The minutes of the latest Fed meeting could cause some movement in the process. According to market experts, investors will primarily check the statements of the central bankers for indications that monetary policy will no longer be quite as loose in the future. A gradual rise in US yields is no big deal for high-risk assets like stocks, according to analyst Stephen Innes at broker Axi. However, there are also those among the Fed governors who would rather reduce support measures sooner rather than later.

The number of voices that the US economy is facing a prolonged upswing is growing. Analyst Konstantin Oldenburger of trading house CMC Markets wrote: US President Joe Biden’s plan for a greener economy combined with an economic stimulus package on an unprecedented scale could also result in an unprecedented boom in the US economy and demand for products as well Trigger shares.

JPMorgan boss Jamie Dimon is also very optimistic about the economic prospects in the USA. The economic boom after the end of the pandemic could continue without problems until 2023, Dimon said in his annual letter to shareholders. These were also able to look forward to price gains of 1.3 percent on Wednesday, which means that JPMorgan shares were at the top of the Dow.

Shares in cruise operators were wanted on Wednesday. Carnival initially rose to a high since March 2020, but then the price gains crumbled to only 1.4 percent. The group has another quarter in the deep red behind it, but is hoping for a strong comeback. The demand for cruises has risen sharply, in the three months to the end of February bookings have risen by around 90 percent compared to the previous quarter. In the wake of Carnival, papers from other cruise operators also rose, Norwegian Cruise Lines around 1.4 percent and Royal Caribbean by one percent.

The shares of Beyond Meat started strong, but then turned into the red with last two and a half percent. The manufacturer of vegan meat substitute products announced the opening of a production facility in China.

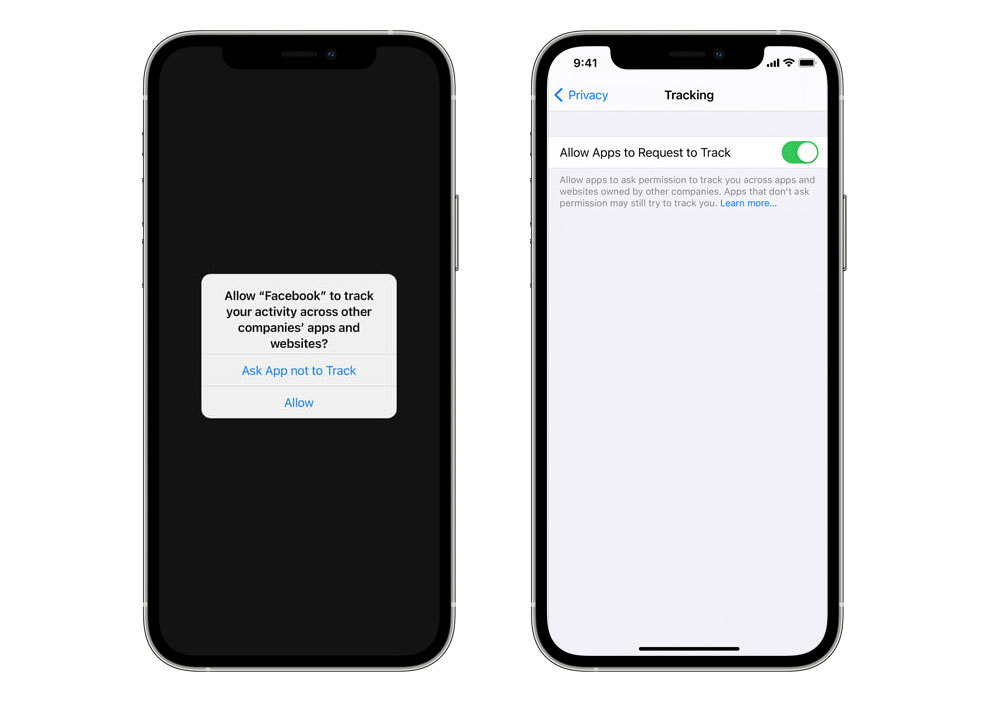

Facebook reached another record high and recently gained 1.8 percent. Since the beginning of March, the shares of the online network have already risen by a fifth, while the Nasdaq 100 has only caught up a bit since the end of March

(AWP)

–