The US stock market fell sharply on the 7th. The US employment report showed a strong job market and the Fed’s aggressive interest rate hikes are likely to continue. The 10-year US Treasury yield recorded its longest consecutive weekly rise since 1984. The dollar / yen exchange rate is in the low 145 yen range.

|

The S&P 500 fell 2.8% to 3639.66. Almost 95% of the constituent shares fell. The Dow Jones Industrial Average fell $ 630.15, or 2.1%, to $ 29,296.79. The Nasdaq Composite Index fell 3.8% and the Nasdaq 100 Index fell nearly 4%.

David Donabedian, chief investment officer of CIBC Private Wealth Management, said the jobs data put an “exclamation mark” on the idea that the market shutdown process would be prolonged. EToro’s Carrie Cox said that in a “strangely inverted world” of steep rate hikes, the strong statistic could be seen as one reason to prepare for the turmoil. Brown Brothers’ Wing Singh said a 75 basis point rate hike in November was a “definitive thing” and a 75 basis point hike in December was becoming more likely.

US Treasuries plummet across the board as yields hit record highs of the weekreached up. At 4:15 pm New York time, the 10-year yield increased 6 basis points to 3.88%. It increased for 10 consecutive weeks on a weekly basis. Swap markets priced in a rate hike of nearly 75 basis points at the Federal Open Market Committee (FOMC) meeting in November. The top level of the benchmark interest rate indicated by the money market has also risen.

New York Fed Chairman Williams said the policy rate will eventually have to rise to around 4.5%. But the pace of the rise and peak in this tightening cycle will depend on future economic conditions, he said. Other Fed officials have also taken on a bold hawkish tone in recent days.

New York Fed Governor Says Key Rate Will Increase To Nearly 4.5% To Curb Inflation

Investors’ attention will shift to US inflation data and the minutes of the FOMC meeting (September 20-21) which will be released early next week.

In the foreign exchange market, the Bloomberg Dollar Spot Index, which shows the movement of the dollar against the 10 major currencies, rose 0.4%. The view that aggressive monetary policy will continue in response to US employment data has strengthened. The Canadian dollar also outperformed other currencies thanks to better-than-expected Canadian employment data and rising oil prices.

Deutsche Bank’s Alan Ruskin said in a note after the employment report that there was little to stop the Fed from reacting aggressively to a large overrun in inflation. “The employment report gives the authorities (hawkish) freedom. As long as the economy is strong, there is absolutely no incentive to change policy,” he said.

The dollar continues to rise slightly against the yen. At one point, the price was 145.44 yen. At 4:15 pm New York time, the dollar / yen rose 0.2% to 145.37 yen per dollar. The euro fell 0.5% against the dollar to $ 0.9738 per euro.

Dollar / yen spot market (white line) and closing price on September 22 (orange dashed line)

Source: Bloomberg

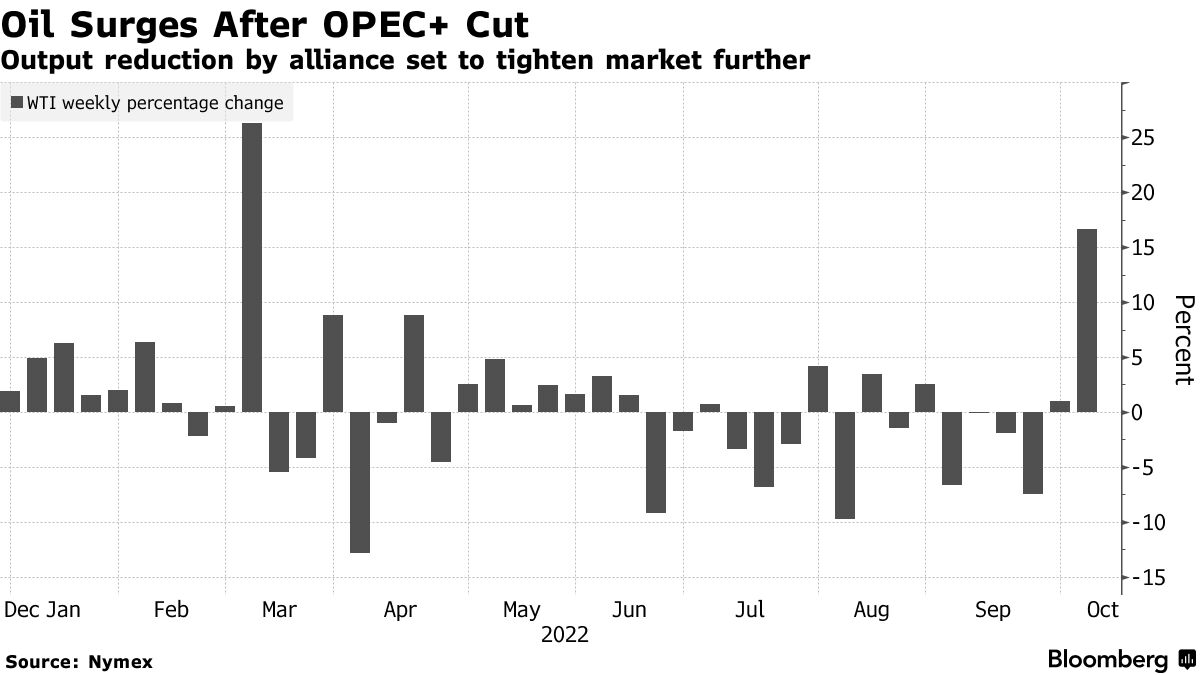

New York crude oil futures rose for the fifth consecutive day. On a weekly basis, it has been the highest since the beginning of March. Despite growing macroeconomic uncertainties, the supply outlook was deteriorating further.

Time differentials, the price differentials between the months of futures, were tight even before OPEC +, a group of OPEC and major non-member oil producers, announced major production cuts this week.

Analysts at fuel wholesaler TAC Energy said, “Supply concerns appear to be the main driver of market movements this week, with demand concerns fading into the background, although demand concerns remain central to the market. equity. No, “he said in a report to clients.

The West Texas Intermediate (WTI) futures contract on the New York Mercantile Exchange (NYMEX) for November closed at $ 92.64 a barrel, up $ 4.19 (4.7%) from the previous day. It has risen by over 16% for the week. London ICE’s December delivery of North Sea Brent increased by $ 3.50 / barrel over the day to $ 97.92 / barrel.

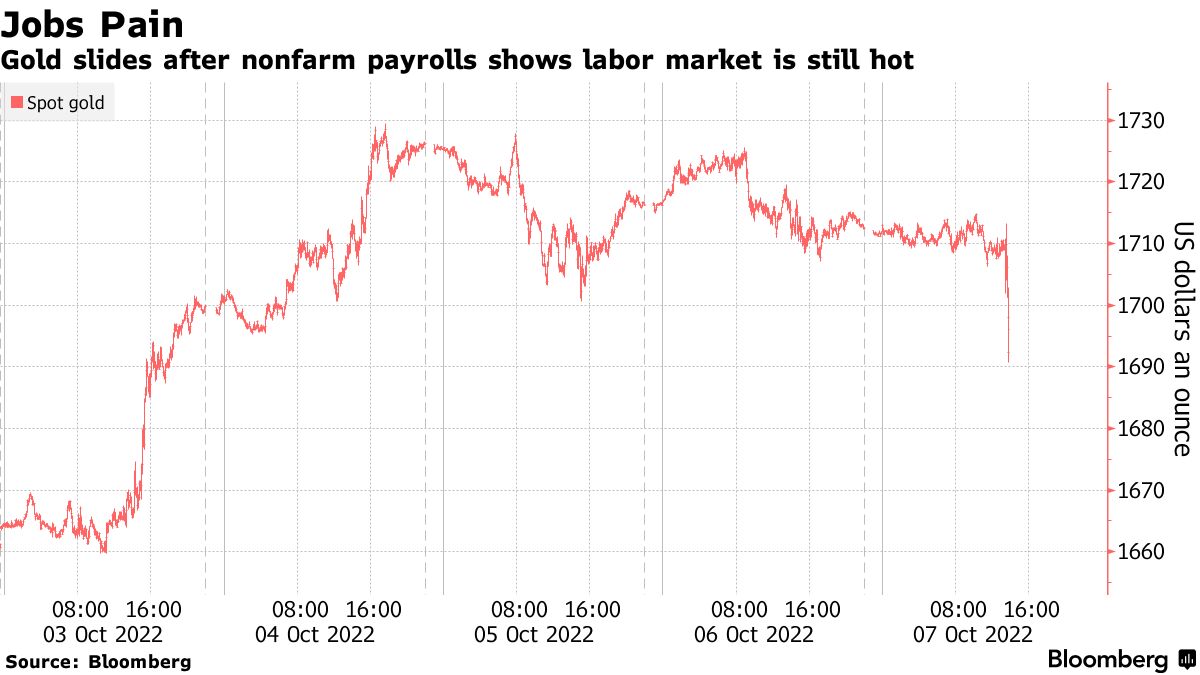

New York gold prices have fallen. Spot prices fell below $ 1,700 an ounce. The sales were fueled by a still tense job market in the US employment report which suggested the Fed would keep its hawkish political trajectory.

“The possibility of an aggressive Fed tightening remains likely given the solid US employment data,” said Ed Moya, senior market analyst at Oanda, who weighs in on gold. “The US economy is not deteriorating as fast as some traders expected, and if there are no slowdown surprises in next week’s inflation data, the Fed’s policy reversal seems distant.”

Spot prices fell 1% to $ 1,696.08 an ounce at 3:04 pm New York time. December gold futures on the New York Mercantile Exchange (COMEX) fell 0.7% to close at $ 1,709.30.

Original title:Stock traders hit the sell button on Fed Hawkish: Markets Wrap bets(extract)

Dollar gain after jobs data; Loonie Best in Show: Inside G-10 (抜 粋)

Oil records its biggest weekly gain since March due to supply concerns(extract)

Gold plummets after US employment data keeps the Fed on a hawkish trail(extract)

![[Mercato USA]Shares sold, aggressive Fed likely to continue – dollar low at 145 yen – Bloomberg [Mercato USA]Shares sold, aggressive Fed likely to continue – dollar low at 145 yen – Bloomberg](https://assets.bwbx.io/images/users/iqjWHBFdfxIU/imuq9FDhG7vo/v2/-1x-1.png)