The survey showed that companies spent an average of a quarter of their reserves this year. Better are larger companies, which are more resilient so far and have used only about a tenth of the reserves on average.

–

“We are currently drawing on reserves. If we didn’t have them, we wouldn’t survive, “says Olga Gřundělová, the owner of Kremo, which produces old-town butter tubes and operates a confectionery in the village of Branná in the Šumperk region.

–

Many companies also reached reserves to purchase protective equipment. “Partly in the spring months, yes, because we bought veils for our portfolio,” confirms Marie Logrová, a spokeswoman for Adler Czech textile factory in Ústí nad Labem.

–

In many companies, especially those directly affected by measures against the spread of coronavirus, free resources are now running low. “It is a gratifying finding for us that more than seventy percent of companies were thinking about the back door during the boom and raising funds for the crisis we are currently experiencing due to the pandemic. However, it is clear that this cushion is shrinking significantly with each wave of anti-pandemic restrictions, ”points out Petr Manda, Executive Director of ČSOB’s Corporate Banking Department.

–

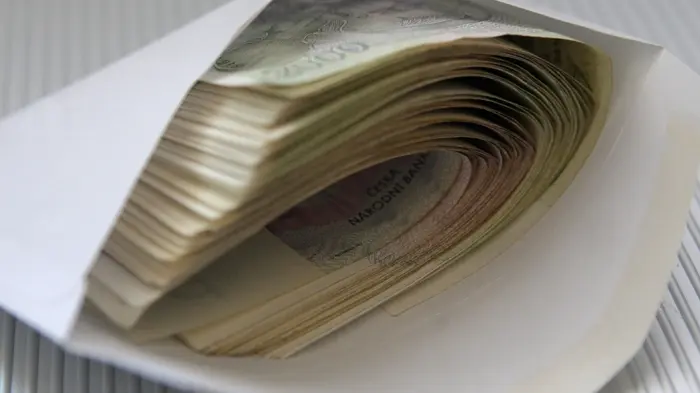

A total of 58 percent of company representatives in the survey said that they did not have to proceed with emergency financing of their company yet. If they already had to get some money into the company, then it was most often in the form of drawing reserves. Due to the effects of the coronavirus crisis, only six percent of companies have taken out a commercial loan so far. Fifteen percent of companies used another method of financing – this applies especially to small and medium-sized companies.

–

Some companies have applied for a state-guaranteed loan under the Covid programs. However, as the ČSOB survey showed, it is still more of a percentage unit. In the case of the Covid III program, in which sole proprietors and companies with up to 500 employees can still apply for loans, banks approved applications for CZK 16.5 billion by mid-November, according to CNB data. Entrepreneurs from the program have so far received loans worth CZK 14.1 billion.

–

“Covid’s warranty programs are still available. They are suitable for both small and larger companies and we recommend using them to create the necessary reserves. If the companies do not subsequently draw the relevant loan, the guarantee can be returned, “says Manda. He adds that at ČSOB the total approved volume of financing through the Covid II, Prague, III and Plus programs amounted to CZK 7.4 billion at the end of October.

–

There will be no place for rewards this year

The coronation crisis and dwindling financial reserves will also limit the payment of 13th salaries and special bonuses this year. There will be significantly fewer employers’ money for them than in previous years, according to analyzes by the Czech Chamber of Commerce.

–

Even before the autumn wave of coronavirus, a third of companies planned to pay bonuses, with a record 60 percent of private sector employees receiving last year.

—