The return on ten-year government bonds was most recently 1.34 percent./tih/he

— By Timo Hausdorf, dpa-AFX —

– .