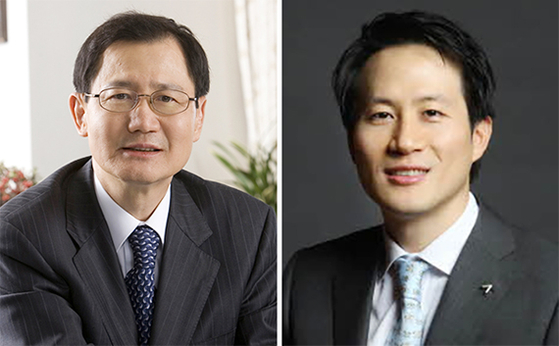

Park Chan-gu (左), Park Cheol-wan (右)

– It looks like Kumho Petrochemical is getting caught up in a whirlwind of management disputes. According to the electronic disclosure of the Financial Supervisory Service, Kumho Petrochemical, Managing Director Park Chul-wan, said through the disclosure, “We will resolve the joint ownership and special relationship with the existing representative reporter.” The representative reporter means Park Chan-gu, chairman of Kumho Petrochemical.

Chairman Park Chan-gu, nephew Park Chul-wan, Managing Director

Disclosure of “Dissolution of joint ownership and special relationship”

May confront Chairman Park at the general meeting in March

– On the 28th, managing director Park did not announce any other position regarding the announcement. However, Kumho Petrochemical criticized Park’s disclosure and shareholder proposal as being unsense in its position statement. Park is the son of the late Kumho Group Chairman Park Jung-gu and the nephew of Park Chan-gu, the largest individual shareholder with a 10% stake in Kumho Petrochemical. The business community is interpreting that the announcement on the 27th by Managing Director Park is the prelude to the dispute over management rights. This interpretation is weighing even more as it is confirmed that Park has appointed a law firm to respond.

Kumho Petrochemical unveiled the shareholder’s proposal suggested by Park in the statement issued that day. Kumho Petrochemical said, “As of the end of December 2020, we received recommendations from outside directors, auditors, and shareholder proposals such as dividend expansion from Managing Director Park Chul-wan, who is currently serving as an in-house executive.” Kumho Petrochemical said in its position, “It is unwise to ask for a change of management and excessive dividends without prior consultation in the difficult socio-economic conditions due to Corona 19.”

At the same time, he concluded the position, saying, “I urge shareholders not to be shaken by the movements of unscrupulous forces trying to obtain economic benefits through short-term stock price hikes while promoting shareholder proposals through management disputes.”

Chairman Park Chan-koo’s personal share is 6.7%, which is less than that of Park. Park’s son, executive director Park Joon-kyung, owns 7.2%, and daughter Park Joo-hyung, managing director, owns 0.8%. Apart from private equity, Kumho Petrochemical’s share of treasury stock reached 18.35%.

In the business world, there is an analysis that the seeds of the dispute over management rights were sown in July of last year. In a greeting in July last year, Park Joon-kyung, the son of Chairman Park, was promoted, but Park was not on the promotion list.

The business community is paying attention to the shareholders’ meeting to be held in March. There is a possibility that IS Dong-seo and Park, a construction company that are constantly buying shares of Kumho Petrochemical, will alliance. This is a scenario in which Park’s allied forces and the IS East-West allied forces enter into a vote confrontation with President Park over the appointment and dismissal of directors. However, there are many prospects that Kumho Petrochemical’s high share of treasury stocks will make it difficult for disputes over management rights.

Reporter Kiheon Kang [email protected]

–