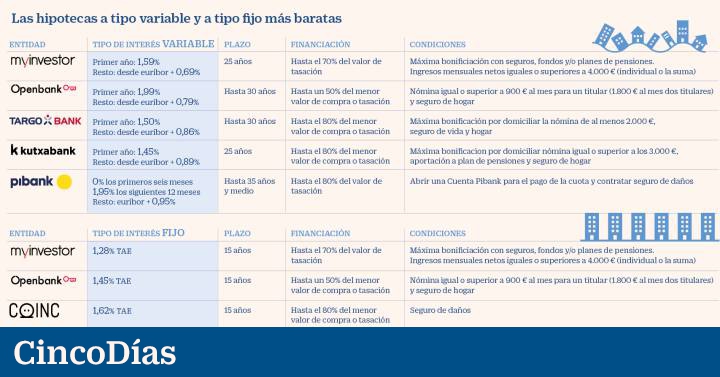

Banks continue to battle for fixed rate mortgages, with which they obtain greater income while the Euribor continues by the floors. Several offers have improved shortly after the start of the new year, a move that will continue in the coming weeks. In contrast, variable mortgages are already undergoing upward adjustments.

Open sofa It opened the ban in January with a reduction in the fixed interest subsidized in its shortest term, up to 15 years. Thus, its best price goes from 1.65% APR to 1.45% APR, if a maximum of 50% of the value of the home is financed. Up to 70%, the rate stands at 1.6% APR and up to 80%, at 1.70% APR. He followed Bankinter with a rate cut of 10 basis points in the shortest terms, up to 2.07% APR at 10 years, 2.02% APR at 15 years and 2.04% APR at 20 years. At 25 and 30 years, the reduction was 15 basis points, to 2.06% APR and 2.13% APR, respectively. As well Santander Bank you have just made your fixed mortgage cheaper in all sections. At 15 years and financing up to 60% of the appraisal value, the APR remains at 1.81%.

They are the forefront of what is expected to do much of the banking sector, given the strong competition to attract mortgage clients in the field of fixed rates, which already represent almost half of the new loans signed in Spain. MyInvestor points out that its intention is “to always have the best mortgages on the market”, which suggests that it could also move in this direction. “There is always movement in the mortgage board at the beginning of the year,” he says Juan Villén, head of mortgages at Idealista, who explains that “a domino effect usually occurs and some entities move token and others adjust their prices so as not to be left out.”

But, while banks are launching increasingly aggressive offers on stable rates, cuts in variables they seem to have stalled. And they even begin to see rises to give a push to the margins before the lows of the Euribor, below -0.5%. Banco Santander has raised the price of its Discounted Variable Mortgage up to 2.09% in the first year and Euribor plus a differential of 1.09% from the second year for amounts of up to 60% at 25 years. Until now it was 1.59% the first year and from now on Euribor plus 0.79%. “With the fall of the Euribor, the prices of the variables are unsustainable,” say bank sources. “I do not see much downward path in the variables,” says Villén, who claims that “the big banks stand out from the market trend to try to protect profitability.”

Almost half of the new mortgages established in Spain are signed at a fixed rate

Experts advise not to keep the photo advertised by entities, since it is possible to achieve better proposals by negotiating, especially in traditional banks. HelpMyCash argues that while the advantages of online banking are the “very competitive offers and the agility of the application process”, its “Achilles heel” is the lower negotiating capacity. “Lifelong finance companies, on the other hand, are more willing to agree to some type of improvement if the applicant has obtained more attractive offers from other banks or if they have a good profile,” they highlight.

Pablo Manzano, from DBRS, believes that the mortgage market in 2020 “has behaved very solidly” despite the crisis. It affirms that despite the good evolution in terms of production and prices, the loan approval criteria have tightened, “due to the worst economic expectations, the perceived solvency of the borrower or the lower risk tolerance of the banks, which require better credit profile and lower financing amounts ”.

– .