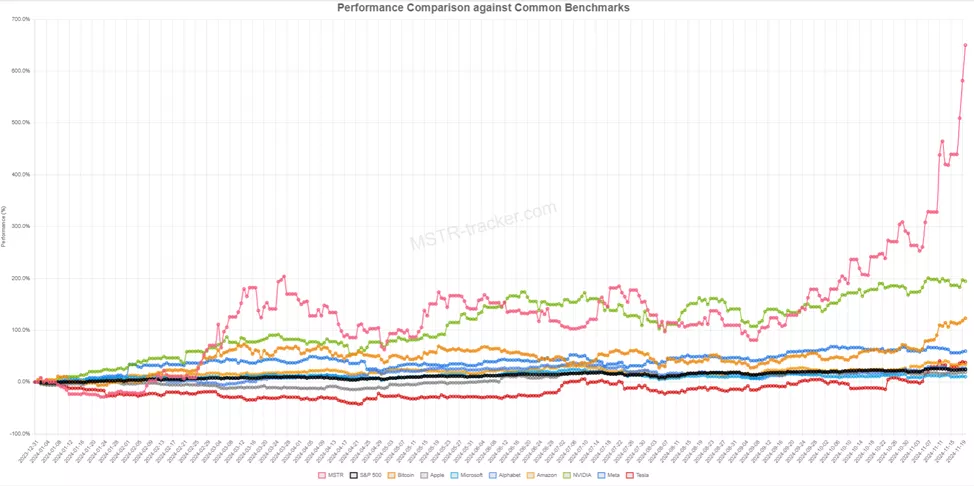

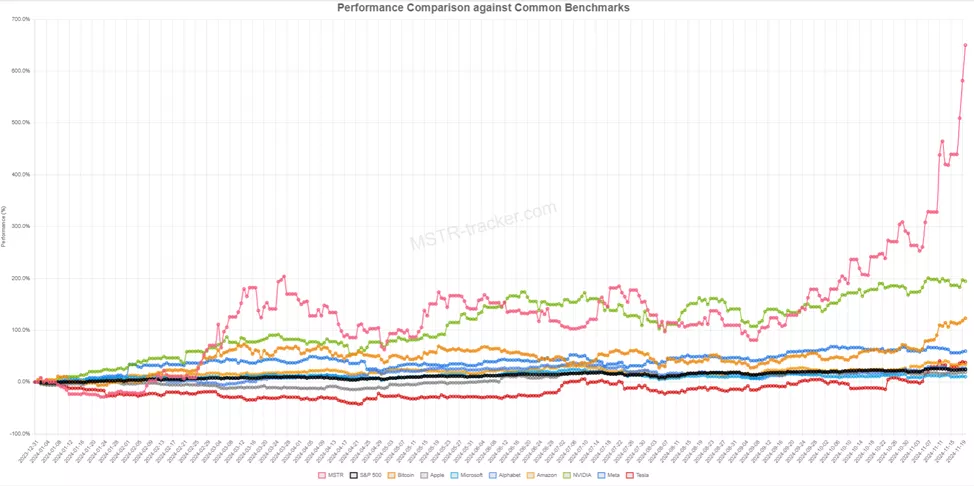

Since the beginning of the year, MicroStrategy shares have increased in price by 650.2%, and digital gold – changed to date -123.1%. This data is provided by MSTR Tracker.

Data: MSTR Tracker.

Data: MSTR Tracker.

The chart also shows MSTR’s gain over the S&P 500 (24.2%), Nvidia (194.6%) and others.Magic seven».

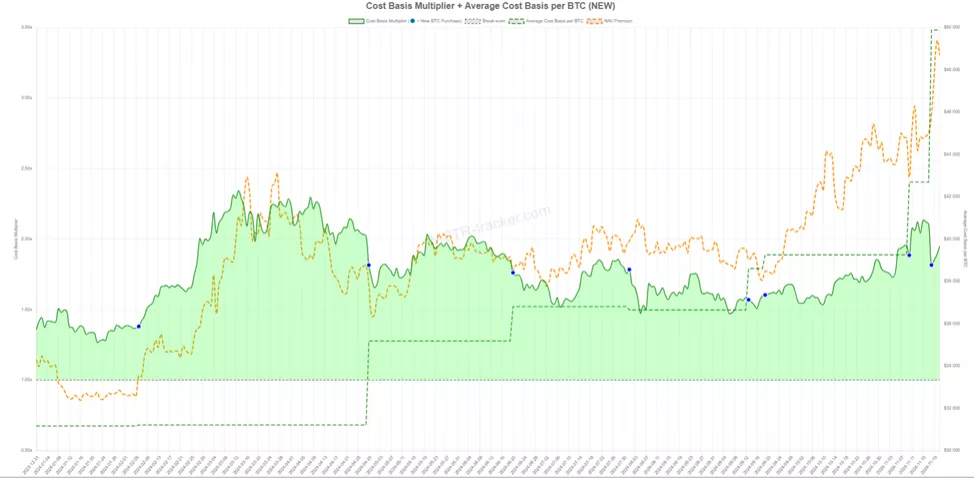

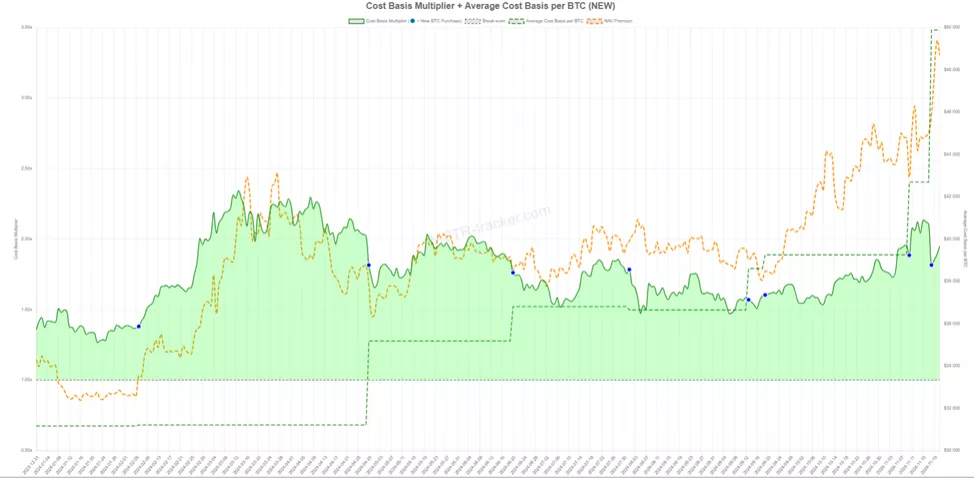

The company’s total market value was more than $96 billion, showing an increase NAV to assess those on the balance sheet 331 200 BTC to 3.3x against 1.15x at the beginning of the year.

The dynamics of the indicator shows the gap in capital growth compared to the increase in the price of digital gold over the same period.

Data: MSTR Tracker.

Data: MSTR Tracker.

November 20 in the background new records for the first cryptocurrency The company’s unreasonable profit from Bitcoin investments at the moment has exceeded $16 billion. The market value of the coins was twice the equilibrium price.

Earlier day MicroStrategy reported plans to issue $1.75 billion in five-year convertible notes to buy digital gold. Later the company increased the number of cases up to $2.6 billion.

Previously ForkLog reported about preparing a speech by MicroStrategy founder Michael Saylor on December 10 at Microsoft’s board of directors with a proposal to use the first cryptocurrency as a reserve fund for the treasury.

In October, MicroStrategy released the “Plan 21/21” aimed at it raising $42 billion over the next three years to buy digital gold.

Let’s remember that Saylor announced that he intended to change the company to a Bitcoin bank. with a capitalization of $1 trillion.

Find an error in the text? Select it and press CTRL + ENTER

ForkLog Newsletters: keep your finger on the pulse of the Bitcoin industry!

2024-11-21 16:48:00

#MicroStrategys #exchange #rate #exceeded #dynamics #Bitcoin

Here are two PAA related questions for the MicroStrategy Bitcoin Gamble article:

## The MicroStrategy Bitcoin Gamble: A Divided Opinion

**Introduction:**

Welcome to World Today News. Today, we’re diving deep into the fascinating world of MicroStrategy, the business intelligence firm that’s made headlines for its massive investment in Bitcoin. Joining us are two expert voices:

* **[Guest 1 Name]**, a financial analyst specializing in emerging markets and cryptocurrency trends.

* **[Guest 2 Name]**, an experienced investment strategist known for their cautious approach to highly volatile assets.

We’ll be exploring MicroStrategy’s remarkable stock price surge, the company’s ambitious Bitcoin-centric strategies, and the broader implications for both the company and the future of Bitcoin itself.

**Section 1: The Bitcoin Boom at MicroStrategy**

* **Host:** MicroStrategy’s stock has seen an incredible rise this year, significantly outperforming Bitcoin itself. [Guest 1], from your perspective, what are the main drivers behind this impressive performance?

* **[Guest 1 Response]**

* **Host:** [Guest 2], you’ve expressed a more cautious outlook on the cryptocurrency market. What factors are contributing to your skepticism regarding MicroStrategy’s heavy reliance on Bitcoin?

**Section 2: Delving into “Plan 21/21” and the Future**

* **Host:** MicroStrategy’s “Plan 21/21” is an ambitious roadmap aimed at acquiring a staggering $42 billion worth of Bitcoin over the next three years. [Guest 1], do you believe this plan is achievable, and if so, what are the potential implications for both MicroStrategy and the wider Bitcoin ecosystem?

* **[Guest 1 Response]**

* **Host:** [Guest 2], some argue that MicroStrategy is essentially betting the company on Bitcoin. In your view, what are the biggest risks associated with this strategy, and what could be the potential consequences if Bitcoin fails to deliver on its promised returns?

**Section 3: Examining the Broader Implications**

* **Host:** MicroStrategy founder Michael Saylor has publicly stated his belief that Bitcoin can become a global reserve asset. [Guest 1], do you think this vision is realistic, and what steps need to be taken for Bitcoin to gain wider adoption among institutional investors and central banks?

* **[Guest 1 Response]**

* **Host:** [Guest 2], on the other hand, you’ve pointed out the inherent volatility of cryptocurrencies and the regulatory uncertainties surrounding them. How do you see these factors playing out in the long-term viability of Bitcoin as a dominant financial asset?

**Conclusion:**

We’ve heard contrasting viewpoints on MicroStrategy’s bold Bitcoin strategy. Whether this gamble ultimately pays off remains to be seen. One thing is clear – MicroStrategy’s actions are shaping the narrative around Bitcoin, and the world is watching closely to see how this story unfolds.

**Final Remarks:**

We encourage our viewers to weigh the arguments presented today and form their own opinions. The cryptocurrency landscape is constantly evolving, and staying informed is crucial in navigating this exciting and often unpredictable world.

Remember, this interview structure is designed as a starting point. It can be further tailored according to the specific expertise and perspectives of the chosen guests.

:format(jpeg):quality(90)/https%3A%2F%2Fimg.4gamers.com.tw%2Fpuku-clone-version%2F174802fd40ea3a3802f71633b3bac541a698327f.jpg)