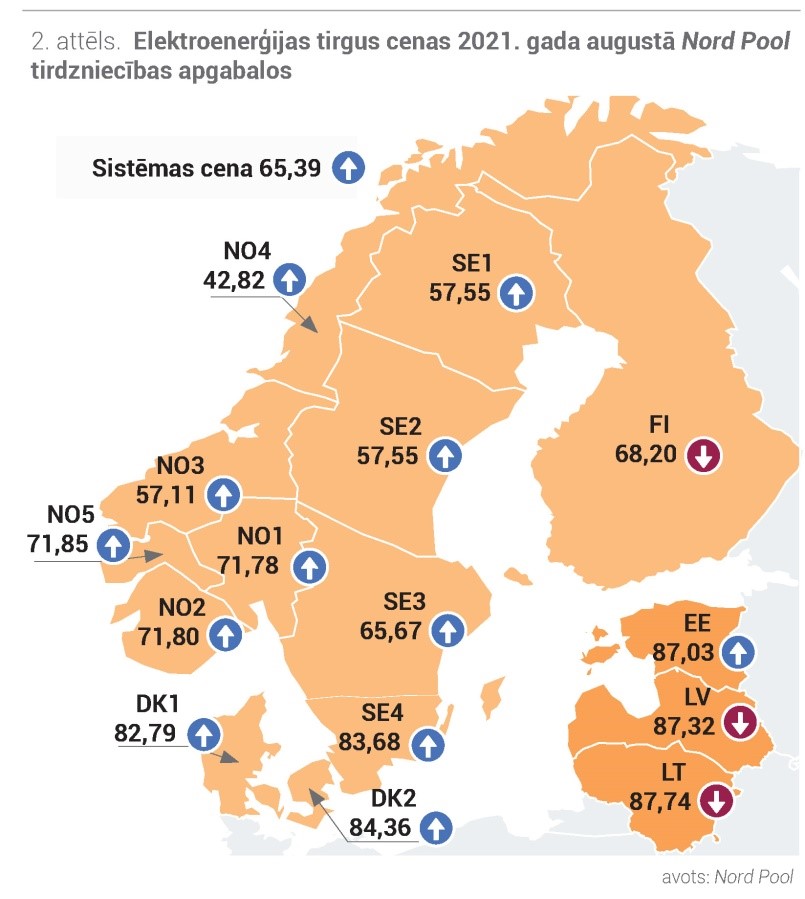

Last month, the average price of the Nord Pool system increased by 21% to 65.39 EUR / MWh and was historically the highest price in the summer months. A higher system price level was last observed in the winter months of 2011. In August, the trend of electricity prices in the Baltic trade areas was different, but they remain at an all-time high. In Estonia, the price of electricity rose by 4% to 87.03 EUR / MWh. In Latvia, the average monthly electricity price was 87.32 EUR / MWh, while in Lithuania – 87.74 EUR / MWh, but both countries decreased by 1% compared to July. In the Baltics, on the other hand, the hourly price range ranged from 0.04 EUR / MWh, determined by the rapidly growing development of wind farms in Germany on 8 August, to 200.00 EUR / MW.

–

–

Content will continue after the ad

Advertising

–

In August, the Nord Pool region maintained moderate weather conditions, but a gradual drop in air temperature signaled the end of the summer. Total electricity demand in the region increased by 2% last month compared to July. Although electricity generation remained unchanged from the previous month’s level, wind farm development increased by 21% compared to July. However, it was unable to curb the rise in electricity prices, which was mainly driven by upward trends in the market for energy products and emission allowances. High electricity prices in August were also maintained by a 12% drop in the level of hydro reservoirs below the norm, although precipitation last month was slightly above the norm. The annual maintenance of nuclear power plants in the Nordic countries will continue in August, however, not only did this lead to a reduction in the development of nuclear power plants, but also the shutdown of Unit 2 of the Swedish nuclear power plant “Forsmark”. Energy prices and flows from neighboring countries also had an impact on Baltic electricity prices. In August, the price of electricity in Finland decreased by 13% and amounted to 68.20 EUR / MWh, while energy flows from Finland increased by 32%. Meanwhile, flows from Sweden’s SE4 area decreased by 12%, but from Russia they were 63% higher than in July.

electricity futures prices continue to rise sharply

Last month, electricity futures contracts had a growing but also volatile trend. The main reason is the rapidly rising prices in the market for energy products and emission allowances. The decline in the Nordic hydro balance has also affected electricity futures prices. At the end of August, the hydro balance decreased to -13.4 TWh below the normal limit.

In August, the September futures contract for the electricity system (Nordic Futures), the average price increased by almost 32% compared to the previous month and was 63.49 EUR / MWh. Last month, the average price of the system’s contract for the 4th quarter of 2021 was 60.39 EUR / MWh, which increased by 27%. At the end of the month, the contract price reached a record high, exceeding the limit of 66.00 EUR / MWh. There was also a growing trend for the average futures price of the system in 2022, which increased by 17% and was 37.97 EUR / MWh, closing the month with 40.20 EUR / MWh, which is the highest price level of the annual system futures contracts at least in the last 2 years. , In 5 years.

In August, the average price of Latvian electricity futures for the September futures contract rose by 16% to 94.96 EUR / MWh, and at the end of the month the contract ended at an even higher level – 104.70 EUR / MWh. The price of Latvia’s “futures” in 2022 increased by 12% to 67.50 EUR / MWh, at the end of the month the contract ended with a price of 71.48 EUR / MWh.

Electricity generation in the Baltics has decreased

Last month, electricity consumption in the Baltics remained unchanged compared to the previous month, but increased by 3% compared to August 2020, and a total of 2,151 GWh of electricity was consumed. Latvia’s electricity consumption increased by only 1% to 570 GWh compared to August last year. Last month, Lithuania’s electricity consumption was 961 GWh, which remained at the level of August 2020. The amount of electricity consumed in Estonia increased by 8%, and 620 GWh was consumed last month. In August, 1,073 GWh of electricity was generated in the Baltics, which is a decrease of 19% compared to July and by 35% compared to August of the previous year. Last month, electricity generation in Latvia decreased by 48% compared to July, and a total of 155 GWh was generated. In Lithuania, production in August was 298 GWh, a decrease of 6% compared to July. In Estonia, electricity generation decreased by 8% compared to July, and 421 GWh was generated in August. Last month, the total development ratio of electricity consumption in the Baltics decreased by 9% compared to July and amounted to 41%. In Latvia, the ratio of generation to monthly consumption fell to 27%, in Estonia last month this indicator was 68%, but in Lithuania – 31%.

Daugava inflow 25% below the multi-year average inflow level

Although according to the Latvian Environment, Geology and Meteorology Center in August the total precipitation in Latvia was above the monthly norm, the inflow of the Daugava continued the decreasing trend and was 25% lower than the multi-year average, and it was 9% lower than the inflow in August 2020. . This is due to the fact that the inflow has decreased in the western regions of Russia upstream of the Daugava and in Belarus. In August, the development reduction of JSC “Latvenergo“in hydropower plants was not expressed – it has decreased by 5% compared to July data and by 4% compared to August of the previous year. In total, Latvenergo AS hydropower plants produced 70 GWh last month. Meanwhile, Latvenergo AS thermal power plant produced only 14 GWh of electricity, which is a decrease of 91% compared to July and 94% compared to August last year. TEC The capacity limitations of the 2-1 and TEC 2-2 power units in the first half of the month due to high air temperatures contributed to the development of the lowest August TEC since 2012.

European emission quotas and natural gas prices are setting new records

In August, the price of Brent Crude Futures crude oil futures contract was volatile, but on average, it decreased by 4% on a monthly basis to USD 70.40 / bbl. At the end of the month, the contract ended with a price of 73.41 USD / bbl.

The spread of the Covid-19 virus delta variant in Asia, especially in China, had a significant impact on oil prices last month, resulting in stricter movement restrictions in some regions. There is a great deal of uncertainty about how this situation will develop and how it will affect global oil demand. Following the decision of the OPEC + member states in July, oil production volumes were increased by 0.4 m bbl / day in August, which reduced the increase in the oil market price. At the end of the month, however, the rise in oil prices was stimulated by the stabilization of demand in China and the hurricane Ida in the Gulf of Mexico, which forced major US oil producers to stop production.

Last month, a coal futures contract (API2 Coal Futures Front month), the average price increased by 15% to USD 144,02 / tonne and the contract closed at USD 149,05 / tonne.

Although the price of coal was volatile in August, its growth continued to be driven by strong demand not only in Asia but also in Europe. This was driven by rising natural gas prices, which turned the profitability of natural gas-fired power plants into negative ones, stimulating the production of electricity from coal-fired power plants. At the beginning of the month, the railway bridge in Russia collapsed, which reduced the supply of coal from that country. But already in mid-August, the market faced supply problems in Australia, South Africa and Colombia, which undoubtedly contributed to the rise in the price of a coal futures contract, reaching a new high of USD 151.75 / t over the last 13 years. In August, the natural gas futures contract (Dutch TTF) continued the upward trend of previous months, with its average price rising by 23% to 44.02 EUR / MWh. At the end of the month, the contract ended with 47.81 EUR / MWh.

Natural gas imports from Norway decreased last month due to several unplanned interruptions in natural gas production. In the middle of the month, the price of the natural gas futures contract reached a new historical level – 47.99 EUR / t. However, the second half of the month saw a temporary but strong drop in natural gas prices of more than EUR 4 / MWh due to the publication of erroneous data from Germany’s TSO Gascade, which indicated the start of gas flows from Russia to Germany via the new gas pipeline.Nord Stream 2Demand remained strong in the Asian region and the struggle between Europe and Asia for liquefied natural gas (LNG) supplies continued in August. Another important factor influencing the price was the low level of filling of the EU’s natural gas storage facilities, which, according to Gas Infrastructure Europe, accounted for 67.2% of total capacity at the end of August, which is 23.9% less than in August of the previous year. The price of EUA Futures was volatile in August, but on a monthly basis the price of the EUA Dec.21 contract increased by 6% to 56.66 EUR / t.

Reduced auction volumes by more than 50% in August compared to January-July, delays in issuing free allowances and a reduction in summer trading activity made the European emissions trading market more volatile and vulnerable to speculative price movements. Last month, the main driver of quotas was high gas prices, so coal was preferred, which in turn stimulated the rise in both coal and carbon prices. At the end of the month, the European emission quota reached a new record high, exceeding the price limit of 60.00 EUR / t.

–

:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/3XZGGCDB6VC6PLCBGMYNET4IKE.jpg)