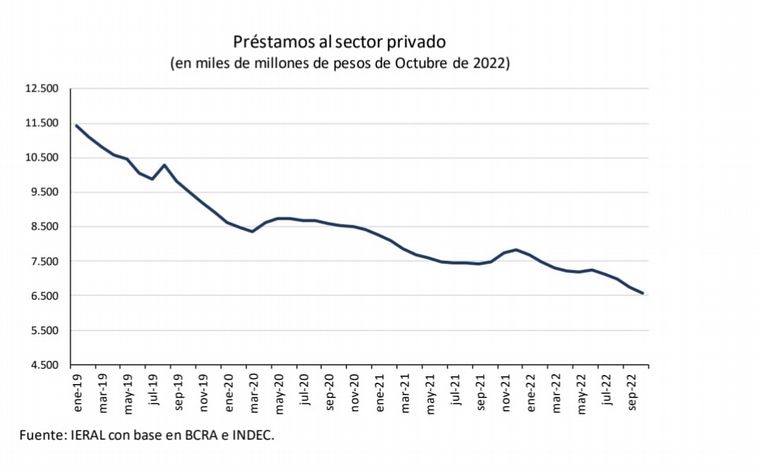

Loans to businesses and households it fell 40% in four years

The state has ramped up the power of its financial vacuum cleaner to ease its deficit but that policy pays for private stagnation.

We need cuts in tariff concessions, transfers to the provinces or public works hold out until the elections. And despite the inflationary tax – which liquefies payments and, for now, improves revenue – the Argentine state has not managed to reduce the deficit.

Since collecting more taxes is becoming more difficult or less efficient (moratoria happen more frequently because nobody pays), then there is only one avenue left: issue money, but in order for everything not to be flooded with pesos, they must be sterilized through Leliq.

/Start embed code/

/End embed code/

To whom do we sell that debt; which is increasingly linked to inflation or the dollar?

Primarily to the banks, who will buy Treasury or Central Bank bonds and make huge deals just on the handrail of their customers’ deposits and the interest to be paid by the state. To address your deficit.

This directly affects private investment, economist Jorge Vasconcelos said in his weekly report released on Friday.

“This policy has the dual effect of a monetary expansion outside the limits of direct assistance to the Treasury from the Central Bank and, on the other hand, of a sustained increase in the Entity’s Remunerated Debt (the Leliq), due to the task powered by avoid excess liquidity arising from such operations”.

/Start embed code/

/End embed code/

“This isn’t free,” remarked one of Ieral e’s historical researchers warns against the age-old trend of credit contraction to businesses and households

The data, alarm: in the last four years, the decline in credit to the private sector exceeds 40% at constant weights.

This occurs when buying durables becomes more difficult with current income: To buy a km 0 today you need 43 salaries. In December 2019 there were 20.

This is an example of how “the contraction of the private sector versus state gigantism It ends up working like a boomerang.” says Vasconcelos. Which gives two other examples: the income asymmetries and the deterioration of Argentine exports both in terms of the world market and in relation to imports from neighboring countries.

The financial aspirator of the state is aspiring to its maximum power. And when that happens, part of the economy is sure to be out of breath.

/Start embed code/

look too

Political corner Economy

/End embed code/