The environmental impact assessment has just started on the Rajapalot project, which is an important step towards the production decision. Australia is also doing well and the stock is undervalued.

Mawson Gold Limited is a Canada listed gold exploration company with high quality gold assets in the mining friendly Tier 1 jurisdictions of Finland and Australia. It has established itself as a leading Nordic / Arctic exploration company with a primary focus on the flagship Rajapalot gold project in Finland. In addition to a secured gold resource, this property also has an economic cobalt deposit, which will not only wash money into the company’s cash register, but in particular can facilitate the future approval process, as the government in Finland has extremely high levels of cobalt deposits as part of the expansion of the Electromobility is interested. On February 23, Mawson announced the start of two key planning processes, Environmental Impact Assessment (EIA) and Land Use Planning, for the 100% owned Rajapalot project in Finland. The purpose of the EIA process is to obtain information about the environmental impact of a project, to facilitate the consideration of environmental concerns in planning and decision-making processes and to give the public and other interest groups the opportunity to participate in and influence these processes. The initiation of EIA and land-use planning is evidence of the long-term, strong support from local stakeholders for one of Finland’s most strategically important gold-cobalt projects. As the project moves from exploration to advanced studies, Mawson will continue to work in the same transparent and open manner to gain social acceptance from the local community to make this strategic gold-cobalt project risk-free for the future benefit of all involved becomes.

The 100% owned Rompas-Rajapalot exploration project is Mawson’s flagship property in Finnish Lapland and is located a few kilometers south of the Arctic Circle. Both high grade gold and cobalt were discovered within an area of over 10 square kilometers. The currently proven Inferred Mineral Resource has been estimated at 9.0 million tonnes grading 2.1 g / t gold and 570 ppm cobalt, which is 2.5 g / t gold equivalent for 600,000 ounces of gold or 716,000 ounces of gold equivalent.

Following the completion of the 2020 winter drill program, a total of 63,424 meters were drilled at Rajapalot with an average depth of 136 meters. The average drilling depth in the 2019-2020 winter season was 390 meters. The growth potential remains strong in the future as the updated resource areas remain open to the side and downward slope. There are currently four diamond drills on site to complete the resource expansion drill program in 2021. A total of 20,000 meters of diamond drilling is planned, which should be completed by mid-April 2021. The program aims to significantly expand the currently Inferred Resource of 716,000 ounces gold equivalent. This will be accomplished by filling and expanding high grade zones within the current resource areas and testing and drilling multiple potential shallow resource areas where shallow exploratory drilling has identified high grade mineralization.

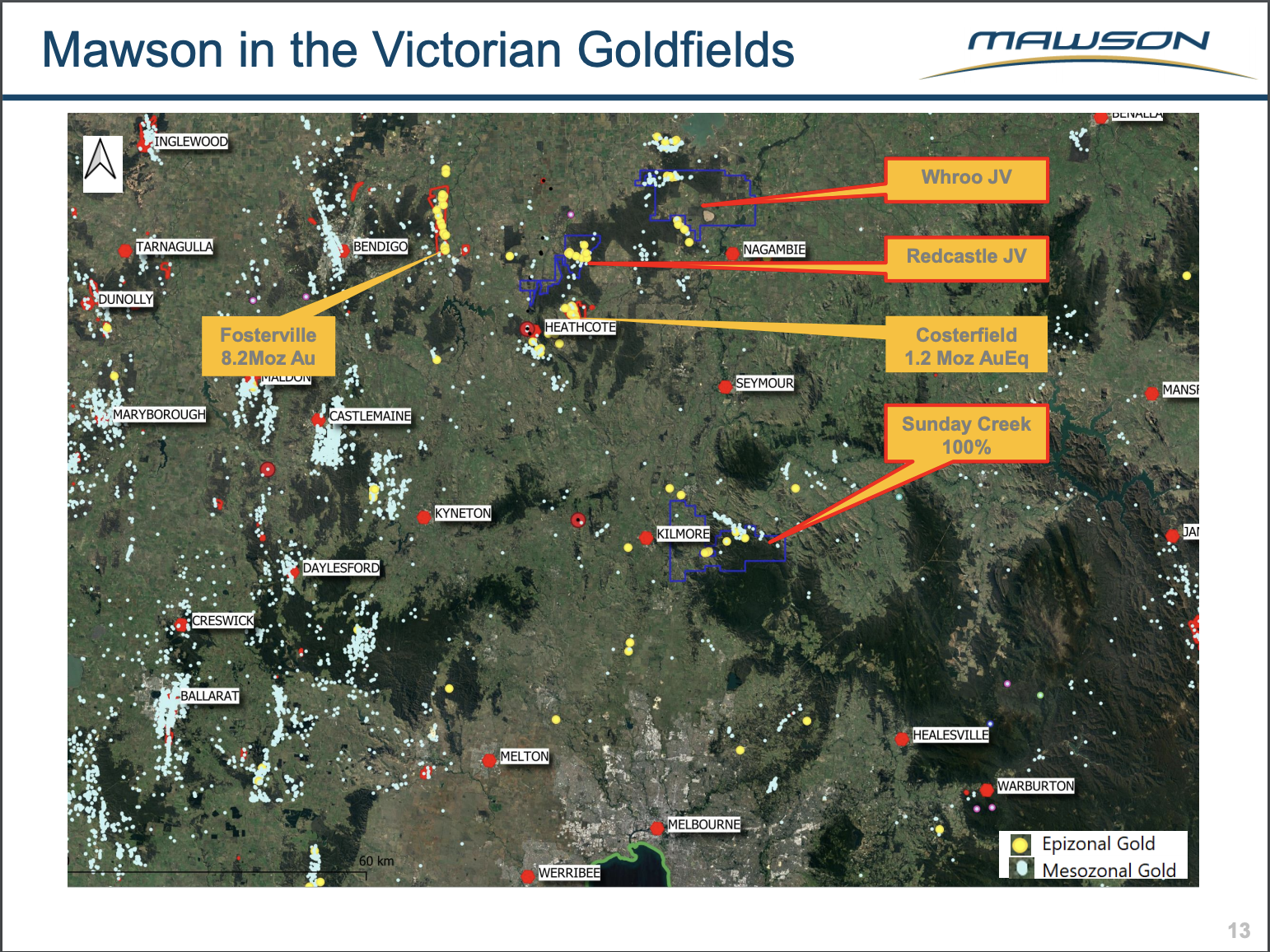

Mawson also owns three high grade, historic, epizonal gold fields covering 470 square kilometers in Victoria, Australia. At the end of January 2020, an extensive agreement was announced with the large landowner Nagambie Resources Limited (NAG: ASX). This includes, among other things, the exclusive right of first refusal on the largest, contiguous land package in the Australian state of Victoria and thus in what is probably the most famous gold belt in the world. Initial Company-owned drilling has been completed on the 100% Company-owned Sunday Creek Project. For example, recent assay results intersected 7.0 meters of 6.0 g / t gold over 72.4 meters, including 2.0 meters of 18.5 g / t gold over 73.9 meters and 3.4 meters of 9.7 g / t gold over 97.9 meters. Mawson has now completed twelve holes with one ongoing and one abandoned hole totaling 1,955.4 meters on the Sunday Creek Gold Project. Results from 10 of the 12 holes completed have already been released and drilling is continuing. Mawson has now drilled strong gold results from three individual stratified vein structures at Sunday Creek: Apollo, Central and now Gladys. All areas remain open at depth and significant strike potential over 500 meters between and below the historic mines is untested. There is also the opportunity to test the 11-kilometer historical mining trend in more detail. We are more likely to see the stock at $ 0.80-1 for the next 12-18 months. Mawson is also included in the SRC Mining Special Situations Certificate.

This is not investment advice or a solicitation to buy or sell stocks. Everyone has to know for themselves what kind of risk they can take and trust themselves. Everyone is responsible for themselves.

Attention conflict of interest: I own the shares discussed in the article or are they included in the SRC Mining Special Situations certificate.

Good luck and warm greetings from Switzerland.

Yours Jochen Staiger

CEO Swiss Resource Capital AG

NEU! SRC Mining Special Situations Zertifikat: http://www.wikifolio.com/de/ch/w/wf0srcplus

The SRC AG disclaimer applies: https://www.resource-capital.ch/de/disclaimer-agb/

All SRC special reports for download: https://www.resource-capital.ch/de/reports/

Use our free newsletter in German:?: http://eepurl.com/08pAn

Are you subscribing to our YouTube channel?: https://www.youtube.com/user/ResourceCapitalAG’sub_confirmation=1

Values included: XD0002747026, CA5777891006

– .