LG Energy Solutions and General Motors (GM) establish a second electric vehicle battery joint venture in the United States. It is planning to preoccupy the US market through a’battery alliance’ with GM, the largest automaker in the US, which announced its plan to transform into an electric car company.

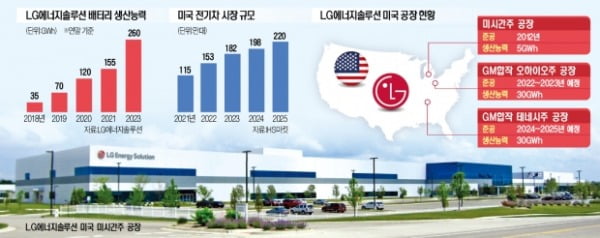

According to foreign media and industry sources such as the Wall Street Journal (WSJ) on the 5th, LG Energy Solutions is promoting the establishment of battery factories in GM and Tennessee. As for the site, the vicinity of the GM plant in Springhill, Tennessee is being considered promising. The investment scale and production volume are similar to those of the current Ohio plant, the industry predicted. The two companies are building a plant with an annual production capacity of 30GWh in Rosetown, Ohio, with an investment of $2.3 billion through the 5-to-5 joint venture UltiumSells. Prior to the completion of the Ohio plant, it started to establish a second plant of similar size.

–

–

An LG official said, “We are considering the establishment of additional battery factories in the US with GM, but we have not confirmed specific details such as the size and location of the investment.” The two companies are planning to finalize their investment plans in the first half of this year. GM is planning to phase out the production of internal combustion engine cars by 2035 and turn it into an electric car company. As a stable supply of batteries is essential for mass production of electric vehicles, we are strengthening cooperation with LG Energy Solutions, a partner in the battery business.

LG Energy Solutions is also planning to secure the largest battery production capacity in the US using GM as a foothold. The 5GWh Michigan plant completed in 2012, the 30GWh Ohio plant scheduled to be completed at the end of next year, and the Tennessee plant will secure a production capacity of about 65GWh, surpassing Japan’s Panasonic to have the largest electric vehicle battery production capacity in the United States.

On this day, LG Energy Solutions released a final statement of opinion on the US International Trade Commission’s (ITC) infringement of SK Innovation’s battery trade secrets, putting pressure on competitors.

LG Energy Solution, invested more than 2 billion yen… Factory promotion in Tennessee, U.S.

US electric vehicles doubled within 5 years… Preemptive investment in preparation for supply shortage

LG Energy Solution’s decision to establish an additional electric vehicle battery joint plant with General Motors (GM) is a foundation for preoccupying the US electric vehicle battery market, where’shortage of supply’ is expected. The US electric car market is growing rapidly thanks to President Joe Biden’s policy support, but the battery supply has not been able to keep up with it, and shortage is inevitable within a few years. It is analyzed that LG will fully enjoy the’fruit of growth’ as competitors such as China’s CATL, which are the largest competitors, are tied up.

US finished car makers looking only at LG

According to the battery industry and foreign press on the 5th, LG Energy Solutions and GM are discussing a plan to establish an electric vehicle battery cell plant in Tennessee, USA. The two companies will jointly announce the specific factory location and investment scale in the first half of the year. The two companies are investing $2.3 billion (about 2.6 trillion won) in Rosetown, Ohio, to build a total electric vehicle battery plant of 30 GWh (gigawatt hours). The size of the Tennessee plant is expected to be similar to or larger than the Ohio plant.

LG Energy Solutions has been operating a 5GWh battery plant in Michigan since 2012 and supplying it to GM Ford Chrysler. When all the factories are completed as planned, LG’s battery production capacity in the US is expected to reach 65GWh. This is a scale that can supply batteries for about 970,000 electric vehicles.

LG’s strategy is to gain a clear advantage in the US electric vehicle market, which is expected to grow rapidly through this investment. CATL, the largest contender in the world market, is unable to make an investment plan after only opening an office in the United States. This is because the way to advance was virtually blocked due to the trade dispute between the United States and China. The US was also left out of the large-scale investment plan recently announced by CATL.

AESC, which was a Japanese company and then sold to China, has a factory in the country, but it is at the level of supplying small quantities (3GWh) to Nissan. In addition, Panasonic only supplies batteries to Tesla, so US automakers have no choice but to look at LG.

Although SK Innovation is building a battery 1 and 2 plant with a scale of 20 GWh in Georgia, it lost a lawsuit against LG in infringing battery trade secrets, causing a’braking’. If President Biden does not veto the decision of the International Trade Commission (ITC) that LG has given, SK will be unable to produce batteries in the United States for the next 10 years. An industry official said, “Even if US automakers rush to produce their own batteries, it will take at least 5 to 7 years.” In the future, Ford and Chrysler, in addition to GM, will have inquiries about establishing joint factories with LG.

Strategy revised to LG’pre-investment’

According to market researcher IHS Markit, the US electric vehicle market is expected to grow from 1.15 million units this year to 2.2 million units by 2025. Considering that it can supply power to 15,000 electric vehicles per GWh of battery, about 146 GWh should be secured by 2025, but IHS analyzed that the production capacity in the US will be only 115 GWh.

President Biden’s executive order last month to review the supply chain for 100 days by designating batteries as four key items along with semiconductors, rare earths, and pharmaceuticals is analyzed as a measure with this shortage situation in mind. “We will work with trusted nations and partners to build a strong supply chain of key items,” said Catherine Thailand, a nominee for US Trade Representative (USTR). It made it clear that it would exclude China and work with companies from friendly countries such as Korea, Japan, and Taiwan.

LG is creating conditions to solidify its position as the world’s number one company by preoccupying the European and American markets. It is analyzed that CATL is virtually monopolizing its domestic market thanks to subsidies from the Chinese government, but it can be exceeded sufficiently if it dominates the European and US markets. LG’s market share in Europe reaches 70%.

Although the provision of several trillion won of investment funding was pointed out as the’Achilles heel’, it is analyzed that this year, through IPO, etc., it will be possible to prepare enough real shots. By establishing a joint venture with automakers, LG’s investment burden will be reduced by about half.

Reporter Mansu Choi/Jaekwang Ahn [email protected]

–