The Stock of credit to families exceeded US $ 6,700 million, according to the latest information from the Central Bank (BCU) available as of September of this year. “In real terms, the last data indicates a relevant acceleration, especially in consumer credit, “highlights the report on Economic Outlook and Monitoring of the Credit Market for Families that Itaú Bank released this Thursday. In the mortgage business, the BHU is losing ground and private companies are gaining space.

Meanwhile, in the case of automotive segment –in line with the strong dynamism shown by the sale of 0 km in 2021 – there was a Stock of US $ 233 million as of September, in this case with a 3% year-on-year increase. Finally, in the case of consumer credit (loans and cards) the stock reached US $ 3,902 million, also with an expansion of 3% in the same comparison. In this case, there was an increase of more than 8.8% year-on-year in private banks, 3% in the BROU, but a retraction of 0.5% in credit administrators.

Itau.

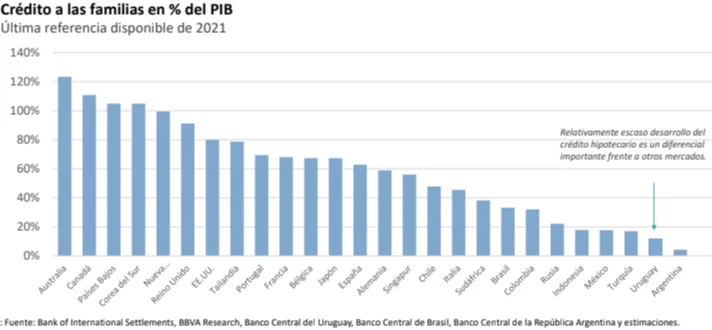

Despite the growth that loans to families have had, penetration with respect to the size of the economy still looks very low in the international comparison, the survey warns. Uruguay and Argentina are the countries with the lowest percentage of credit to families (below 20%) in the region and it is far from the percentages shown by other emerging countries and also from developed economies.

–

–

Itau.

Private banks most active in mortgages

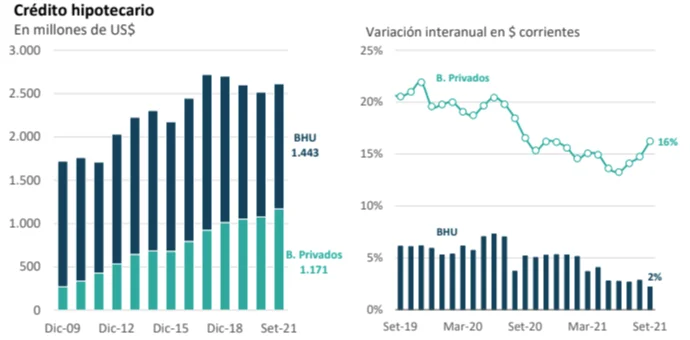

In the case of mortgage credit, as of September it had a stock of loans for US $ 2,614 million, with an increase in real terms of 2% compared to the same month last year. The private banks have accelerated in recent months and maintain significant growth in real terms, while the BHU had a further moderation in September and grew 2% nominal year-on-year (which represents a persistent decline in real terms). As of September, the state bank had a loan stock of US $ 1,443 million (55% of the total), while the sum of private banks totaled US $ 1,171 million (45%).

–

–

Itau.

“In recent months, the improvement in the health situation in Uruguay has brought about a noticeable increase in mobility and a consolidation of a more favorable context of expectations,” says the Itaú report, which highlights the improvement in the Confidence Index of Consumers, increased mobility, an improvement in labor market indicators and foreign trade operations (exports and imports).

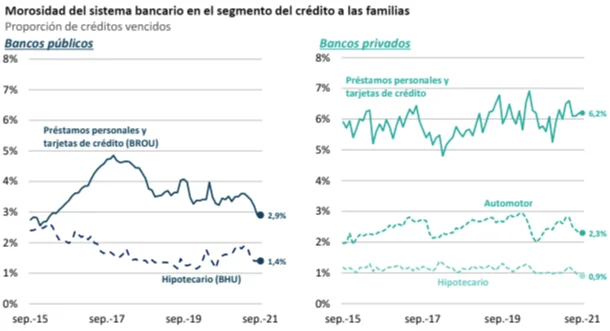

On the other hand, in terms of arrears, the proportion of overdue loans presented decreases in recent months both in the BROU and in private banks in financing families. In private banks, delinquencies in the mortgage sector were barely 0.9%, 2.3% in the case of the automotive segment and 6.2% for personal loans and credit cards.

–

–