New nightmare day for the cryptocurrency sector, which loses the price levels gained and maintained over the last week, returning to thresholds that, with enormous difficulty, are currently being defended by pochi tori.

Worrying situation? Not exactly, also because there have been gods anyway excellent signs that come from the market, in terms of resistance to a wave bearish aiming to overtake the last of the supports.

Interesting situation for those who do trading and therefore want to try to take advantage of volatility. We can do it with eToro – go here to apply for free trial account for smart auto trading – intermediary that offers the top in terms of instrumentation also in short and allows you to copy the best crypto-traders.

We have the best tools of technical analysis, together with what is also offered in terms of additional services, such as CopyTrader per invest copying the top of the market. We also have the CopyPortfolios, useful for those who want only one title which represents, up and down, the top of the market for cryptovalute. With 50$ we can open a real account.

Top of short positions: Bears try to hit hard

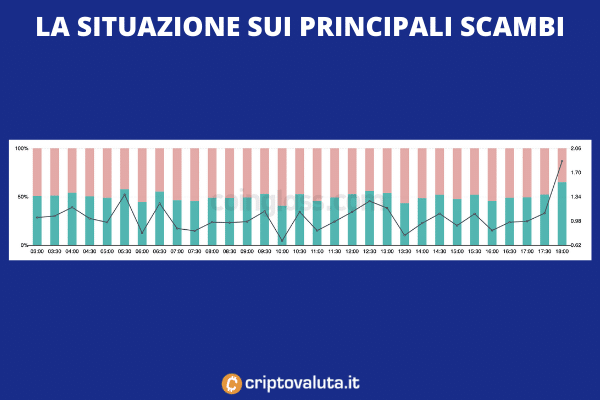

The first graph we need to look at is that of long and short positions his Bitcoin, which is derived from CoinGlass taking into account all the major platforms they also offer derivatives. During the afternoon, in conjunction with theopening of the USA square there was a significant increase in positions bearish, which they managed to push BTC and the whole sector below price levels that have not been seen for a while.

–

Great swing, with the short who continue to insist in the moment in which we are writing this deepening. A sign that the battle is lengthen from ending, for an evening that will still be of great agitation on the markets, in particular pending the reopening of asian stock exchanges.

Terror weighs on the economy – risk off for all major sectors

To weigh on cryptovalute – and also on assets considered mainly risky – it is an economic situation that we have been talking about for some time now, and about which we have also anticipated what later admitted from major central banks. L’there is inflation, it is now out of control and the central banks’ tools to control it have not sprung up, but they may even aggravate the problem.

That is, the reduction of monetary expansion through the purchase of public debt securities and other maneuvers. The governor of the FED, Jerome Powell, he has made it clear that you are ready to start the program, frightening the markets but without having to deal with their reaction.

A situation that we believe to be very close to what we have already seen several times in the past in conjunction with other situations of this type. That is, the markets obviously react badly to the start of these programs, then forcing them central banks to go back on their purposes.

An increase in the same – which would obviously strengthen the US dollar against any type of asset – it would seem to be due by now. But even in this case we will have to deal with the rash reactions of the markets, which could to bleed enough to report FED and other central banks to milder advice.

In such a situation a sell off constant by large investors and speculators on cryptovalute it’s more than understandable, although the risks the bears are taking are very high and discover the side also a possible recoveries in quick terms, with someone who has correctly signaled the possibility that a price squeeze will follow a recovery in style short squeeze.

Pre-Christmas discounts on all major cryptocurrencies: let’s take a look at the most appetizing

The prices of Bitcoin, but also of Ethereum and other major cryptocurrencies are all very interesting, even if they are close to important ones supports which, if they do not hold, could open up further nefarious scenarios.

Someone, among those who have important liquidity in his portfolio, he will be able to take advantage of it by buying the cryptocurrencies he wants to bet with Crypto.com – go here for the free account with $ 25 free bonus on signup – intermediary that offers all the main cryptocurrencies in direct purchase, with some gems in the list that we cannot find elsewhere. The ideal system for those who want accumulate now, in view of the recovery and recovery.

Is there to be worried?

Bears seem to have a lot of strength after dominating the asian session, something that hadn’t happened for some time. The uncertainty will sooner or later dissipate, even if no one expected a December of this type.

The phase is for us to still be considered as of accumulation, as well as preparatory to the recovery of price shares close to ATH that almost the entire sector has registered in recent weeks. The battle however between bears e market goes crazy – and those with a weak stomach will do well in case to buy and stay a bit off the charts.

–