Posted on Jan 14, 2021 at 8:02 am

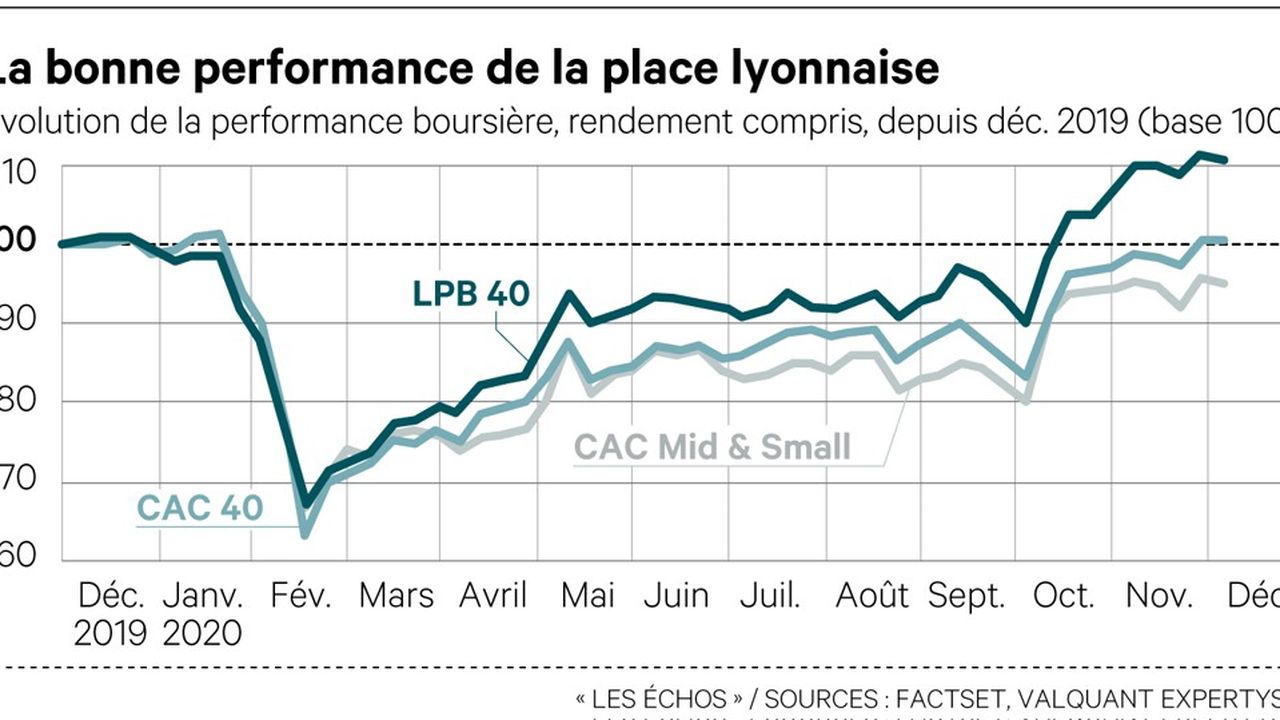

In a year 2020 which saw the stock market plunge in March and recover since, the LPB 40 index, which brings together 38 listed companies from the Auvergne-Rhône-Alpes region and 2 from Bourgogne-Franche-Comté, “achieved a performance very favorable ”according to Lyon Pôle Bourse: + 11.1%, when the national CAC Mid & Small index took only 0.3%, and the CAC 40 fell by 5%.

The LPB 40, created in 2015, aims to be representative of the economic fabric, with emblematic leaders from strong regional sectors. There are Casino, Seb, Boiron, Michelin, Visiativ, Esker, LDLC, Olympique Lyonnais and even technological start-ups, with the concern of geographical distribution. Some companies born here have since moved their head office to Paris (Plastic Omnium), or moved to other horizons following a merger, but “they all have a strong regional anchoring”, explains Martine Collonge, Managing Director of Lyon Pôle Bourse . The association promotes the financing and transmission of regional SMEs and midcaps through the Stock Exchange (29 introductions in seven years).

25% of introductions

The positive results of the LPB 40 index in 2020 are no exception: since its creation, it has risen by 101.4%, against 70% for the CAC Mid & Small and 67% for the CAC 40. The positive comparison should not forget a decline in its performance compared to previous years, on average 25% (except in 2018, -26%).

There are 109 regional companies on Euronext or Euronext Growth, representing 18% of listed companies, and 15 listed on Euronext Access. Stock market culture is historic around Lyon, which had provided a quarter of the secondary market when the regional stock exchanges merged with Paris in 1991. Even today, with 25% on average of new introductions made each year, this percentage is higher than economic weight of the area.

969 million euros in shares

In 2020, fourteen regional companies saw their share price rise by more than 100%. In the top five: McPhy Energy (+ 824%), Theranexus (+ 513%), Amoeba (494%), Gaussin (445%) and Carbios (317%). Martine Collonge notes “the good recovery of biotechs” in this leading pack, and “that none belongs to the index”, which they would inevitably have pulled up. But 14 companies also show more than 30% decrease, including five more than 50%: Boostheat, Spineway, MND, GL Events and AKKA Technologies.

These companies collectively raised € 969 million on the equity market last year (including a third for Cap Gemini).

–