The leading index in the New York Stock Exchange showed mixed trend due to concerns about the immediate containment policy, even though vaccination for the novel coronavirus infection (Corona 19) was started in the United States.

On the 24th (hereafter Eastern time), the Dow Jones 30 Industrial Average on the New York Stock Exchange (NYSE) closed at 29,861.55, down 184.82 points (0.62%) from the battlefield.

The Standard & Poor’s (S&P) 500 index closed at 3,647.49, down 15.97 points (0.44%) from the battlefield, while the Nasdaq index, centered on technology stocks, rose 62.17 points (0.5%) to 12,440.04.

The market watched the release of the Corona 19 vaccine and negotiations on US stimulus measures.

The stock market was strong at the beginning of the market.

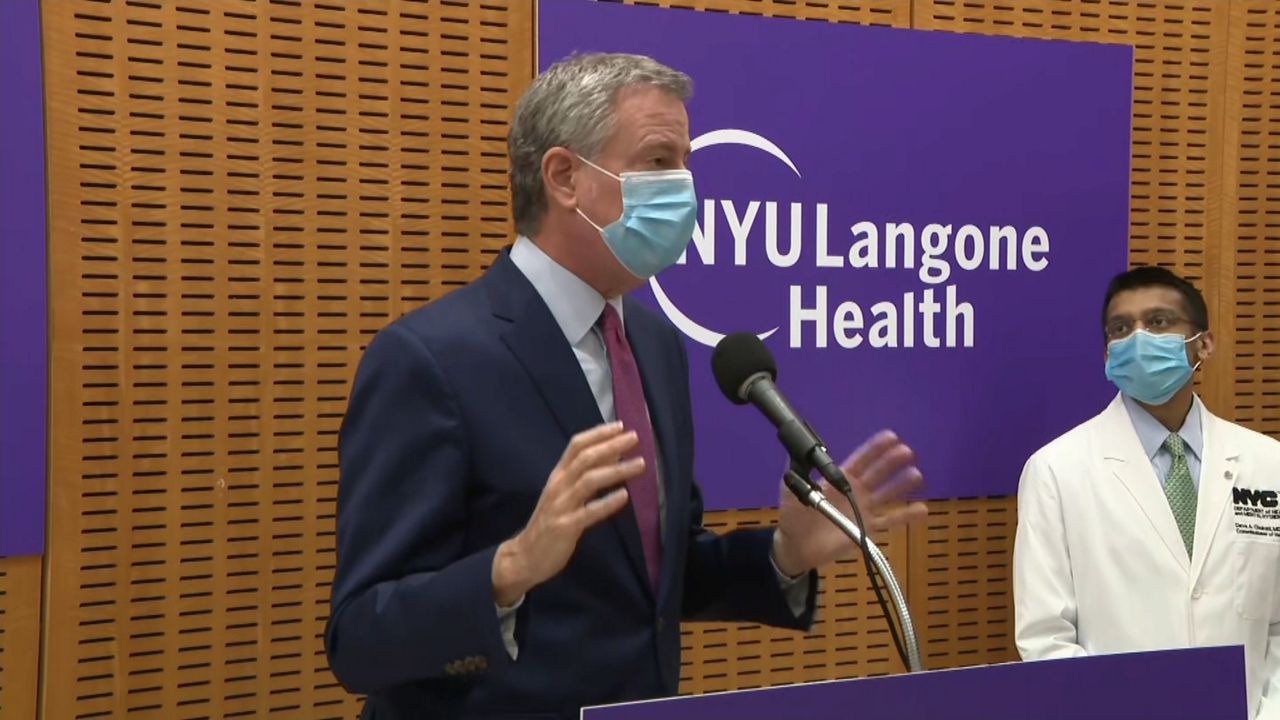

Starting with a hospital in New York, inoculation of the Corona 19 vaccine developed by Pfizer and Bioentech in the United States began.

The vaccine was distributed shortly after the U.S. Food and Drug Administration (FDA) approved the emergency use of the vaccine last week, and the first vaccine was given.

Although vaccination was scheduled, it once again stimulated expectations that the pandemic could be controlled.

This week, it is expected that Modena’s vaccine use will also be approved.

Montseff Slawi, head of vaccine development at the White House, expected that by the end of March next year, 100 million people, or about a third of the U.S. population, could be immunized from vaccination.

The expectation that negotiations for new stimulus measures, which are in a deadlock, could find a breakthrough also supported investment sentiment.

According to major foreign media such as the Wall Street Journal, US nonpartisan lawmakers are pushing ahead with a plan to separate the stimulus package into two bills and present it to Congress.

They plan to propose a separate bill for the protection of responsibility between the two parties and a $160 billion local government support plan.

The other bill is expected to contain a stimulus package worth $748 billion with less disagreement.

It is interpreted as a measure to increase the possibility to agree on some issues first.

It was also expected that nonpartisan lawmakers could present the bills to Congress as early as the day.

Last week, Republican Senate Mitch McConnell also proposed a prioritization of other bills other than liability protection provisions and local government support, but the Democrats opposed it.

The opinions of the Democrats and Republicans on the bipartisan lawmaker’s bipartisan bill are not yet clear.

However, expectations for a last-minute agreement are somewhat raised, as claims that the Congress cannot be adjourned at the end of the year until the stimulus bill is concluded.

In an interview with CNN, Democratic House Representative Steney Heuer also expressed the view that the bill could be accepted, excluding local government support.

House Speaker Nancy Pelosi (Democratic Party) and Treasury Secretary Stephen Manusin discussed stimulus measures on the phone the day before, and the negotiations will continue on that day.

As a result, the Dow also hit a record high at the beginning of the market.

The main index, however, declined due to the current Corona 19 crisis and the burden of strengthening containment measures.

According to the statistics of Johns Hopkins University, the total number of deaths from Corona 19 in the United States surpassed 300,000 on that day.

It also made investors uneasy by warning that Bill Double Lazio’s New York market could face a full blockade in the near future.

New York City stopped operating indoor restaurants from that day, but stronger regulations could come out.

Blockades in major regions around the world are being tightened, such as Germany has decided to further strengthen the blockade measures at the end of the year and the beginning of the year, and London, UK, also announced that it will upgrade the Corona 19 response stage from the previous stage 2 to stage 3.

Meanwhile, the additional trade negotiations between the UK and the European Union (EU) acted as a somewhat positive factor.

Both sides initially set last weekend as the deadline for negotiations, but decided to continue the discussion.

Uncertainty remains, but concerns about the Brexit’no-deal’ situation where the UK leaves the EU without a trade agreement have been somewhat reduced.

By industry on this day, industrial stocks fell 1.28%, sluggish, and energy fell 3.53%.

Tech shares rose 0.41%.

New York stock market experts expressed their expectations for the Corona 19 vaccine.

Mark Hapel, chief investment officer at UBS Global Wells Management, said, “We expect the widespread availability of effective vaccines in the second quarter of next year. We will support the normalization of economic and social activities.”

“Therefore, I think there is more room for further upside in the stock market rally that started in November,” he added.

On the Chicago Options Exchange (CBOE), the volatility index (VIX) recorded 24.72, up 6.05% from the previous trading day.

/yunhap news

–