VMany users, but no ways and means of generating significant income with the high reach: That was the problem for companies in the social media sector for a long time. One company after the other is finding new, creative ways to establish payment barriers from the free Internet and thus not only generate a growing number of Internet followers, but also a growing number of investors in their own shares.

The Pinterest photo and ideas community has just started so-called “Shopping Lists”, in which the “Pinners”, as the users of Pinterests are also called, can store the products and services that they are interested in on the Pinterest photo pin board Rummage noticed. From then on, users will receive notifications about these products – for example when the price has fallen. The hope: More people buy on Pinterest, which would make it more attractive for companies to advertise on the platform. The stock has avoided forming a trend reversal formation in the past few months. The uptrend is intact as long as it does not close below the $ 60.37 support at the end of a week.

Pinterest Stock CFD, Source: CMC Markets

Pinterest isn’t the strongest social media stock

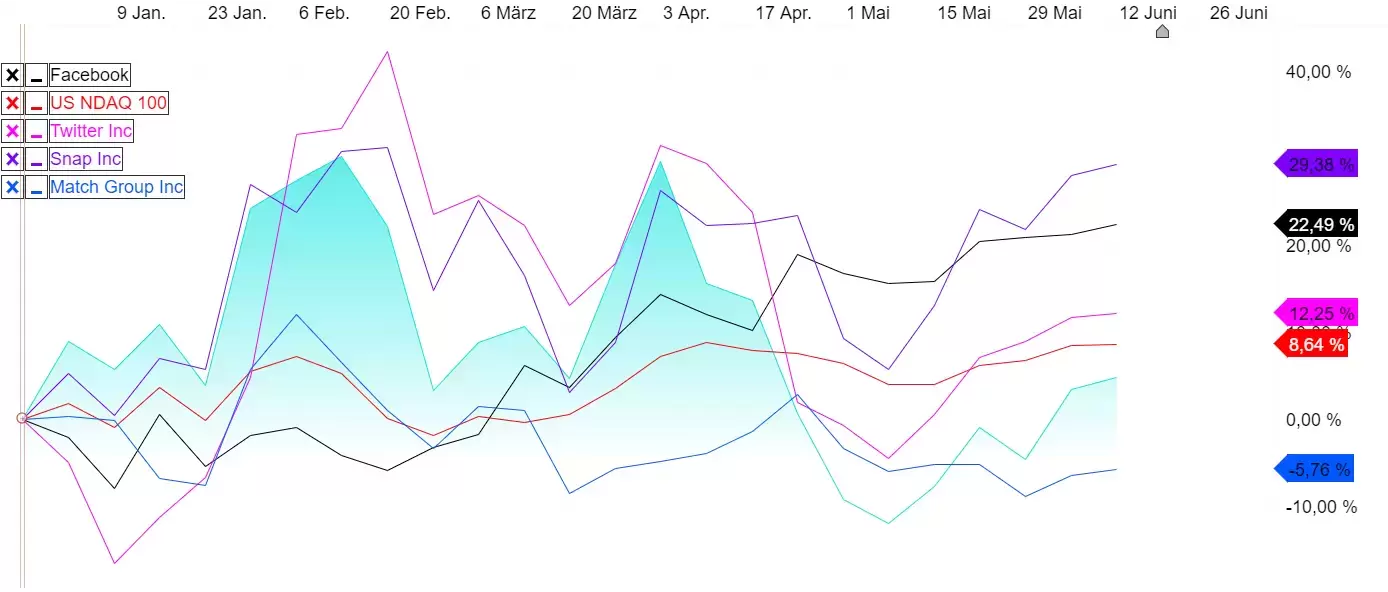

If you compare the development of the large social media stocks with the development of the NDAQ 100 Cash CFD, Pinterest has only been midfield since the beginning of the year. Snap (+ 29%), Facebook (+ 22%) and Twitter have performed better than the NDAQ 100 Cash CFD (+ 8%) Pinterest is up 5%. The Match Group developed even more weakly at -5%.

Comparing social media stocks, source: CMC Markets

Snap: Snapchat app continues to be popular

With 500 million people opening and using the Snapchat app every day, Snap is one of the most popular social media companies in the world. Recently, Snapchat relies heavily on the area of ”Augmented Reality” – even with its own mobile device – Spectacles – which, according to US investor magazine Barron’s, should be around four times heavier than Rayban aviator sunglasses, be equipped with two cameras and four microphones and be able to enrich the environment with additional information projected onto the glasses. Piper Sandler analyst Thomas Champion called Snap an “innovation leader” in new products. The analyst sees the price potential at Snap at $ 83. Technically, potential resistance can be seen at $ 75.66 and potential support at $ 53.77.

Snap Stock CFD, Source: CMC Markets

Disclaimer: This information material (regardless of whether it reflects opinions or not) is for general information only. It does not constitute an independent financial analysis or financial or investment advice. It should not be relied upon as an authoritative basis for an investment decision. The information material should never be understood to mean that CMC Markets recommends or considers the purchase or sale of certain financial instruments, a certain point in time for an investment decision or a certain investment strategy for a certain person. In particular, the information does not take into account the individual investment goals or financial circumstances of the individual investor. The information has not been prepared in accordance with the legal requirements to promote the independence of financial analysis and is therefore regarded as a promotional communication. Although CMC Markets is not specifically prevented from acting prior to the provision of the information, CMC Markets will not attempt to take advantage of the information prior to the dissemination of the information.

–