In the $ 23.7 trillion Treasury market, the biggest buyers are pulling out.

Japanese pension funds and life insurers, foreign governments and US commercial banks once lined up to get their hands on US Treasuries, but most of them are now back. And let’s not forget the US Fed, led by Fed Chairman Jerome Powell. In September, the bank began to scale down its balance sheet and just raised the US Treasury outflow amount (decrease in holdings of securities due to redemption) to a maximum of $ 60 billion per month.

If one or two of the treasury’s regulars are retiring, even a noticeable move would be no cause for alarm. But if everyone pulls out en masse, that’s undeniably a cause for concern, especially given the unusually high volatility, falling liquidity and weak US Treasury auctions in recent months.

Although Treasuries have suffered their biggest sell-off so far this year since at least the early 1970s, according to more markets there will be even more pain until a steady stream of new demand emerges, this is the conclusion underlined by. Watcher. It is also bad news for American taxpayers who have to bear the rising cost of loans.

“With central banks and banks in general off the stage, new Treasury buyers are on the rise,” said Glenn Capello, who has been trading bonds for over 30 years at Wall Street trading desks and is now CEO. by Mishler Financial. I’m not sure who it is yet, but I know they will be more price sensitive. “

It is true that over the past decade, whenever many expected a significant decline in Treasuries, buyers, including central banks, seemed to be supporting the market. Should the Fed abandon its hawkish stance, as some are betting, last week’s short-term Treasury rally could be just the beginning.

But analysts and investors say this time around is likely to be very different from the past, as inflation is at its highest level in decades and the Fed is unlikely to be accommodative anytime soon.

Unsurprisingly, the Federal Reserve is responsible for most of the decline in demand for Treasuries. The Fed’s bond portfolio more than doubled in the two years to early 2022, topping $ 8 trillion. The budget, which includes mortgage-backed securities (MBS), will shrink to $ 5.9 trillion by mid-2025 if current outflow plans remain unchanged, officials estimate.

While many see the decline in the Fed’s distorting market influence as healthy in the long run, the reversal is stark for investors accustomed to the Fed’s preeminent presence.

“Since 2000, there has always been a central bank that has bought tons of Treasuries,” said Zoltan Pojarr of Credit Suisse Group on the Bloomberg podcast “Odd Lots”. “At a time when the dynamics of inflation are more uncertain than ever, we basically expect the sector to replace the public sector,” he said.

However, fears would have been more contained if the exit from the market had been limited to the Fed, which had long predicted its budget outflow policy. Reality is different.

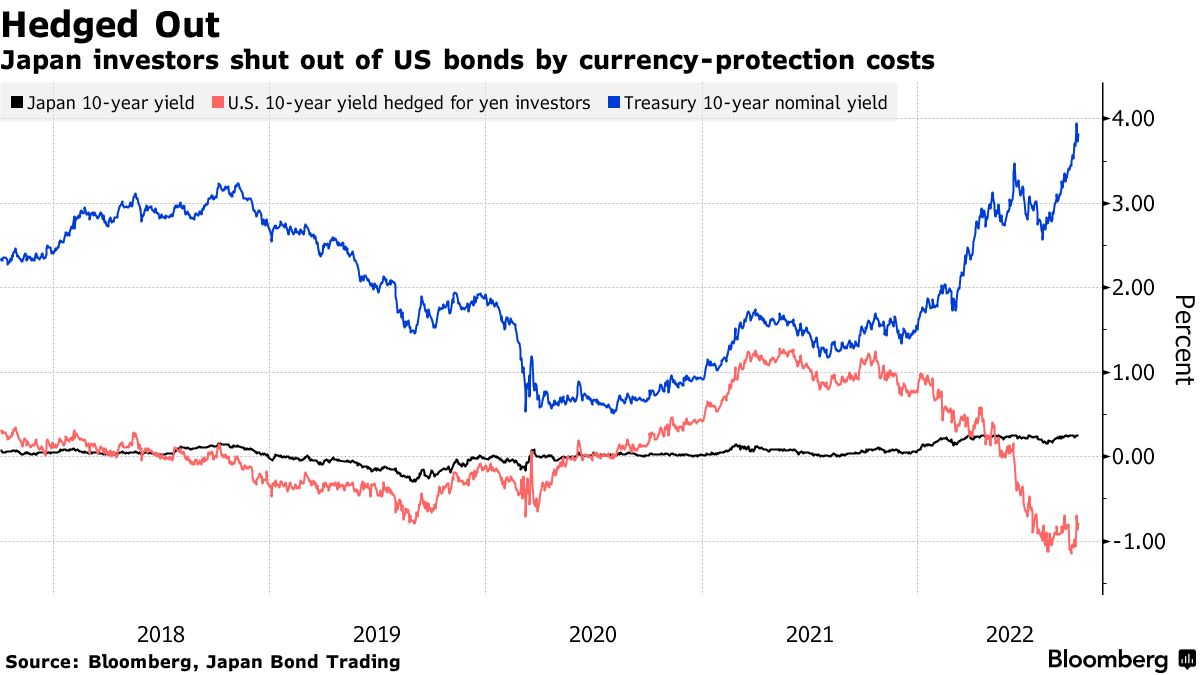

Rising hedging costs have also effectively squeezed Japan’s giant pension funds and life insurers out of the Treasury market. Even if 10-year US Treasury yields were above 4%, the real yield would be negative for Japanese buyers, who must subtract currency hedging costs from returns.

The rise in hedging costs parallels the strength of the dollar. The dollar gained more than 25% against the yen this year, its largest ever recorded gain in Bloomberg data dating back to 1972.

With US financial authorities continuing to raise interest rates to push the inflation rate above 8%, the Japanese government and the Bank of Japan intervened in September for the first time since 1998 to buy the yen and sell the dollar. Speculations have emerged that Japan will actually have to start selling US Treasuries to further support the yen purchase.

This situation is not unique in Japan. Authorities around the world have spent the past few months reducing foreign reserves to protect their currencies. According to data from the International Monetary Fund, emerging market central banks have reduced their foreign exchange reserves by $ 300 billion this year.

As a result, limited demand is expected at best from less price sensitive investor groups who have traditionally invested around 60% or more of their dollar reserves.

Peter Bookver, chief investment officer of Bleakley Financial Group, said Wednesday that he believes Treasury buyers “will eventually be found” to replace the Federal Reserve, foreign powers and banks, indicated it was dangerous.

news-rsf-original-reference paywall">Original title:The most powerful buyers of Treasuries are pulling out all at once(extract)